United Natural (UNFI) Allies With RELEX to Boost Supply Network

United Natural Foods, Inc. UNFI entered into a collaboration with RELEX Solutions to implement the latter’s advanced cloud-based procurement solution. The partnership will support United Natural Foods’ objective of improving its sales and supply chain execution to deliver products and services efficiently to its customers.

Based in Atlanta, GA, RELEX specializes in providing unified supply chain and retail optimization solutions to retailers and consumer goods companies globally.

Inside the Headlines

United Natural Foods will leverage RELEX’s expertise in cloud-based procurement solutions to transform its supply chain capabilities, enabling it to boost its operational efficiency. Empowered with AI and machine learning tools, RELEX’s procurement solutions will allow UNFI to automate its network and optimize its procurement processes, thus enhancing the customer experience.

RELEX’s advanced solution will allow UNFI to boost its demand planning, ordering and inventory management capabilities. The improved platform will help UNFI to optimize its inventory across all categories by minimizing spoilage, boosting service levels and improving data visibility in the supply chain. The deal will involve RELEX consolidating and eventually replacing multiple buying systems into a single process, thus enhancing UNFI’s supply chain capabilities.

As noted, the new platform is likely to be functional at United Natural Foods over the next 12-18 months.

Zacks Rank, Price Performance & Estimate Trend

The Zacks Rank #5 (Strong Sell) company has been grappling with the adverse impacts of cost inflation, supply-chain bottlenecks and operational complexities. In second-quarter fiscal 2023, its gross margin (excluding non-cash charges) of 14% contracted from 14.8% in the year-ago quarter. However, a solid demand environment for its products is likely to prove beneficial for United Natural Foods.

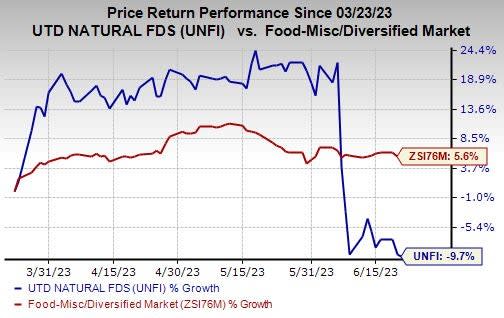

Image Source: Zacks Investment Research

In the past three months, the company’s shares have dropped 9.7% against the industry’s growth of 5.6%.

The Zacks Consensus Estimate for fiscal 2023 earnings declined by 23% to $2.54 in the past 60 days. Earnings estimates for fiscal 2024 have declined by 19.7% to $3.01 over the same period.

Key Picks

Some better-ranked stocks are Celsius Holdings, Inc. CELH, Nomad Foods Limited NOMD and Conagra Brands, Inc. CAG.

Celsius Holdings specializes in commercializing healthier, functional foods, beverages and dietary supplements. The Zacks Consensus Estimate for CELH’s current financial-year sales suggests 70.4% growth, while earnings per share are expected to rise by 154.3% from the corresponding year-ago reported figures. The company had an earnings surprise of 81.8% in the last reported quarter.

CELH currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nomad Foods, sporting a Zacks Rank #1, manufactures and distributes frozen foods. NOMD has a trailing four-quarter earnings surprise of 8.5%, on average.

The Zacks Consensus Estimate for Nomad Foods’ current financial year sales suggests growth of 8%, while earnings are likely to decline 3.4% from the prior-year reported numbers.

Conagra Brands operates as a leading branded food company in North America. The Zacks Consensus Estimate for CAG’s current financial-year sales and earnings per share suggests growth of 7.1% and 17%, respectively, from the corresponding year-ago reported figures.

Conagra, currently carrying a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 13.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report