Unisys Corp (UIS) Exceeds Full-Year Guidance with Revenue and Profitability Growth

Revenue Growth: Full-year revenue increased by 1.8% year over year, with Ex-L&S revenue growth of 4.9%.

Profitability: Full-year non-GAAP operating profit margin reached 7.0%, with a significant improvement in free cash flow.

Contract Signings: Ex-L&S Total Contract Value (TCV) surged by 27% year over year, with New Business TCV growing by 18%.

2024 Guidance: Unisys projects constant currency revenue growth of (1.5)% to 1.5% and a non-GAAP operating profit margin of 5.5% to 7.5% for the full year.

Balance Sheet Strength: Cash and cash equivalents stood at $387.7 million at the end of 2023.

On February 21, 2024, Unisys Corp (NYSE:UIS) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global technology solutions provider, operates through three business segments: Digital Workplace Solutions (DWS), Cloud & Infrastructure Solutions (C&I), and Enterprise Computing Solutions (ECS). These segments collectively drive the company's success in delivering secure, high-performance technology solutions across various markets.

Financial Performance and Challenges

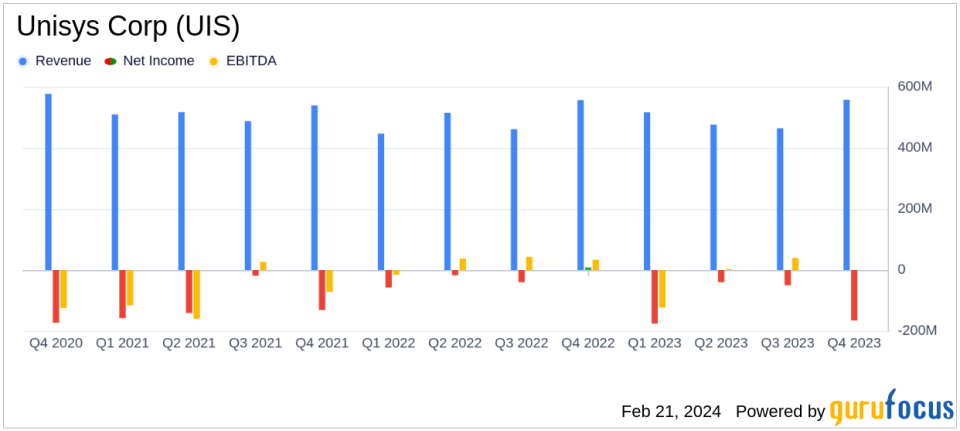

Unisys reported a modest full-year revenue growth of 1.8% year over year, or 1.6% in constant currency. Notably, excluding License and Support (Ex-L&S) revenue, the growth was more pronounced at 4.9% year over year. The fourth quarter saw a slight uptick of 0.1% in revenue year over year, though constant currency figures reflected a 2.1% decline. The company's operating profit margin for the full year was 3.8%, with a non-GAAP operating profit margin of 7.0%. Operating cash flow showed a robust increase to $74.2 million from $12.7 million in 2022, and free cash flow improved significantly to ($4.5) million from ($73.2) million in the previous year.

The challenges faced by Unisys included a decline in License and Support (L&S) revenue, which dropped by 15.2% year over year. This decline was partially offset by growth in Ex-L&S revenue, which increased by 6.8% year over year in the fourth quarter. The company also faced a non-cash pension settlement loss, which impacted net income. However, the company's strategy to manage pension liabilities through annuity purchases transferred approximately $500 million in pension liabilities, demonstrating proactive financial management.

Segment Highlights and Financial Achievements

Unisys' Digital Workplace Solutions (DWS) segment experienced a revenue increase of 8.9% year over year, driven by new business with existing clients. The Cloud, Applications & Infrastructure Solutions (CA&I) segment saw a slight revenue increase, while the Enterprise Computing Solutions (ECS) segment faced a revenue decline due to the timing of software license renewals. Despite these mixed results, the company's overall financial achievements, particularly in free cash flow and contract signings, underscore its resilience and strategic focus.

Unisys' financial achievements are critical as they reflect the company's ability to navigate market fluctuations and invest in growth areas. The improvement in free cash flow is particularly important for Unisys, as it provides the liquidity needed to fund operations, reduce debt, and invest in strategic initiatives. The growth in contract signings indicates the company's competitive strength and potential for future revenue.

Key Financial Metrics and Analysis

Key financial metrics from Unisys' earnings report include:

"Our fourth quarter performance capped a successful year for Unisys," said Unisys Chair and CEO Peter A. Altabef. "In 2023, we exceeded our upwardly revised full-year guidance ranges. During the year, we grew our backlog, signed 18% more New Business TCV than the prior year, and expanded our New Business pipeline."

These metrics are important as they provide insights into the company's operational efficiency, profitability, and growth prospects. The increase in backlog and New Business TCV suggests a strong demand for Unisys' services and a healthy pipeline for future revenue.

Looking ahead, Unisys has issued guidance for the full year of 2024, projecting constant currency revenue growth of (1.5)% to 1.5% and a non-GAAP operating profit margin of 5.5% to 7.5%. This guidance reflects the company's cautious optimism and strategic focus on improving profitability.

In conclusion, Unisys Corp (NYSE:UIS) has demonstrated a solid financial performance in 2023, exceeding its revised revenue and profitability guidance. The company's strategic initiatives, particularly in managing pension liabilities and focusing on high-growth segments, position it well for continued success in 2024. Investors and stakeholders can look forward to Unisys' sustained efforts to drive value and innovation in the technology solutions market.

For a more detailed analysis of Unisys Corp's financial performance and future outlook, interested parties are encouraged to join the conference call or access the webcast and presentation materials on the Unisys Investor Website.

Explore the complete 8-K earnings release (here) from Unisys Corp for further details.

This article first appeared on GuruFocus.