Is Unilever Poised for a Turnaround in 2024?

In the ever-evolving landscape of the global consumer goods market, Unilever PLC (NYSE:UL) presents a unique case. After years of underperforming the broader market, the company stands at a potential turning point. With a valuation suggesting it is more affordable than it has been in over a decade and a normalized price-earnings ratio that underlines this notion, Unilever might be gearing up for a significant recovery in 2024.

Historical context and recent performance

Reflecting on Unilever's past is like going through a history book filled with tales of endurance and adaptability. This company, with its wide variety of products touching nearly every aspect of daily life, from the soap in our bathrooms to the tea in our cups, has become more than just a brand, it is part of our homes. Its portfolio has secured its spot not just in our homes, but also in the investment community for its reliable dividends. Yet, even the mightiest of ships can hit rough seas. Unilever's recent journey has not been all smooth sailing. The market's shifting tides have tested its durability. It is a reminder that even giants need to adapt or face the risk of falling behind in a race that waits for no one.

The turning point: Analysis of current valuation

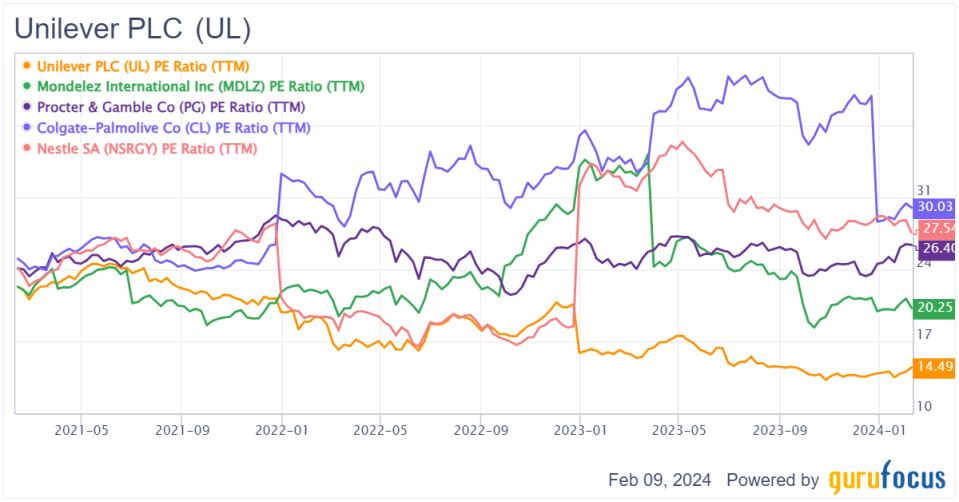

When we take a closer look at Unilever's current valuation, it tells an interesting story. It is such a marvelous find in the saturated market. The company's current forward price-earnings ratio stands at 13.40, a figure that is considerably lower than that of its peers, with Mondelez International (NASDAQ:MDLZ) at 23.67, Procter & Gamble (NYSE:PG) at 25.50, and Nestle (NSRGY) with a ratio of 26.90. This significant gap in valuation, which has widened in recent months, suggests the market might be overlooking Unilever.

This valuation not only reveals Unilever's competitive pricing, but also implies its potential undervaluation compared to the industry peers. Paired with dividend payouts, this makes it an attractive investment for those who want to balance income and growth potential within the consumer goods industry.

