uniQure (QURE) Up on Restructuring Plans, Workforce Reduction

Shares of uniQure N.V. QURE were up 11.61% on Oct 5 after the company announced a strategic reorganization to reduce its operating expenses.

The company will discontinue investments in more than half of its research and technology projects, which includes AMT-210 for the treatment of Parkinson’s disease and multiple undisclosed programs.

Consequently, a research lab in Lexington will be closed and the company plans to sublease this space.

All GMP manufacturing will be consolidated into its Lexington, MA, manufacturing facility and processing and analytical development will be consolidated into its Amsterdam, NL, facility. These will, however, not impact the commercial manufacturing of Hemgenix for CSL Behring.

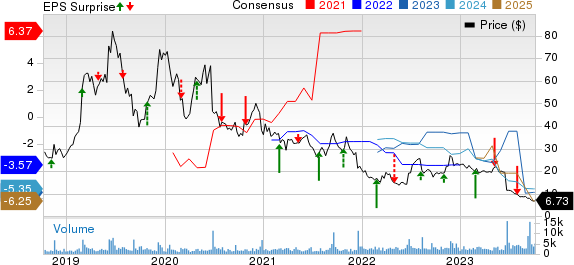

uniQure N.V. Price, Consensus and EPS Surprise

uniQure N.V. price-consensus-eps-surprise-chart | uniQure N.V. Quote

As a result of the restructuring plan, uniQure will eliminate 114 positions. This reduction represents 28% of the workforce not committed to Hemgenix manufacturing obligations and approximately 20% of the total workforce.

The company expects to undertake a one-time restructuring cost of approximately $2.3 million, primarily incurred in the fourth quarter of 2023. The restructuring action is expected to result in cost savings of approximately $180 million over the next three years.

The current balance of cash, cash equivalents and investment securities of $628.6 million as of Jun 30, 2023, (excluding the $100 million milestone payment subsequently received from CSL Behring) should fund operations into the second quarter of 2027.

uniQure will prioritize the continued development of AMT-130 in Huntington’s disease and the near-term initiation of clinical trials for AMT-260 in refractory mesial temporal lobe epilepsy, AMT-162 in SOD1- amyotrophic lateral sclerosis and AMT-191 in Fabry disease.

The company expects to meet with the FDA to review the data and discuss future development of AMT-130 in the first quarter of 2024 and will provide a clinical update from both the U.S. phase I/II study of AMT-130 and the European phase I/II study.

The company’s current chief scientific officer, Ricardo Dolmetsch, will leave the company due to the significant reduction in research activities.

Year-to-date, shares of QURE have plunged 70.3% compared with the industry’s decline of 17%.

Image Source: Zacks Investment Research

Last month, the company announced that the FDA cleared the investigational new drug application for AMT-260, its gene therapy candidate for refractory mesial temporal lobe epilepsy.

Hemgenix, gene therapy for the treatment of hemophilia B, is approved in the United States and European Union uniqQure has licensed Hemgenix to CSL Behring LLC, which is now responsible for commercializing the therapy.

Zacks Rank and Stocks to Consider

uniQure currently has a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks in the industry are Eton Pharmaceuticals ETON and Dynavax Technologies DVAX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for Eton for 2023 have narrowed to 10 cents from 31 cents in the past 60 days, while earnings estimates for 2024 are pegged at 26 cents per share.

Loss estimates for Dynavax for 2023 have narrowed to 23 cents from 56 cents in the past 90 days, while earnings estimates for 2024 are pinned at 3 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

uniQure N.V. (QURE) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report