United Therapeutics (UTHR) Q3 Earnings & Sales Beat Estimates

United Therapeutics‘ UTHR third-quarter 2023 earnings of $5.38 per share beat the Zacks Consensus Estimate of $4.89. Earnings rose 10% year over year on the back of higher product sales.

Revenues in the reported quarter were $609.4 million, beating the Zacks Consensus Estimate of $576.5 million. Revenues rose 18% year over year, driven by Tyvaso sales.

Quarter in Detail

United Therapeutics markets four products for pulmonary arterial hypertension (PAH) — Remodulin, Tyvaso, Adcirca and Orenitram. It also markets Unituxin for treating pediatric patients with high-risk neuroblastoma.

Tyvaso sales totaled $325.8 million, up 26% year over year. Tyvaso revenues included $205.1 million in sales from the Tyvaso dry powder inhalation (DPI) formulation, which was launched in 2022 and $120.7 million in sales from nebulized Tyvaso. Sales of Tyvaso DPI rose 225% in the quarter, driven by higher volumes and continued growth in utilization by patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD). Sales of nebulized Tyvaso declined 38% due to lower volumes following patient switch to Tyvaso DPI.

Tyvaso DPI is a drug-device product that offers some benefits over the nebulized Tyvaso and is approved for both PAH and PH-ILD. Nebulized Tyvaso is also approved for PAH and PH-ILD.

Tyvaso sales beat the Zacks Consensus Estimate of $305 million and our model estimate of $309.1 million.

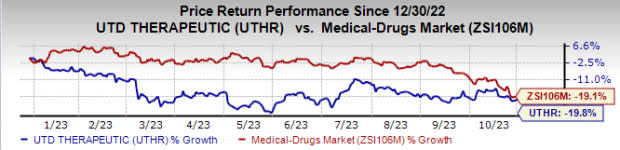

Shares of United Therapeutics were up slightly in pre-market trading. The stock has declined 19.8% year to date compared with the industry’s decline of 19.1%.

Image Source: Zacks Investment Research

Remodulin (including Remunity Pump) sales rose 15% year over year to $131.1 million, while Orenitram sales rose 5% year over year, amounting to $92.0 million.

Unituxin sales rose 11% year over year to $51.3 million. Adcirca sales were $7.3 million, down 32% year over year.

Research and development expenses were $84.7 million in the quarter, up 28% year over year. Selling, general and administrative expenses were up 30% to $127.6 million in the quarter.

Pipeline Update

United Therapeutics’ key phase III pipeline programs include TETON 1 and TETON 2 phase III studies of nebulized Tyvaso in patients with idiopathic pulmonary fibrosis and ADVANCE OUTCOMES studies on oral ralinepag for PAH. Data from both studies are expected in 2025.

Earlier this week, United Therapeutics announced that the first patient had been enrolled in the 52-week phase III TETON PPF study of nebulized Tyvaso in patients with another type of pulmonary fibrosis called progressive pulmonary fibrosis.

New Acquisition Deal

Earlier this week, United Therapeutics announced that it has entered into a definitive agreement to acquire Miromatrix Medical MIRO, which is making bioengineered organs composed of human cells. The acquisition will expand United Therapeutics’ existing organ manufacturing programs, which include xenotransplantation, three-dimensional organ printing, regenerative medicine and ex-vivo lung perfusion.

United Therapeutics will acquire all outstanding shares of Miromatrix for $3.25 per share in cash or approximately $91 million. In addition, United Therapeutics will be entitled to make a milestone payment of $1.75 per share in cash to Miromatrix Medical by Dec 31, 2025. The milestone payment is related to a study on Miromatrix’s fully-implantable manufactured kidney product known as mirokidney.

Zacks Rank & Key Picks

United Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Dynavax Technologies Corporation DVAX and MEI Pharma, Inc. MEIP, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 24 cents to 22 cents. Meanwhile, during the same period, earnings per share estimates for 2024 have improved from 2 cents to 8 cents. Year to date, shares of DVAX have rallied 33.5%.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters while missing the same on the remaining two occasions. DVAX delivered a four-quarter average earnings surprise of 25.78%.

In the past 60 days, estimates for MEI Pharma’s 2023 loss per share have improved from $6.54 to $4.89. During the same period, loss per share estimates for 2024 have narrowed from $5.14 to $4.02. Year to date, shares of MEIP have rallied 40%.

Earnings of MEI Pharma beat estimates in three of the trailing four quarters and met the same on the other occasion. On average, MEIP came up with a four-quarter earnings surprise of 53.58%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

United Therapeutics Corporation (UTHR) : Free Stock Analysis Report

MEI Pharma, Inc. (MEIP) : Free Stock Analysis Report

Miromatrix Medical Inc. (MIRO) : Free Stock Analysis Report