UL Data by GuruFocus

Strategic actions and market positioning

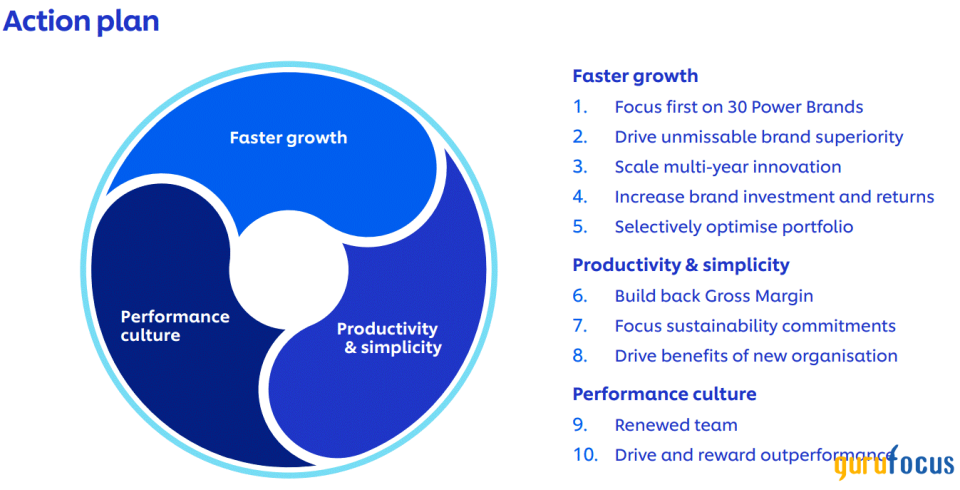

Unilever's strategic focus has been locked in on enhancing its top "Power Brands," aiming for revenue growth and margin enhancement. Bringing noted activist investor Nelson Peltz (Trades, Portfolio) to the board was a move that did not just turn heads, it sparked conversations in boardrooms and investment circles alike. Known for his transformative influence at Procter & Gamble, he adds a layer of optimism to Unilever's future prospects. His track record suggests a focus on core brands, trimming underperformers and prioritizing performance-oriented management over traditional people management could instill a culture of excellence at Unilever. This strategy coupled with Peltz's expertise holds the potential to be a game changer, similar to the success witnessed at P&G.

