Unearthing the Dividend Dynamics of US Global Investors Inc

A Comprehensive Analysis of GROW's Dividend Performance and Sustainability

US Global Investors Inc(NASDAQ:GROW) recently announced a dividend of $0.01 per share, payable on 2023-10-23, with the ex-dividend date set for 2023-10-05. This news has piqued the interest of value investors, who are now keen to understand the company's dividend history, yield, and growth rates. Using the data from GuruFocus, we delve into US Global Investors Inc's dividend performance and assess its sustainability.

About US Global Investors Inc

Warning! GuruFocus has detected 3 Warning Signs with NECB. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

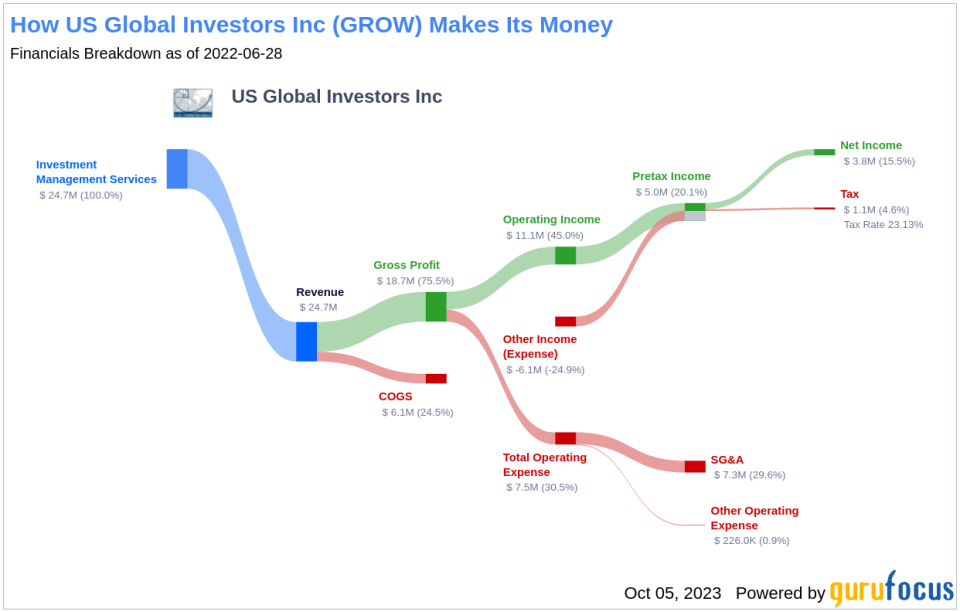

US Global Investors Inc is a registered investment advisory firm. It provides an investment program for each of the clients it manages, determining clients' investments subject to overall supervision by the applicable board of trustees of the clients, pursuant to an advisory agreement. The company operates business segments including Investment management services and Corporate Investments, with all its revenue derived from Investment management services.

US Global Investors Inc's Dividend History

Since 2007, US Global Investors Inc has maintained a consistent dividend payment record, with dividends currently distributed on a monthly basis. The chart below provides a glimpse into the company's annual Dividends Per Share for tracking historical trends.

US Global Investors Inc's Dividend Yield and Growth

As of today, US Global Investors Inc has a 12-month trailing dividend yield of 3.17% and a 12-month forward dividend yield of 3.17%. This suggests an expectation of consistent dividend payments over the next 12 months.

Over the past three years, US Global Investors Inc's annual dividend growth rate was 41.50%. This rate decreased to 20.20% per year over a five-year horizon. However, over the past decade, the annual dividends per share growth rate was -11.30%. Based on these figures, the 5-year yield on cost of US Global Investors Inc stock as of today is approximately 7.95%.

Payout Ratio and Profitability: Assessing Dividend Sustainability

The company's dividend payout ratio is a critical factor in evaluating dividend sustainability. As of 2023-03-31, US Global Investors Inc's dividend payout ratio is 0.43, suggesting a substantial portion of earnings retained for future growth and unexpected downturns.

Further, US Global Investors Inc's profitability rank of 4 out of 10 as of 2023-03-31, coupled with reported net profit in 3 years out of the past 10 years, raises concerns about the sustainability of the dividend.

Growth Metrics and Future Outlook

US Global Investors Inc's growth rank of 4 out of 10 suggests limited growth prospects, potentially impacting dividend sustainability. However, with a revenue per share increase of approximately 93.30% per year on average over the past three years, which outperforms approximately 93.82% of global competitors, the company boasts a robust revenue model.

Conclusion

While US Global Investors Inc has a commendable dividend history and yield, the sustainability of its dividends is questionable given its profitability and growth ranks. Investors should consider these factors along with the company's robust revenue model before making investment decisions. For those interested in high-dividend yield stocks, the High Dividend Yield Screener provided by GuruFocus can be a valuable tool.

This article first appeared on GuruFocus.