United Rentals Inc (URI) Posts Record Earnings, Announces Share Buyback and Dividend Hike

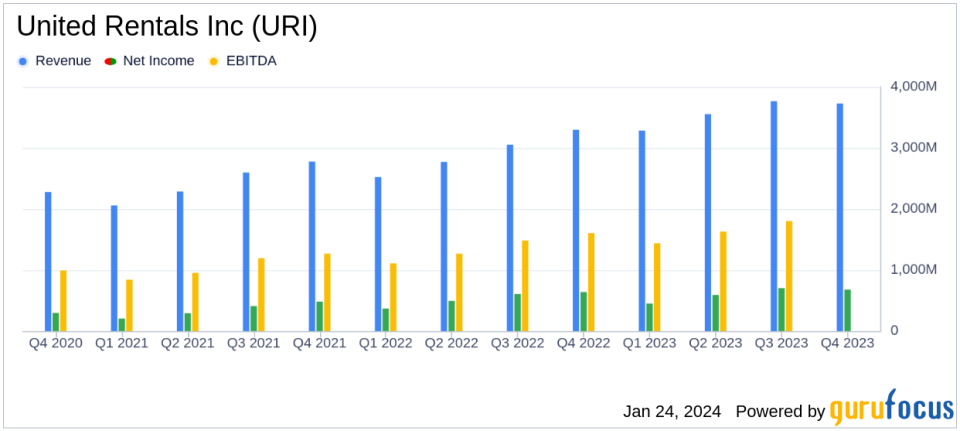

Revenue: Q4 total revenue reached $3.728 billion, a 13.5% increase year-over-year.

Net Income: Q4 net income rose to $679 million, with a net income margin of 18.2%.

Adjusted EBITDA: Q4 adjusted EBITDA hit a record $1.809 billion, despite a margin decrease to 48.5%.

Capital Expenditures: Full-year gross rental capital expenditures were $3.508 billion.

Shareholder Returns: URI returned $1.406 billion to shareholders in 2023 through buybacks and dividends.

Leverage and Liquidity: Year-end net leverage ratio was 1.6x, with total liquidity of $3.330 billion.

2024 Outlook: Revenue forecasted between $14.650 billion and $15.150 billion, with adjusted EBITDA between $6.900 billion and $7.150 billion.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 24, 2024, United Rentals Inc (NYSE:URI) released its 8-K filing, unveiling a record-setting fourth quarter and full-year 2023 results. The world's largest equipment rental company, with a commanding market share in North America, announced a robust financial performance that included significant revenue growth, net income increases, and a strong adjusted EBITDA. The company's comprehensive fleet, valued at $21 billion, and its strategic acquisitions have positioned it well in the industrial, commercial construction, and residential construction markets.

Financial Performance and Strategic Highlights

URI's fourth quarter saw rental revenue climb to $3.119 billion, a testament to the company's broad-based demand and the strategic acquisition of Ahern Rentals. Fleet productivity edged up by 0.3% as reported, and 2.4% on a pro forma basis. The company's net income for the quarter increased by 6.3% year-over-year to $679 million, marking a record high for the fourth quarter, excluding a one-time benefit in 2017.

Adjusted EBITDA for the quarter set a new record at $1.809 billion, although the adjusted EBITDA margin saw a decrease to 48.5%. This was primarily due to the impact of the Ahern Rentals acquisition on rental and used equipment gross margins, coupled with higher interest expenses, which were partially offset by reductions in SG&A and income tax expenses.

Capital Allocation and Shareholder Value

URI's enhanced capital allocation strategy includes a reduced leverage target, with the full-year net leverage ratio impressively standing at 1.6x. The company has also announced its intention to repurchase $1.5 billion of common stock in 2024 and increase its dividend per share by 10%. These shareholder-friendly moves underscore URI's commitment to delivering value and reflect confidence in the company's financial strength and future growth prospects.

2024 Outlook and Growth Prospects

Looking ahead, United Rentals provided an optimistic outlook for 2024, with total revenue expected to range between $14.650 billion and $15.150 billion, and adjusted EBITDA forecasted to be between $6.900 billion and $7.150 billion. The company's guidance reflects the anticipated growth and opportunities across its business segments, leveraging its competitive advantages to support customers and outpace the market.

Conclusion

United Rentals Inc (NYSE:URI) has demonstrated a strong financial performance in 2023, setting the stage for continued growth in 2024. With a clear strategy focused on balancing growth with returns, the company is well-positioned to capitalize on market opportunities and enhance shareholder value. Investors and stakeholders can look forward to a year of robust activity and strategic initiatives aimed at sustaining URI's market leadership in the equipment rental industry.

For a detailed analysis of United Rentals Inc's financial results and forward-looking strategies, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from United Rentals Inc for further details.

This article first appeared on GuruFocus.