Uniti Group Inc (UNIT) Reports Mixed 2023 Financial Results Amid Economic Challenges

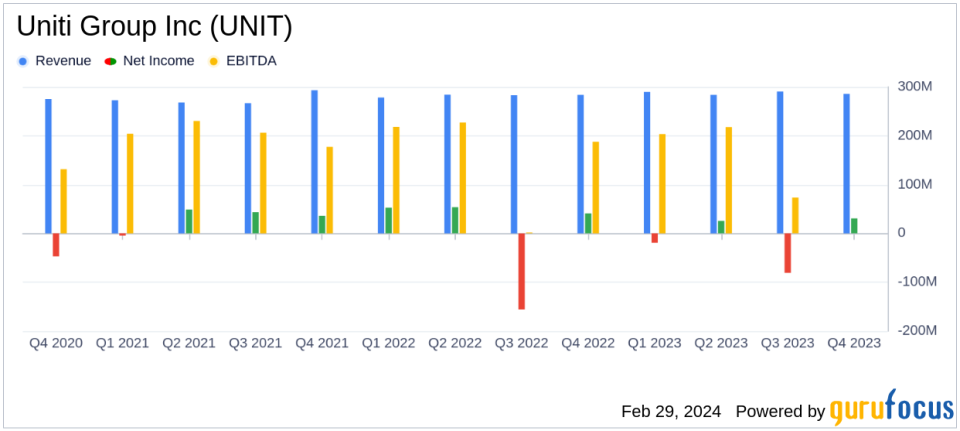

Net Income: $30.7 million for Q4, but a full-year loss of $(81.7) million.

Adjusted EBITDA: $231.1 million for Q4 and $923.5 million for the full year.

Revenue: $285.7 million for Q4 and $1.1 billion for the full year.

AFFO Per Share: $0.34 for Q4 and $1.42 for the full year.

Leverage Ratio: 6.03x based on net debt to Q4 2023 annualized Adjusted EBITDA.

Dividend: Quarterly cash dividend of $0.15 per common share declared.

2024 Outlook: Revenue projected between $1,154 million to $1,174 million, with net income attributable to common shareholders expected to be $108 million to $128 million.

On February 29, 2024, Uniti Group Inc (NASDAQ:UNIT) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading provider of mission-critical communications infrastructure with approximately 140,000 route miles of fiber, faced a challenging economic environment throughout the year. Despite these challenges, Uniti Group Inc managed to post a net income of $30.7 million in the fourth quarter, although the full year reflected a net loss of $(81.7) million.

Uniti's leasing segment, which accounts for the majority of its revenue, primarily through a master lease agreement with Windstream, contributed $214.9 million in revenue and $209.5 million in Adjusted EBITDA for the fourth quarter. The fiber segment reported $70.7 million in revenue and $27.0 million in Adjusted EBITDA for the same period. The full year saw the leasing segment contribute $852.8 million in revenue and $829.6 million in Adjusted EBITDA, while the fiber segment contributed $297.1 million in revenue and $115.7 million in Adjusted EBITDA.

Uniti's financial achievements in 2023 included refinancing $3.1 billion of outstanding debt and raising up to $437 million through asset-backed securities (ABS) bridge financing and non-core asset sales. These initiatives have fully funded the company's current business plan, with no significant permanent debt maturities until 2027 and over 95% of debt being at fixed rates.

However, the company's full-year results were impacted by a $204.0 million goodwill impairment charge related to the Uniti Fiber segment, driven by an increase in the macro interest rate environment. The company's Adjusted EBITDA and AFFO results for the full year were essentially in line with previous guidance, despite lower non-recurring revenue from equipment lease termination (ETL) fees and one-time low-margin equipment sales.

Looking ahead to 2024, Uniti Group Inc provided an initial outlook, which includes the impact of the recent ABS Facility, the planned exit from most one-time equipment sales, the recently completed asset sales, and the upcoming maturity of the remaining 4.00% exchangeable notes due June 2024. The company's consolidated outlook for 2024 anticipates revenue between $1,154 million to $1,174 million, with net income attributable to common shareholders expected to be between $108 million to $128 million.

Uniti's liquidity position remains strong, with approximately $354.3 million in unrestricted cash and cash equivalents at year-end. The company's leverage ratio stood at 6.03x based on net debt to Q4 2023 annualized Adjusted EBITDA. The Board of Directors declared a quarterly cash dividend of $0.15 per common share, payable on April 12, 2024, to stockholders of record on March 28, 2024.

Uniti Group Inc's performance in 2023 demonstrates the company's resilience in the face of economic headwinds. The strategic moves to strengthen the balance sheet and the focus on high-margin recurring revenue streams position the company to navigate the challenges ahead. For value investors, Uniti's ability to maintain a steady AFFO per share and its proactive financial management may offer a compelling investment opportunity in the REIT sector.

Investors and analysts interested in further details can access the full earnings release and participate in the conference call hosted by Uniti, or review the webcast on the company's Investor Relations website.

For a deeper dive into Uniti Group Inc's financials and strategic outlook, visit GuruFocus.com for comprehensive analysis and up-to-date information.

Explore the complete 8-K earnings release (here) from Uniti Group Inc for further details.

This article first appeared on GuruFocus.