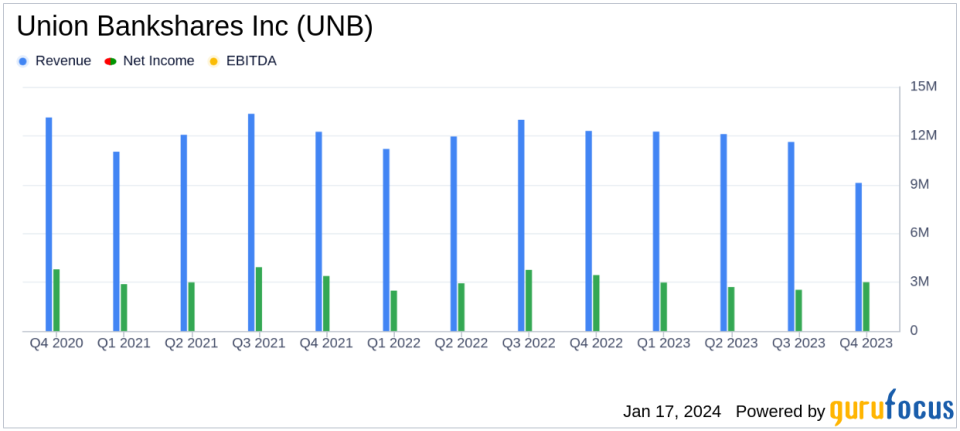

Union Bankshares Inc Reports Decline in Quarterly and Annual Earnings for 2023

Net Income: Q4 net income decreased to $3.0 million, or $0.68 per share, compared to $3.4 million, or $0.77 per share in Q4 2022.

Annual Earnings: 2023 net income was $11.3 million, or $2.50 per share, down from $12.6 million, or $2.81 per share in 2022.

Asset Growth: Total assets increased by 9.9% to $1.5 billion, driven by loan growth and investment securities.

Interest Income and Expense: Interest income increased, but was offset by a significant rise in interest expense due to higher customer deposit rates and wholesale funding costs.

Dividend: A quarterly cash dividend of $0.36 per share was declared, payable on February 1, 2024.

On January 17, 2024, Union Bankshares Inc (NASDAQ:UNB) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a community bank offering a range of banking and wealth management services, reported a decrease in net income for both the quarter and the year, despite asset growth and a strong asset quality.

Financial Performance Overview

For the fourth quarter of 2023, Union Bankshares Inc reported a consolidated net income of $3.0 million, or $0.68 per share, a decrease from the $3.4 million, or $0.77 per share, recorded in the same period of the previous year. The annual net income for 2023 was $11.3 million, or $2.50 per share, down from $12.6 million, or $2.81 per share, in 2022. This decline in earnings was attributed to a decrease in net interest income and an increase in noninterest expenses, partially offset by an increase in noninterest income and a decrease in credit loss expense and income tax expense.

Balance Sheet and Income Statement Highlights

UNB's total assets grew to $1.5 billion as of December 31, 2023, marking a 9.9% increase from the previous year. This growth was primarily fueled by an expansion in loans, investment securities, and overnight deposits. The bank's total loans stood at $1.0 billion, including $3.1 million in loans held for sale. The company's investment securities portfolio was valued at $265.9 million, though it faced unrealized losses due to the current interest rate environment.

On the liabilities side, total deposits reached $1.31 billion, which included $153.0 million of purchased brokered deposits. Borrowed funds totaled $65.7 million, an increase from the $50.0 million reported at the end of 2022. The company's equity capital also grew to $65.8 million, with a book value per share of $14.56, up from $55.2 million and $12.25 per share, respectively, in the previous year.

Net interest income for the fourth quarter decreased by 12.1% to $9.1 million, while interest income for the year increased by 30.0% to $57.1 million. However, the bank's interest expense saw a substantial rise of 325.9% for the year, reflecting the higher rates paid on customer deposit accounts and the use of wholesale funding. Noninterest income for the year increased modestly by 4.8% to $9.9 million, and noninterest expenses rose by 5.2% due to increases in salaries, wages, and other expenses.

"The decrease in net income was comprised of a decrease in net interest income of $1.2 million and an increase in noninterest expenses of $137 thousand, partially offset by an increase in noninterest income of $265 thousand, and decreases of $338 thousand in credit loss expense and $387 thousand in income tax expense."

Dividend and Corporate Insights

The Board of Directors declared a cash dividend of $0.36 per share for the quarter, demonstrating the company's commitment to shareholder returns despite the earnings decline. Union Bankshares Inc, with a history dating back to 1891, continues to focus on serving its communities in Vermont and New Hampshire, emphasizing personal and business banking services, as well as wealth management.

The company's performance reflects the challenges faced by the banking industry, including the impact of interest rate changes on net interest income and investment securities valuations. However, the growth in assets and the bank's ability to maintain a strong asset quality showcase its resilience in a complex economic environment.

Investors and stakeholders will be closely monitoring Union Bankshares Inc's strategies to navigate the current financial landscape and its efforts to sustain profitability and growth in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Union Bankshares Inc for further details.

This article first appeared on GuruFocus.