Unity (NYSE:U) Beats Q4 Sales Targets But Stock Drops 15.7%

Game engine maker Unity (NYSE:U) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 35.1% year on year to $609.3 million. On the other hand, next quarter's revenue guidance of $417.5 million was less impressive, coming in 30.8% below analysts' estimates. It made a GAAP loss of $0.66 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy Unity? Find out by accessing our full research report, it's free.

Unity (U) Q4 FY2023 Highlights:

Revenue: $609.3 million vs analyst estimates of $585.5 million (4.1% beat)

EPS: -$0.66 vs analyst expectations of -$0.48 (38.9% miss)

Revenue Guidance for Q1 2024 is $417.5 million at the midpoint, below analyst estimates of $603 million

Management's revenue guidance for the upcoming financial year 2024 is $1.78 billion at the midpoint, missing analyst estimates by 31.4% and implying -18.6% growth (vs 59.9% in FY2023)

Free Cash Flow of $60.74 million, down 41.6% from the previous quarter

Gross Margin (GAAP): 57.1%, down from 69.7% in the same quarter last year

Market Capitalization: $11.88 billion

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

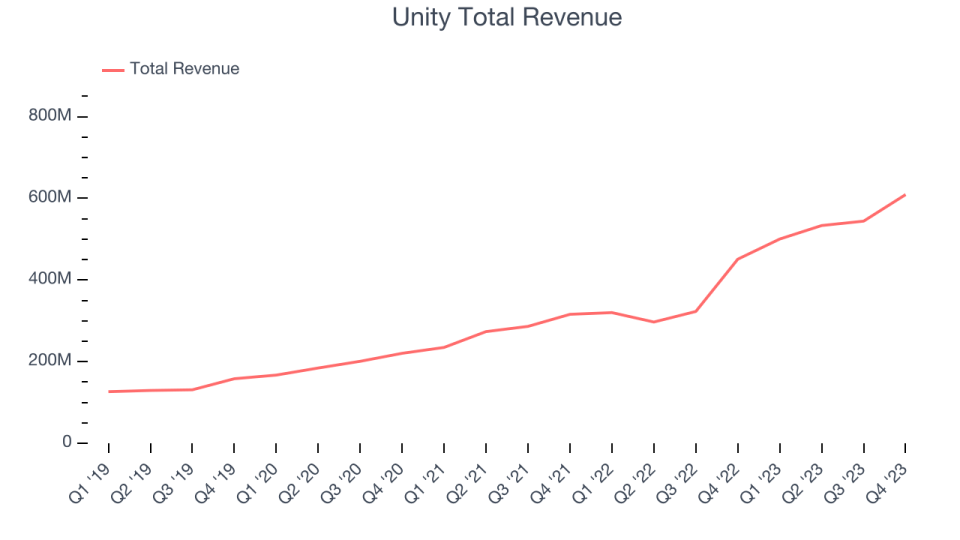

As you can see below, Unity's revenue growth has been impressive over the last two years, growing from $315.9 million in Q4 FY2021 to $609.3 million this quarter.

Unsurprisingly, this was another great quarter for Unity with revenue up 35.1% year on year. On top of that, its revenue increased $65.06 million quarter on quarter, a very strong improvement from the $10.73 million increase in Q3 2023. This is a sign of acceleration of growth and great to see.

Next quarter, Unity is guiding for a 16.6% year-on-year revenue decline to $417.5 million, a further deceleration from the 56.3% year-on-year decrease it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.78 billion at the midpoint, declining 18.6% year on year compared to the 57.2% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

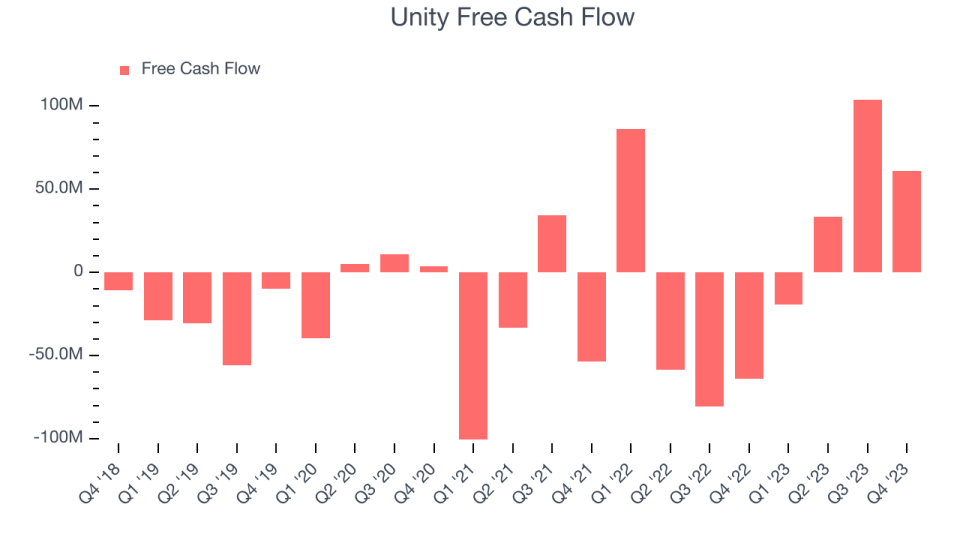

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Unity's free cash flow came in at $60.74 million in Q4, turning positive over the last year.

Unity has generated $178.8 million in free cash flow over the last 12 months, or 8.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Unity's Q4 Results

We struggled to find many strong positives in these results as the company's full-year 2024 revenue and EPS guidance fell short of analysts' estimates. Although this quarter's headline revenue beat, Unity stated it benefitted from a unique event where one of its customers, Wētā, terminated its service agreement and opted for a perpetual license to access its software. This resulted in a one-time revenue boost of $99 million - without this sale, Unity's revenue would have been $510 million, dropping 2% year on year.

In its shareholder letter, James Whitehurst, the company's recently appointed CEO (October 2023), also shared Unity's new strategy. The company's reset will be split into two phases, the first being to focus on its core business by narrowing its investments. Unity also intends to right-size its cost structure, as seen in its January 8th layoff of 25% of its workforce. Phase one is expected to finish by the end of Q1, and once Unity's leaner cost base is established, it plans to return to growth initiatives and new product development.

Overall, this was a mediocre quarter for Unity, and investors are likely uncomfortable with the company's outlook. The stock is down 15.7% on the results and currently trades at $27.83 per share.

Unity may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.