Unearthing Value: A Closer Look at Comcast's (CMCSA) Modest Undervaluation

Comcast Corp (NASDAQ:CMCSA) stock recently saw a 6.02% gain, with Earnings Per Share (EPS) of $1.32. This raises an intriguing question: is the stock modestly undervalued? To answer this, we delve into an in-depth valuation analysis. Join us as we unravel the intrinsic value of Comcast (NASDAQ:CMCSA).

A Snapshot of Comcast Corp (NASDAQ:CMCSA)

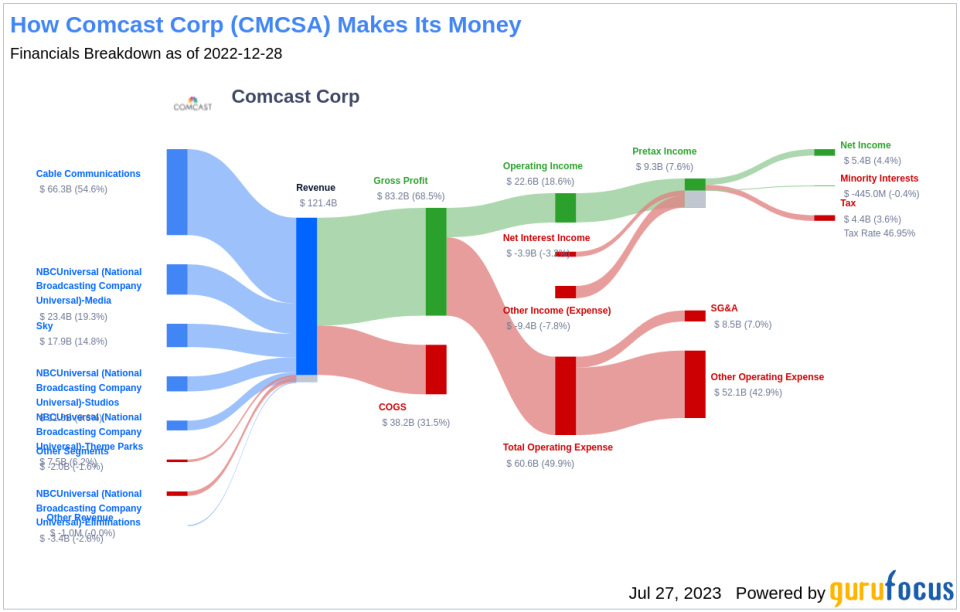

Comcast, a dominant force in the telecommunications industry, is a multifaceted corporation comprising three distinct branches. The core cable business provides television, internet access, and phone services to approximately 61 million U.S. homes and businesses. The company also owns NBCUniversal, which includes several cable networks, the NBC broadcast network, Universal Studios, and various theme parks. Additionally, Comcast owns Sky, the leading television provider in the U.K., with a significant presence in Italy, Germany, and Austria.

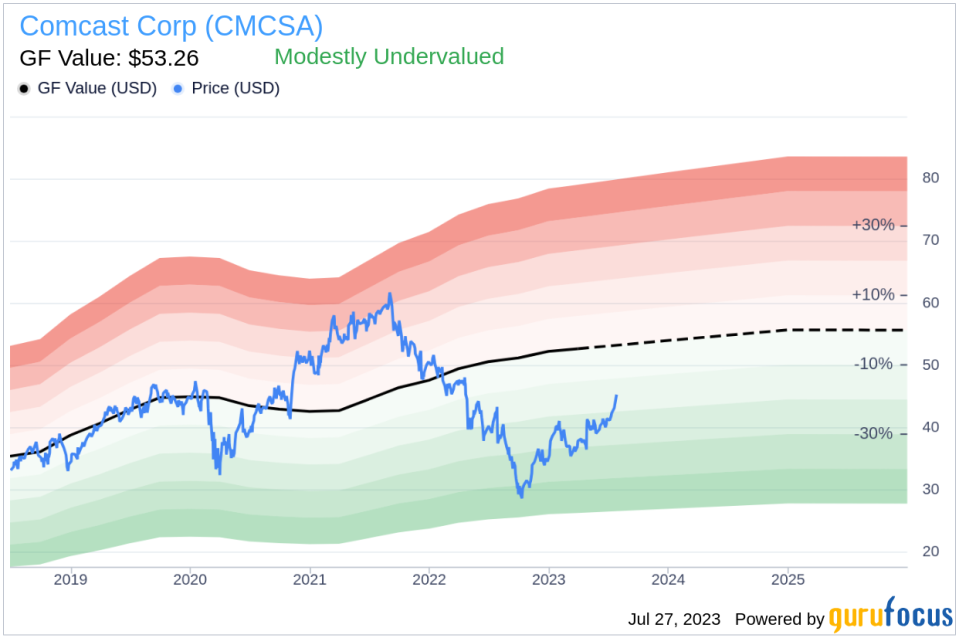

At its current price of $45.5 per share, Comcast (NASDAQ:CMCSA) has a market cap of $189.7 billion. Our analysis suggests that the stock is modestly undervalued when compared to its fair value (GF Value) of $53.26.