Source: Unilever presentation

Commodity prices and revenue growth

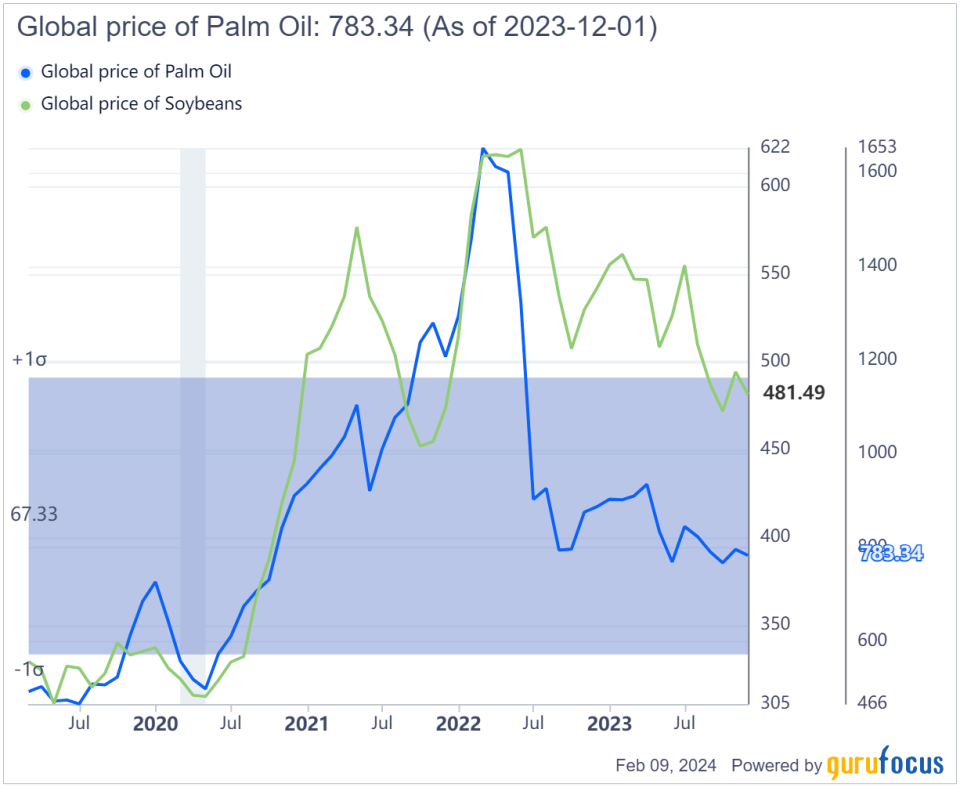

A significant factor in Unilever's past struggles has been its exposure to fluctuating commodity prices directly impacting its bottom line, particularly for soybeans and palm oil. However, the recent global stabilization of these prices indicates potential easing of cost pressures for the company. This shift is especially crucuial for the company, which relies heavily on these commodities for a variety of its products.

In terms of the revenue, in an impressive showcase of smart pricing and volume balance despite trailing behind its peers historically, Unilever recorded 9.10% underlying sales growth primarily due to an increase in prices, with a minor loss (0.2%) on volumes only . This subtle strategy to inflation control reveals the degree of adaptability that Unilever has and its ability to survive even as the price growth is anticipated to slow down throughout the year. The various business units of the company are all maneuvering through different stages of the inflationary cycle with notable agility, reflecting a trend that not only focuses on responsible pricing, but also seeks to capture and increase volume growth.

Looking into Unilever's performance in key markets reveals a strategic success. In the United States, the company reported 7.40% growth that was partly driven by higher volumes in the Prestige, Beauty and Health & Wellbeing segments, which helped to compensate for the slowdown in price increases. This story of balancing growth continues in India too, where the company achieved 9.10% growth despite a challenging environment with very competitive market dynamics, yet significant progress was made in the Home Care segment. The performance of the Chinese market is even more optimistic, with growth in first half rising to 7.90% as a result of volume increases within Food Solutions and out-of home ice cream propositions.

The story across emerging markets, which represent almost 60% of Unilever's total turnover, is especially impressive. In this case, 10.6% growth was recorded by the company through an effective blend of price increases and positive volume patterns. This performance represents the depth of market penetration by Unilever and its ability to grow in these areas. In addition, the transformative digital commerce cannot be overemphasized as it now represents 16% of turnover, reflecting the company's foresight and agility in responding to changes in consumer purchasing patterns.

Investment outlook and dividend appeal

Unilever's growth over the past decade may not have been characterized by a great increase in value due to flat revenue and minimal margin expansion. Nevertheless, the company has managed to stand out as a fortress of shareholder value by remaining firm on dividends. Since 1999, it has had a noteworthy dividend run that depicts the dependability of this speculation as an income-producing resource. At present, the dividend yield is 3.61% with a sensible payout ratio of up to 52%. This level of yield is even more remarkable when compared to the dividend yields offered by industry leaders such as Procter & Gamble, which stands at 2.44%, and Nestle with a rate of 2.01%. This highlights Unilever's competitive advantage in shareholder returns, especially compared to the average yield of 2.43% for the industry.

Nevertheless, closer scrutiny of Unilever's dividend growth rate paints a more complex picture. In the past five years, dividend growth for the company has been 0.26%, which is far below the industry average of 5.36%. This differential spotlights a possible improvement opportunity, which suggests the requirement for an increasingly strong dividend growth methodology in front. My view on the future of dividend growth at Unilever is cautiously optimistic, mainly dependent upon effective implementation of its aggressive plans for expansion and margin improvement.

Final thoughts

As we head into 2024, Unilever's journey is that of untapped possibilities. By combining the recovery narrative and the quality of an all-season stock for itself, it has become a fairly attractive selection for investors. Having observed this company going through trials and tribulations, I find Unilever not just surviving, but emerging from a weak performance year into one that will be a good year. For investors looking for a combination of stable dividend payments and the potential for capital growth, Unilever is a sensible option, even more so in these volatile times. It is not just about the numbers alone; it is about the story behind them.

This article first appeared on GuruFocus.