Unearthing the Dividend Potential of Royal Gold Inc (RGLD)

A Comprehensive Analysis of the Company's Dividend Performance and Sustainability

Royal Gold Inc (NASDAQ:RGLD) recently announced a dividend of $0.38 per share, payable on 2023-10-20, with the ex-dividend date set for 2023-10-05. As investors eagerly anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using GuruFocus data, let's delve into Royal Gold Inc's dividend performance and evaluate its sustainability.

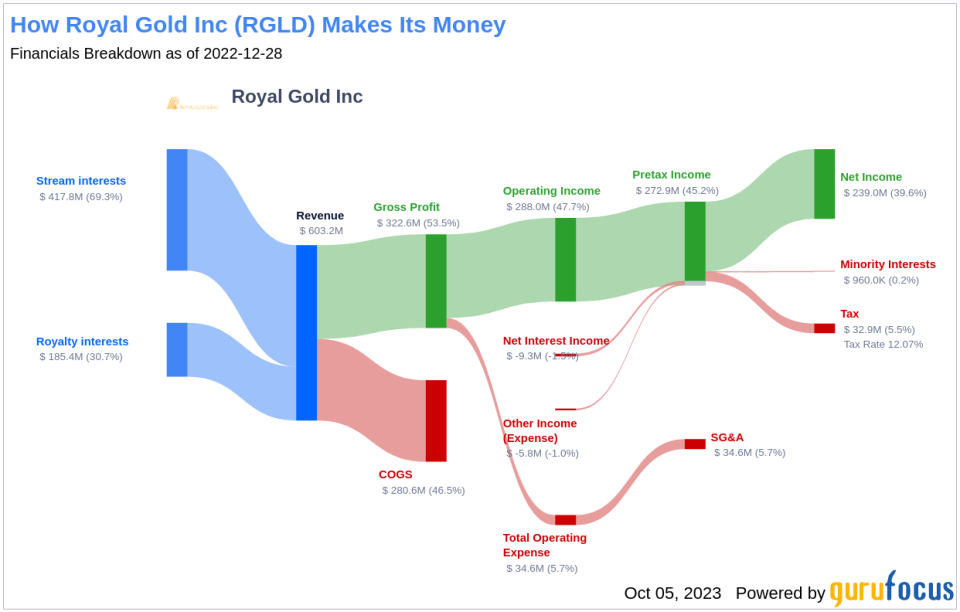

Understanding Royal Gold Inc's Business Model

Warning! GuruFocus has detected 4 Warning Sign with WEGRY. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Royal Gold Inc acquires and manages precious metal royalties and streams, primarily focusing on gold. The company operates by purchasing a percentage of the metal produced from a mineral property for an initial payment, without assuming the responsibility of mining operations. The company's primary revenue is generated from Canada, Mexico, Chile, and the United States.

An Overview of Royal Gold Inc's Dividend History

Since 2000, Royal Gold Inc has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The company has achieved the status of a dividend achiever, a title bestowed upon companies that have increased their dividends each year for at least the past 23 years.

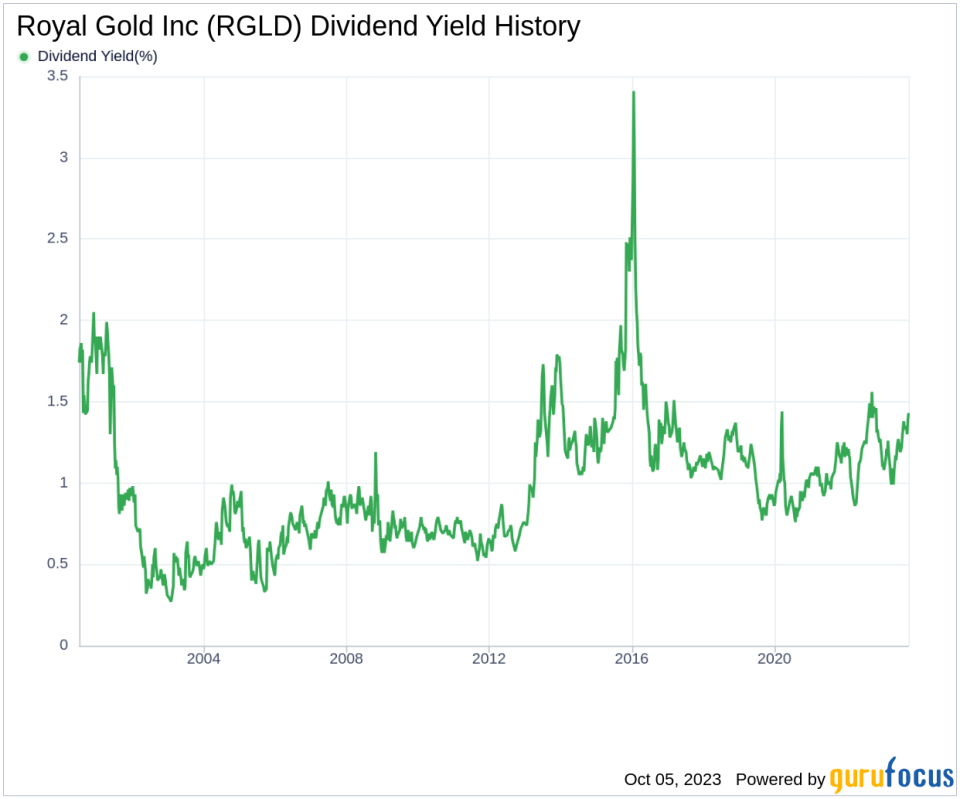

Decoding Royal Gold Inc's Dividend Yield and Growth

As of the current date, Royal Gold Inc has a trailing dividend yield of 1.43% and a forward dividend yield of 1.45%, indicating an expected increase in dividend payments over the next 12 months. The company's annual dividend growth rate over the past three years stands at 10.90%, while the five-year growth rate is slightly lower at 7.70%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a dividend can be assessed by evaluating the company's payout ratio. As of 2023-06-30, Royal Gold Inc's dividend payout ratio is 0.42, suggesting a significant portion of earnings is retained for future growth and unexpected downturns. The company's profitability rank of 7 out of 10 indicates good profitability prospects, with net profit reported in 8 out of the past 10 years.

Examining Growth Metrics for Future Sustainability

Royal Gold Inc's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's strong revenue per share and 3-year revenue growth rate of 12.50% per year on average outperform approximately 51.83% of global competitors. Additionally, the company's 3-year EPS growth rate of 36.40% per year on average outperforms approximately 76.21% of global competitors.

Conclusion

Given Royal Gold Inc's consistent dividend payments, robust growth rate, reasonable payout ratio, and strong profitability, the company presents a promising prospect for dividend-focused investors. However, as with all investments, these factors should be considered in the context of an investor's individual risk tolerance and investment goals. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.