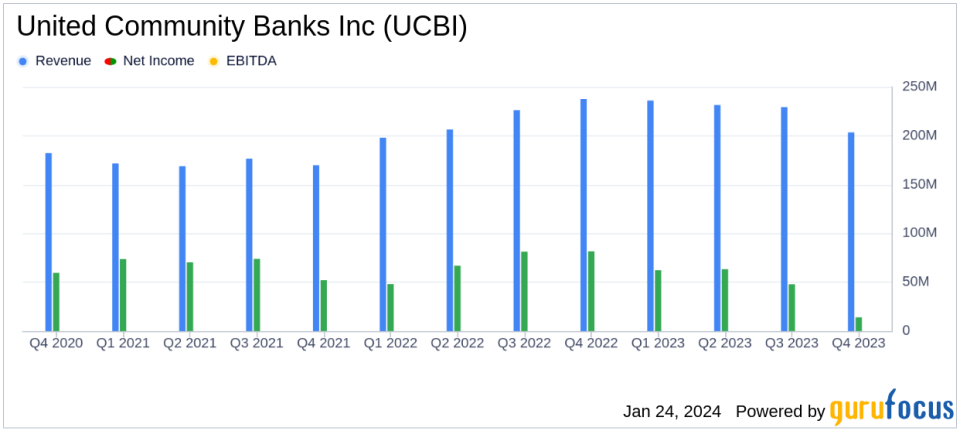

United Community Banks Inc (UCBI) Reports Decline in Q4 Earnings Amid Economic Uncertainty

Net Income: Q4 net income fell to $14.1 million, an 85% decrease from Q4 2022.

Earnings Per Share (EPS): Diluted EPS dropped to $0.11, down 85% from the same quarter last year.

Operating EPS: On an operating basis, diluted EPS rose to $0.53, an 18% increase from the previous quarter.

Asset Growth: Total assets grew to $27.2 billion, a 14% increase year-over-year.

Loan Portfolio: Loans saw a 2.5% annualized growth rate, reaching $18.3 billion.

Deposits: Deposit growth was strong at an 8% annualized rate.

Net Interest Margin: Decreased by 5 basis points to 3.19% compared to the previous quarter.

On January 24, 2024, United Community Banks Inc (NASDAQ:UCBI) released its 8-K filing, detailing the financial results for the fourth quarter of the year. The bank, which operates scores of offices across Georgia, Tennessee, and the Carolinas, reported a significant decline in net income and earnings per share (EPS) compared to the same period in the previous year. Despite these challenges, the bank's operating EPS showed resilience, indicating a potential for recovery.

United Community Banks Inc, a bank holding company, operates through its wholly-owned subsidiary, Union Community Bank. The bank's loan portfolio is well-diversified, predominantly commercial, and has traditionally grown through organic growth and selective acquisitions. United conducts substantially all of its operations through a community-focused operating model, offering a full range of retail and corporate banking services.

The fourth quarter saw net income of $14.1 million, a stark decrease from the previous year's $81.45 million. Diluted earnings per share also fell to $0.11, down from $0.74 in the fourth quarter of 2022. However, on an operating basis, which excludes non-operating items such as merger charges and losses from bond portfolio restructuring, diluted EPS increased by 18% from the last quarter to $0.53.

United Community Banks Inc's financial achievements in the face of economic uncertainty include an 8% annualized growth in deposits and a 2.5% annualized growth in loans. These achievements are crucial for the bank's liquidity and its ability to fund loan growth, especially in a challenging interest rate environment.

Key financial metrics from the earnings report include a modest increase in net interest revenue due to growth in interest-bearing assets, which helped offset the impact of a lower margin. The bank's net interest margin decreased by 5 basis points to 3.19%, with the average yield on interest-earning assets up by 14 basis points. Net charge-offs were down to 0.22% of average loans, indicating solid asset quality.

"Our focus continues to be on both maintaining a strong balance sheet and investing in growth as we continue to build the company," stated Chairman and CEO Lynn Harton. "This quarter, we entered into a bond portfolio restructuring transaction to reduce our exposure to interest rate volatility in this uncertain environment."

Despite the downturn in net income and EPS, United Community Banks Inc's balance sheet remains strong, with tangible common equity to tangible assets at 8.36%, up from the previous quarter. The bank's strategic moves, such as the bond portfolio restructuring, are aimed at positioning it for increased earnings in 2024.

In conclusion, United Community Banks Inc's fourth-quarter performance reflects the broader economic challenges, yet the bank's operational strength and strategic initiatives suggest a focus on long-term growth and stability. Investors and stakeholders will be watching closely to see how these efforts translate into financial performance in the upcoming year.

For a more detailed analysis and updates on United Community Banks Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from United Community Banks Inc for further details.

This article first appeared on GuruFocus.