Unifi Inc (UFI) Reports Modest Sales Growth Amid Cost Containment Efforts in Q2 Fiscal 2024

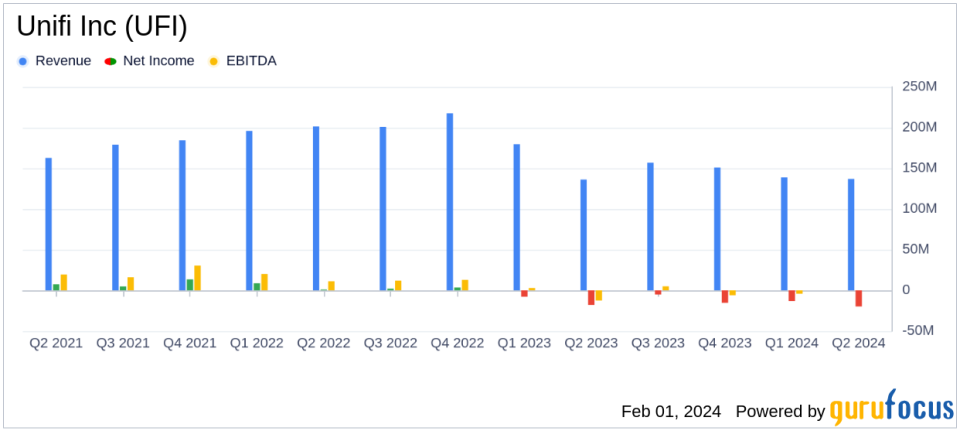

Net Sales: Slight increase to $136.9 million, up 0.5% from the same quarter last year.

Gross Profit: Improved to $1.6 million with a gross margin of 1.2%.

Net Loss: Posted a net loss of $19.8 million, or ($1.10) per share.

Adjusted EBITDA: Improved to ($5.5) million, compared to ($13.0) million in Q2 fiscal 2023.

Cost Efficiency: Continued expansion of cost containment measures to streamline operations.

Outlook: Anticipates net sales between $149.0 million and $154.0 million for Q3 fiscal 2024.

On January 31, 2024, Unifi Inc (NYSE:UFI), a global innovator in synthetic and recycled yarns, announced its second quarter fiscal 2024 results, as detailed in its 8-K filing. The company, known for its REPREVE brand of recycled fibers, reported a modest increase in net sales to $136.9 million, a 0.5% rise from the second quarter of fiscal 2023. This was attributed to higher sales volumes which were somewhat offset by lower pricing due to decreased raw material costs.

Performance and Challenges

Unifi Inc's gross profit saw a significant improvement, reaching $1.6 million with a gross margin of 1.2%, which the company credits to cost-saving initiatives and stable input costs. However, the net loss widened to $19.8 million, or ($1.10) per share, compared to a net loss of $18.0 million in the prior year's quarter. Adjusted for restructuring costs, the Adjusted Net Loss was $14.7 million, an improvement from the Adjusted Net Loss of $21.8 million in the second quarter of fiscal 2023.

The company's performance is particularly important as it reflects resilience in the face of ongoing challenges in the apparel industry and its supply chains. Unifi's efforts in cost containment and commercial initiatives are crucial as they provide a foundation for potential recovery as demand for apparel is expected to improve in calendar 2024.

Financial Achievements and Importance

Unifi Inc's financial achievements, including the improvement in gross profit and Adjusted EBITDA, are vital indicators of the company's ability to manage costs effectively and navigate a difficult market environment. These achievements are significant for the Manufacturing - Apparel & Accessories industry, where margins can be heavily impacted by raw material costs and consumer demand.

Key Financial Metrics

Important metrics from Unifi's financial statements include:

Financial Aspect | Q2 Fiscal 2024 | Q2 Fiscal 2023 |

|---|---|---|

Net Sales | $136.9 million | $136.2 million |

Gross Profit | $1.6 million | ($8.0 million) |

Net Loss | ($19.8 million) | ($18.0 million) |

Adjusted EBITDA | ($5.5 million) | ($13.0 million) |

These metrics are essential for understanding Unifi's operational efficiency and financial health. Gross profit margin, for instance, is a key indicator of the company's ability to control costs relative to sales, while Adjusted EBITDA provides insight into the company's earnings with non-operational costs excluded.

Our second quarter fiscal 2024 results were in line with our expectations and reflect sequential improvement in our underlying gross profit performance," said Eddie Ingle, CEO of Unifi Inc. He also emphasized the strategic actions aimed at reducing ongoing costs and optimizing operations to strengthen the company's position for the anticipated recovery in apparel demand.

Company's Performance Analysis

Unifi Inc's performance in the second quarter of fiscal 2024 demonstrates a company actively adapting to market conditions. The slight increase in net sales, coupled with significant improvements in gross profit and Adjusted EBITDA, suggests that the company's cost containment and operational efficiency measures are yielding positive results. The promotion of key executive leaders and the implementation of the Profitability Improvement Plan in December 2023 are expected to further streamline operations and reduce costs.

The company's outlook for the third quarter of fiscal 2024 indicates a continued focus on improving financial metrics, with expected net sales between $149.0 million and $154.0 million and Adjusted EBITDA between ($2.0) million and $1.0 million. These projections, along with the anticipated sequential improvement from the third to the fourth quarter, suggest cautious optimism for Unifi's performance in the upcoming periods.

For more detailed information and commentary on Unifi Inc's second quarter fiscal 2024 results, interested parties can access the earnings conference call scheduled for February 1, 2024, at 8:30 a.m. Eastern Time via a live audio webcast on Unifi's website.

Value investors and potential GuruFocus.com members seeking to understand the intricacies of Unifi Inc's financial position can find further details and analysis on our website, where we continue to monitor and report on the company's performance and strategic initiatives.

Explore the complete 8-K earnings release (here) from Unifi Inc for further details.

This article first appeared on GuruFocus.