Under Armour Inc (UAA) Tightens Fiscal 2024 Outlook Amidst Mixed Retail Environment

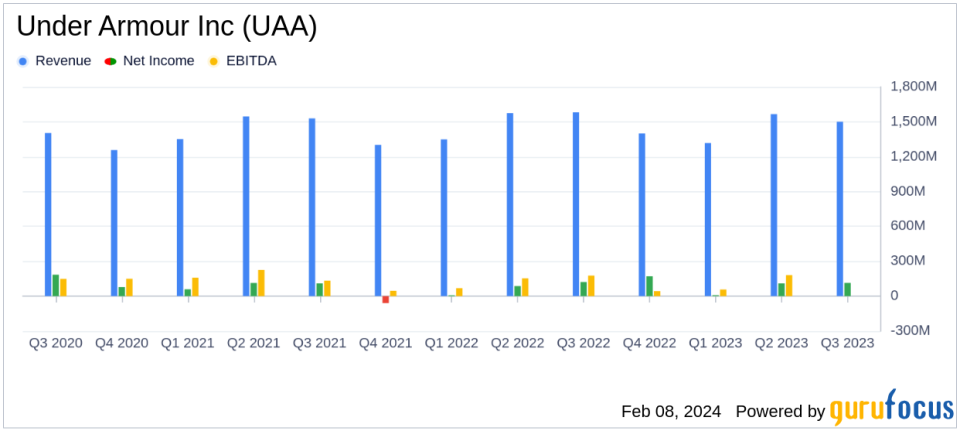

Revenue: Reported a 6% year-over-year decrease to $1.5 billion.

Gross Margin: Improved by 100 basis points to 45.2%.

Net Income: Increased to $114 million, with adjusted net income at $84 million.

Diluted EPS: Posted at $0.26, with adjusted diluted EPS at $0.19.

Inventory: Decreased by 9% to $1.1 billion.

Cash Position: Ended the quarter with $1 billion in cash and cash equivalents.

Share Buyback: Completed a two-year program, repurchasing $500 million worth of shares.

On February 8, 2024, Under Armour Inc (NYSE:UAA) released its 8-K filing, detailing its financial performance for the third quarter of fiscal 2024, which ended on December 31, 2023. The Baltimore-based company, known for its athletic apparel, footwear, and accessories, faced a challenging retail environment during the holiday season. Despite this, Under Armour managed to deliver profitability that exceeded expectations and remains on course to meet its full-year outlook.

Financial Performance and Challenges

Under Armour's revenue saw a decline of 6% to $1.5 billion, with a 7% decrease on a currency-neutral basis. The company's wholesale revenue fell by 13% to $712 million, while direct-to-consumer revenue rose by 4% to $741 million, thanks to increases in both owned and operated store revenue and eCommerce revenue. Geographically, North America revenue dropped by 12% to $915 million, but international revenue grew by 7% to $566 million, with positive trends in EMEA, Asia-Pacific, and Latin America.

Apparel revenue decreased by 6% to $1 billion, footwear revenue was down by 7% to $331 million, and accessories revenue remained flat at $105 million. The gross margin improvement to 45.2% was primarily driven by supply chain benefits, including lower freight expenses, although partially offset by higher sales to the off-price channel and increased promotional activities.

Financial Achievements and Importance

The increase in gross margin is a significant achievement for Under Armour, as it indicates improved profitability in the face of declining revenues. This improvement is particularly important for a company in the Manufacturing - Apparel & Accessories industry, where margins can be heavily impacted by supply chain costs and inventory management.

Under Armour's disciplined approach to inventory management resulted in a 9% reduction in inventory levels, which is crucial for maintaining healthy cash flow and avoiding excess stock that can lead to discounting. The company's strong cash position, with $1 billion in cash and cash equivalents, provides financial flexibility and the ability to navigate a challenging retail landscape.

Key Financial Metrics and Commentary

Under Armour's operating income for the quarter was $70 million, with adjusted operating income at $92 million. Net income stood at $114 million, and after adjusting for a $50 million earn-out benefit and other items, the adjusted net income was $84 million. The diluted earnings per share (EPS) was reported at $0.26, with an adjusted diluted EPS of $0.19.

"Despite a mixed retail environment during the holiday season, our third quarter revenue results were in line with our expectations; we were able to deliver better than anticipated profitability and remain on track to achieve our full-year outlook," said Under Armour President and CEO Stephanie Linnartz.

The company's share buyback update revealed that Under Armour repurchased $25 million of its Class C common stock during the quarter, concluding its two-year program with a total of $500 million in repurchases.

Updated Fiscal 2024 Outlook

Looking ahead, Under Armour has tightened its fiscal 2024 outlook. Revenue is expected to be down 3 to 4 percent, a slight adjustment from the previous expectation. Gross margin is projected to increase by 120 to 130 basis points, reflecting an improvement over prior estimates. Operating income is anticipated to reach $287 million to $297 million, with adjusted operating income expected to be between $310 million and $320 million. Diluted EPS is forecasted to be between $0.57 and $0.59, with adjusted diluted EPS expected to be $0.50 to $0.52. Capital expenditures have been revised down to between $210 million and $230 million.

Under Armour's performance in the third quarter of fiscal 2024 demonstrates resilience in a tough market, with strategic management of costs and inventory helping to offset revenue declines. The company's focus on improving profitability and maintaining a strong balance sheet positions it well for future growth and value creation.

Explore the complete 8-K earnings release (here) from Under Armour Inc for further details.

This article first appeared on GuruFocus.