Understanding the GF Value of Comcast (NASDAQ:CMCSA)

The GF Value is a proprietary measure that estimates a stock's intrinsic value, considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the ideal fair trading value of the stock.

GuruFocus' analysis suggests that Comcast's stock is modestly undervalued. This conclusion is based on the GF Value Line, which indicates that the stock's future return is likely to be higher than its business growth due to its current undervaluation.

Comcast's Financial Strength and Profitability

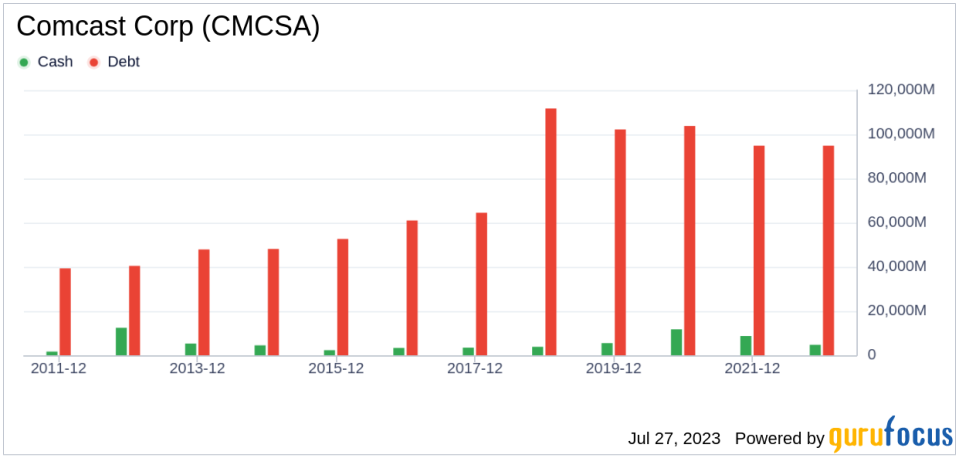

Investing in companies with solid financial strength mitigates the risk of permanent loss. Comcast's cash-to-debt ratio of 0.06 is lower than 83.71% of companies in the Telecommunication Services industry, indicating a weaker financial position. However, a consistent profitability record over the past decade, with an operating margin of 18.9% better than 76.73% of industry peers, underscores Comcast's strong profitability.

Growth and Return on Invested Capital (ROIC)

Comcast's average annual revenue growth is 5.1%, ranking better than 56.54% of companies in the Telecommunication Services industry. However, its 3-year average EBITDA growth is -6.6%, ranking lower than 78.81% of industry peers.

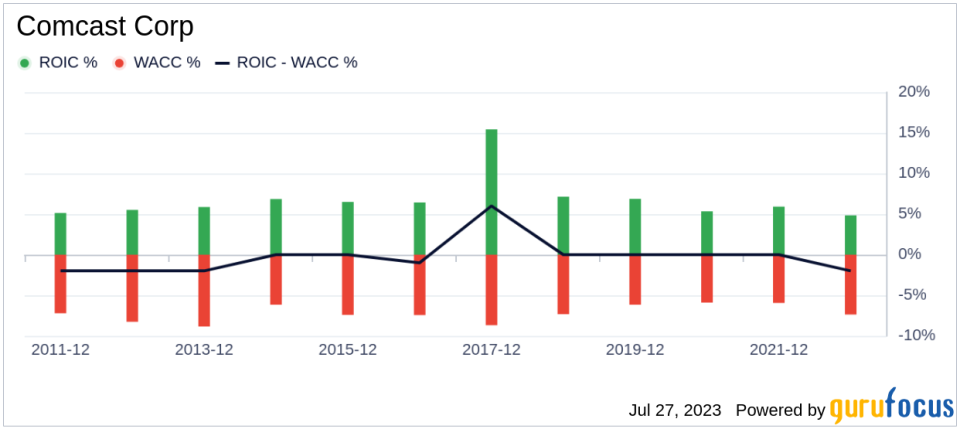

Another measure of profitability is the comparison of a company's return on invested capital (ROIC) and the weighted cost of capital (WACC). Comcast's ROIC is 4.96, lower than its WACC of 7.89, indicating room for improvement.

Conclusion

Overall, Comcast Corp (NASDAQ:CMCSA) stock appears to be modestly undervalued. Despite its weak financial strength, its strong profitability and strategic position in the market make it an attractive option for investors. To learn more about Comcast stock, you can check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.