Union Pacific Corp (UNP) Reports Mixed Financial Results for Q4 and Full Year 2023

Q4 Earnings Per Share: Slight increase to $2.71, up 1% year-over-year.

Full Year Net Income: Decreased by 9% to $6.4 billion.

Operating Ratio: Improved by 10 basis points in Q4, but annual operating ratio deteriorated by 220 basis points.

Capital Expenditures: $3.7 billion in 2023, with a planned $3.4 billion for 2024.

Share Repurchases: 3.5 million shares repurchased in 2023 for $712 million.

On January 25, 2024, Union Pacific Corp (NYSE:UNP) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. The Omaha, Nebraska-based railroad giant, which operates over 30,000 miles of track primarily in the western two-thirds of the United States, reported a marginal increase in fourth-quarter earnings per share, while full-year figures saw a decline.

Financial Performance Overview

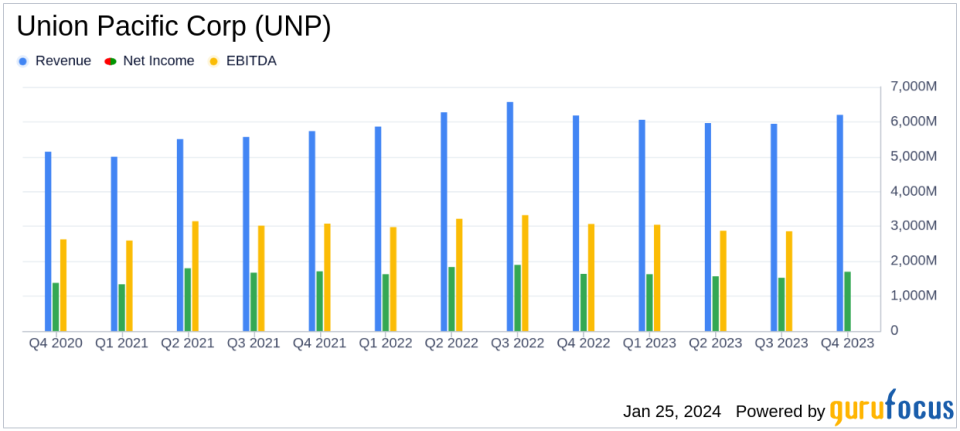

Union Pacific's fourth-quarter net income edged up to $1.7 billion, or $2.71 per diluted share, a 1% increase from the $1.6 billion, or $2.67 per diluted share, reported in the same quarter of the previous year. However, the full-year results were less favorable, with net income falling 9% to $6.4 billion, or $10.45 per diluted share, compared to $7.0 billion, or $11.21 per diluted share, in 2022.

Despite the challenges, CEO Jim Vena remains optimistic, stating,

Our fourth quarter results show much of whats possible at Union Pacific and that were on the right path to reaching our goals."

Vena highlighted the improvements in service and operational metrics and expressed confidence in the company's momentum going into 2024.

Operational Highlights and Challenges

Union Pacific's operating revenue for the quarter remained flat at $6.2 billion, with increased volumes and core pricing gains offset by lower fuel surcharge revenue and changes in business mix. The operating ratio saw a slight improvement of 10 basis points, resulting in flat operating income of $2.4 billion. For the full year, operating revenue declined by 3% to $24.1 billion, with a 220 basis point deterioration in the operating ratio to 62.3%.

On the operational front, the company reported improvements in resource utilization, with freight car velocity and locomotive productivity both up by 14% and 3%, respectively. However, the fuel consumption rate deteriorated by 3%, indicating increased fuel usage relative to transportation work performed.

Looking ahead to 2024, Union Pacific anticipates a muted volume outlook due to factors such as the loss of international intermodal business, lower coal demand, and soft economic conditions. Nevertheless, the company expects pricing gains to exceed inflation and maintains its long-term capital allocation strategy, with a capital plan of $3.4 billion and no share repurchases planned for the first quarter.

Value Investor Considerations

For value investors, Union Pacific's mixed financial results present a nuanced picture. The company's commitment to operational excellence and safety, coupled with its strategic capital investments, suggest a focus on long-term value creation. However, the challenges of a softening economy and changes in the freight landscape will require careful monitoring. The company's share repurchase activity in 2023 reflects a shareholder-friendly capital allocation policy, although the pause in repurchases for the first quarter of 2024 may warrant attention.

Union Pacific's performance in a competitive transportation industry, where efficiency and service quality are paramount, will continue to be a critical factor for investors. The company's ability to navigate economic headwinds while capitalizing on its operational improvements will likely be a key determinant of its financial success in the coming year.

For more detailed information and analysis on Union Pacific Corp (NYSE:UNP)'s financial results, investors and interested parties are encouraged to visit Union Pacific's investor relations website.

Explore the complete 8-K earnings release (here) from Union Pacific Corp for further details.

This article first appeared on GuruFocus.