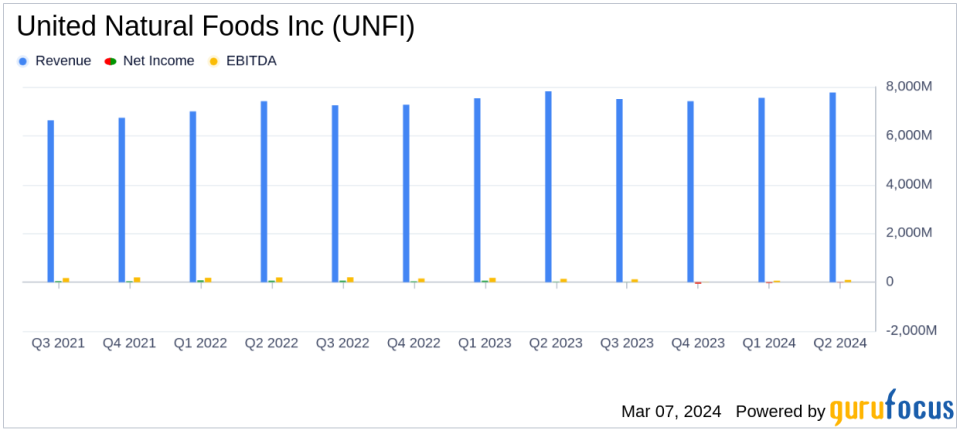

United Natural Foods Inc (UNFI) Faces Net Loss in Q2 Fiscal 2024 Amid Sales Decline

Net Sales: Slight decrease of 0.5% to $7.8 billion.

Net Loss: Reported a net loss of $15 million, a significant downturn from the previous year's net income.

Earnings Per Share (EPS): Dropped to a loss of $(0.25) per diluted share.

Adjusted EBITDA: Decreased by 29.3% to $128 million.

Adjusted EPS: Fell to $0.07, compared to $0.78 in the same quarter last year.

Free Cash Flow: Declined to $116 million from $448 million in the prior year's quarter.

Leverage: Net debt to Adjusted EBITDA leverage ratio stood at 4.3x as of January 27, 2024.

On March 6, 2024, United Natural Foods Inc (NYSE:UNFI) released its 8-K filing, detailing the financial outcomes for the second quarter of fiscal 2024, which ended on January 27, 2024. The company, a leading wholesale distributor of natural, organic, and specialty foods, as well as non-food products across North America, experienced a slight decrease in net sales and a notable decline in profitability compared to the same period last year.

UNFI's net sales dipped marginally by 0.5% to $7.8 billion, primarily due to a decline in unit volumes, which was somewhat offset by inflation and new business in the Supernatural channel. However, the company reported a net loss of $15 million, a stark contrast to the net income of $19 million in the second quarter of fiscal 2023. This resulted in a loss per diluted share (EPS) of $(0.25), down from an EPS of $0.31 in the prior year. Adjusted EBITDA also saw a significant decrease of 29.3% to $128 million, and adjusted EPS plummeted to $0.07 from $0.78.

Financial Performance and Challenges

The company's gross profit for the quarter was $1.0 billion, a decrease of 3.2% compared to the second quarter of fiscal 2023. The gross profit rate, excluding a non-cash LIFO charge, was 13.4% of net sales, down from 14.0% in the previous year. This decline was primarily attributed to lower procurement gains due to decelerating inflation.

Operating expenses were slightly higher at $1,010 million, including $14 million in Business Transformation Costs. Interest expense also increased slightly due to higher average interest rates. The company's effective tax rate was a benefit of 26.3% on pre-tax loss, reflecting the reduction in pre-tax income.

UNFI's free cash flow for the quarter was significantly lower at $116 million, compared to $448 million in the second quarter of fiscal 2023. The company's net debt decreased by $124 million compared to the end of the first quarter of fiscal 2024, and total liquidity stood at approximately $1.43 billion.

Outlook and Capital Allocation

UNFI has revised its fiscal 2024 outlook, reducing net sales expectations while maintaining the midpoints for net income, EPS, adjusted EPS, and adjusted EBITDA. The company continues to focus on operational execution and efficiency, including shrink reduction and network automation, with several initiatives expected to be completed in fiscal 2025.

CEO Sandy Douglas commented on the quarter's results, highlighting the progress on execution and profitability improvement. He noted the greater than anticipated benefits from near-term value creation initiatives and advances in managing shrink, which partially offset the expected reduction in procurement gains and start-up costs associated with a new distribution center.

Our second quarter results reflect our continued focus and progress on execution and profitability improvement through the important holiday selling season. Greater than anticipated benefits from our near-term value creation initiatives and further advances in managing shrink partially offset the expected reduction in procurement gains and start-up costs associated with a new distribution center, said Sandy Douglas, UNFIs Chief Executive Officer.

Value investors and potential GuruFocus.com members may find interest in UNFI's ongoing transformation and the measures it is taking to navigate current challenges. The company's commitment to improving operational efficiency and profitability, despite a challenging quarter, suggests a focus on long-term shareholder value creation.

For a more detailed analysis and further information, readers are encouraged to visit GuruFocus.com, where they can find comprehensive financial data and expert insights into United Natural Foods Inc's performance and prospects.

Explore the complete 8-K earnings release (here) from United Natural Foods Inc for further details.

This article first appeared on GuruFocus.