UniFirst Corp (UNF) Posts Solid Q2 Earnings, Surpassing Revenue Estimates

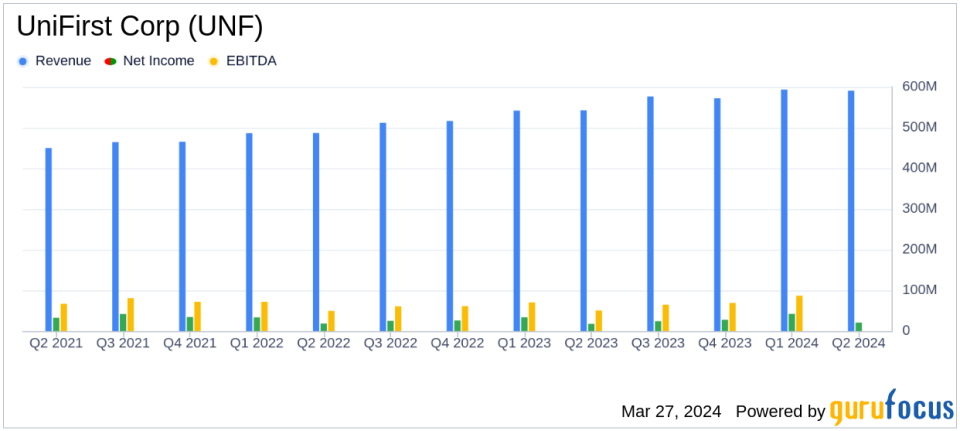

Revenue: Q2 revenue increased by 8.8% to $590.7 million, exceeding analyst estimates of $587.837 million.

Net Income: Net income rose to $20.5 million, a 14.9% increase from the previous year's $17.8 million.

Earnings Per Share (EPS): Diluted EPS reached $1.09, aligning with analyst projections of $1.425 when adjusted for one-time costs.

Operating Income: Operating income surged by 34.9% to $27.9 million.

EBITDA: EBITDA climbed 23.8% to $62.5 million compared to the prior year.

Cash Flow: Cash flows from operating activities increased significantly by 66.3% to $106.7 million in the first half of 2024.

Capital Allocation: The company repurchased 45,250 shares of Common Stock for $7.9 million and has $91.9 million remaining under its share repurchase authorization.

On March 27, 2024, UniFirst Corp (NYSE:UNF) released its second-quarter financial results via an 8-K filing, showcasing a robust performance with a significant increase in revenue and operating income. The company's earnings per share met analyst expectations when adjusted for one-time costs associated with its Key Initiatives.

UniFirst Corp provides workplace uniforms and services across North America and Europe, with a strong presence in the U.S. and Canadian Rental and Cleaning segment. The company also operates in the Manufacturing, Specialty Garments rental and cleaning, and First Aid segments, offering a comprehensive range of products and services to businesses.

Financial Performance and Challenges

The company's second-quarter results reflect a solid 8.8% increase in consolidated revenues, amounting to $590.7 million. This growth is attributed to a 9.5% rise in revenues from the Core Laundry Operations segment and a 3.2% increase in the Specialty Garments segment. Despite facing challenges such as increased costs from Key Initiatives and the acquisition of Clean Uniform, UniFirst managed to boost its operating income by 34.9% to $27.9 million, demonstrating the company's resilience and operational efficiency.

Strategic Financial Achievements

UniFirst's financial achievements, including a 14.9% increase in net income and a 14.7% rise in diluted earnings per share, are significant for the Business Services industry. The company's ability to generate strong cash flows, as evidenced by the 66.3% increase in cash flows from operating activities, underscores its financial health and ability to invest in growth opportunities and return value to shareholders through stock repurchases.

Segment Reporting Highlights

The Core Laundry Operations segment reported a revenue increase of 9.5% to $522.4 million, with organic growth of 4.8%. The operating margin in this segment improved to 3.6% from 2.9%, reflecting the company's operational improvements and cost management. The Specialty Garments segment, which includes nuclear decontamination and cleanroom operations, saw revenues increase by 3.2% to $43.5 million, driven by growth in cleanroom operations.

"We are pleased with the results from our second quarter which met our expectations and delivered solid growth in revenues, EBITDA and cash flows from operating activities," said Steven Sintros, UniFirst President and CEO. "I want to sincerely thank all our Team Partners who continue to Always Deliver for each other and our customers as we strive towards our vision of being universally recognized as the best service provider in the industry."

Balance Sheet and Capital Allocation

As of February 24, 2024, UniFirst reported $101.9 million in cash, cash equivalents, and short-term investments, with no long-term debt outstanding. The company's strategic capital allocation is evident in its share repurchase program, with $7.9 million spent on buying back shares during the quarter.

Outlook and Analysis

Looking ahead, UniFirst expects fiscal 2024 revenues to be between $2.415 billion and $2.425 billion, with fully diluted earnings per share projected to be between $6.80 and $7.16. These projections include the anticipated impact of Key Initiatives and an effective tax rate of 25.0%. The company's performance reflects its strong market position and operational excellence, which are crucial in the competitive Business Services sector.

UniFirst's solid second-quarter results, with revenue growth and disciplined capital management, position the company well for continued success. The alignment of EPS with analyst projections and the impressive increase in operating income highlight UniFirst's operational strength and strategic focus, making it a noteworthy company for value investors and potential GuruFocus.com members.

Explore the complete 8-K earnings release (here) from UniFirst Corp for further details.

This article first appeared on GuruFocus.