Unifi: Down but Not Out

"Predator" is a science-fiction action film released in 1987. The film's storyline takes place in a Central American jungle, where a team of commandos are on a mission to rescue hostages from guerrilla fighters. However, they soon find themselves being hunted by an extraterrestrial warrior known as the Predator. The alien is drawn by action and strife, where it proceeds to hunt both sides of combatants for sport. Many deep-value gurus are like this movie's alien predator; they arrive when the stock price of a company has been devastated and strife is in the air.

One such investment firm I like to keep an eye on is Donald Smith & Co. as its buys often uncover exceptional value. In its 13F filing for the fourth quarter, the firm disclosed a new position in Unifi Inc. (NYSE:UFI), a textile manufacturing company that produces recycled and synthetic yarns.

Investors should be aware 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Looking at the long-term chart, Unifi appears to be selling near 10-year lows, so there must be something making the stock an appealing potential value opportunity.

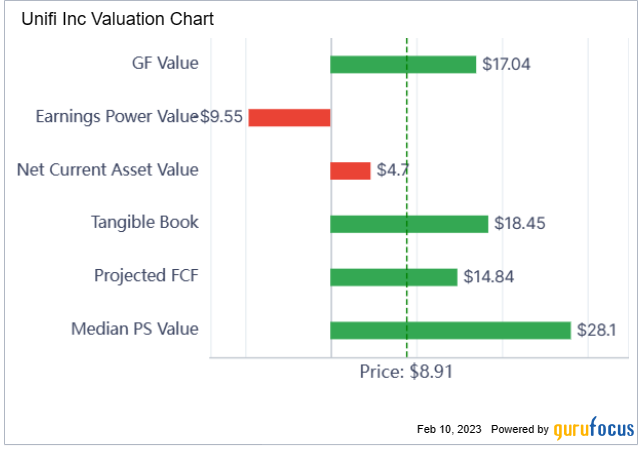

The Valuation Chart hints at great value. In particular, note the stock is selling at half of its tangible book value. Tangible book value per share is important because it shows the value of a company's net assets minus its intangible assets. While intangible assets are important, they are not physical assets that can be readily sold if the company gets into trouble.

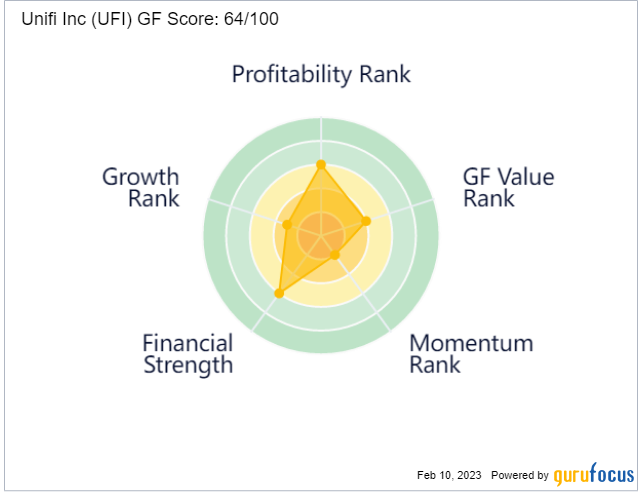

The company's GF Score of 64, however, indicates it has poor future performance potential, dragged down by low growth and momentum ratings as well as a moderate GF Value rank.

Why has the stock fallen so much?

A little probing reveals the company was both a beneficiary and victim of the Covid-19 pandemic.

Unifi offers a range of products, including polyester, nylon and polypropylene yarns, which are used in a variety of applications, such as apparel, home furnishings, automotive and industrial products. The company's flagship product is REPREVE, a recycled polyester yarn made from recycled plastic bottles.

The company's sales took a major hit in 2020 as apparel and auto manufacturers drastically reduced their production or shut down plants entirely for weeks or months at a time. Then, as the economy began to reopen in many areas of the world, demand sharply increased, shipping seized up, causing bottlenecks in supply chains to occur. This caused retailers to over order and build up inventory. After demand started to normalize retailers and manufacturers were stuck with too much inventory. Apparel companies then began to cut orders for its textiles in the face of weaker sales and soaring inventories. This led to a string of disappointing quarterly performances, pushing the stock lower.

Further, CEO Edmund Ingle recently stated that the company's second-quarter 2023 performance was negatively impacted by a decrease in apparel production. Despite cost-cutting measures, Unifi experienced headwinds from inventory destocking. However, he said, customers' supply chains are normalizing and they are expecting a stronger second half of the year.

I see this as a temporary adjustment in inventory rather than a problem specific to the company. I am confident that as the demand for recycled fibers grows, apparel companies will continue to rely on Unifi's expertise. In light of these factors, I believe the recent decrease in share price is a disproportionate response.

Guru interest and insider buys

In addition to Donald Smith & Co., several other gurus have seen an opportunity in the stock in recent months. Chuck Royce (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies and Barrow, Hanley, Mewhinney & Strauss have recorded either new positions or increased holdings of the stock in the past two quarters.

As for insiders, Ingle and directors Kenneth Langone and Archibald Cox Jr. have added to their holdings over the past three months.

The company has also been buying back stock, creating value for shareholders. All this points to better things in the near future for the stock.

Conclusion

CEO Ingle says that despite the recent headwinds, Unifi will continue to invest while controlling costs and maintaining a strong balance sheet. Ingle is confident in the company's position as a global leader for sustainable solutions and expects the business to bounce back in the second half of the year with a strategic plan for long-term growth and value for shareholders.

Although Unifi's share price has been greatly affected by changes in customer behavior and supply chain whip lash, it should just be temporary as the inventory correction works itself out. The company is expected to continue to grow in the long term as the demand for recycled fibers increases.

The long-term outlook for the company is positive. The current market challenges are mostly beyond its control, but the attractive growth trends are expected to reassert themselves a year or two from now. I think the stock can double or more from here as market conditions normalize and the stock drifts back into the $20 range, where it was prior to the pandemic.

I believe Unifi has a positive outlook in the long term due to the growing trend of corporate sustainability initiatives. Many apparel companies as well as auto and furniture manufacturers are committing to using a significant amount of recycled polyester in their fabrics, and Unifi is well positioned to meet this demand with its recycled products like REPREVE. The company has invested in transparency initiatives to provide customers with assurances of the authenticity of its products.

This article first appeared on GuruFocus.