Under Armour's (UAA) Growth Strategies Appear Encouraging

Under Armour, Inc.’s UAA focus on strengthening its brands through enhanced customer connections, effective innovations, better price points and a loyalty program should help it to stand firmly in the challenging operating market. The company has been progressing smoothly on its multi-year transformation plan.

Strategies in Detail

Under Armour’s focus on reinforcing brands and strict go-to-market processes appear encouraging. Additionally, the company strives to boost its operating model as well as return greater profitability and value to shareholders. Its growth strategy is focused on improving sales through product innovation, building long-term relationships with key wholesale partners, investments in its own stores and digitization to directly reach customers, and selling more inventory at full price.

UAA is focusing on digitization by converting real-time data and analytics to drive brand interest and consideration within its largest categories. Restructuring initiatives, cost management, inventory balance and emphasis on productivity should position the company well for growth.

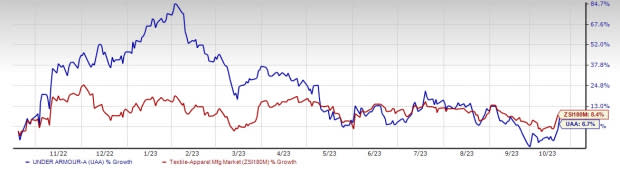

Image Source: Zacks Investment Research

To aid overall growth, management highlighted priorities to drive clarity and business alignment across the company. The initiative is named Protect This House 3 or PTH3. These priorities include driving global brand heat, staying relentlessly focused on elevating design and building better products, and driving growth in the United States. With this plan, management is optimistic about creating a more advantageous position to unlock consistent and sustainable growth for its shareholders over the long term.

In addition, Under Armour has been trying to boost its direct-to-consumer (DTC) business through store expansion initiatives and enhancement of its e-commerce platform. Management has been investing in boosting digital capabilities to drive growth in the DTC channel. This includes buy online and pick-up in-store facilities and flexible payment capabilities. In the first quarter of fiscal 2024, the company’s DTC revenues increased 4% to $544 million due to a 6% rise in e-commerce revenues, which represented 40% of the total DTC business in the quarter.

Furthermore, Under Armour is enhancing its global footprint and market share. Though the company generates a major portion of its revenues from the North American region, it intends to expand business operations to other parts of the world. It has also rolled out e-commerce platforms in countries like Mexico, Australia, New Zealand and Chile. Revenues from the international business increased 12% (up 15% on a currency-neutral basis) in the fiscal first quarter.

To wrap up, Under Armour is well-poised for growth based on the aforementioned strengths. A VGM Score for this current Zacks Rank #3 (Hold) company further demonstrates strength. We note that the shares of this athletic footwear, apparel and accessories dealer have increased 8.9% over the past year compared with the industry’s 8.4% rise.

Analysts seem optimistic about the company. The Zacks Consensus Estimate for fiscal 2025 sales and earnings per share (EPS) is currently pegged at $6.22 billion and 63 cents, respectively. These estimates show corresponding increases of 4.8% and 28.3% year over year.

Eye These Solid Picks

Some better-ranked companies are G-III Apparel Group GIII, lululemon athletica LULU and Ralph Lauren RL.

G-III Apparel sports a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

GIII has a trailing four-quarter earnings surprise of 526.6%, on average. The Zacks Consensus Estimate for GIII’s 2023 sales and EPS indicates increases of 2.4% and 14.7%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.1% and 20.5%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 6.8%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 17.3%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 2.4% and 13.4%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report