Unity Software Inc (U) Reports Mixed Q4 Results Amid Strategic Reset

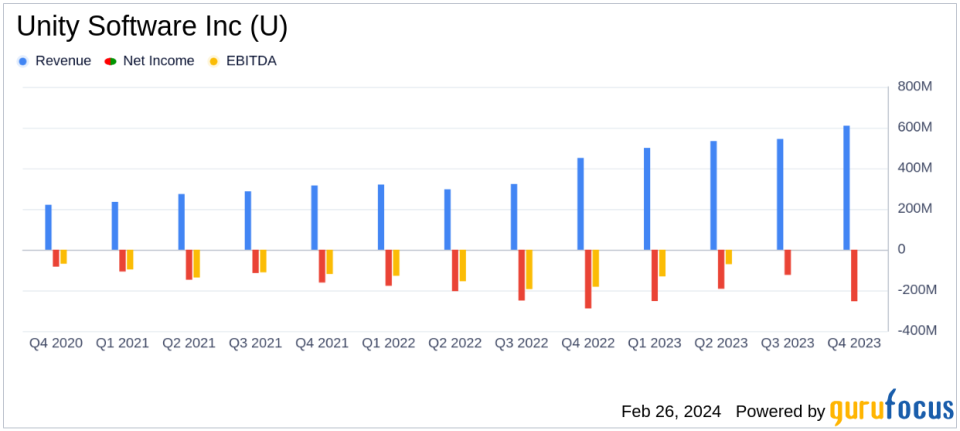

Revenue: Q4 revenue increased by 35% year-over-year to $609 million, with a notable contribution from a one-time transaction.

Adjusted EBITDA: Q4 Adjusted EBITDA stood at $186 million, benefiting significantly from a perpetual license agreement.

Net Loss: GAAP net loss for Q4 was $254 million, an improvement from the previous year's $288 million loss.

Strategic Shift: Unity is refocusing on core businesses and expects to complete the first phase of its reset by the end of Q1.

Guidance: For Q124, Unity guides Strategic Portfolio revenue to be between $415-420 million and Adjusted EBITDA to be $45-50 million.

Cost Reduction: Unity anticipates approximately $250 million in annualized non-GAAP operating expense reductions.

Future Outlook: Unity aims for revenue growth acceleration in H2 2024 and Adjusted EBITDA margins over 25% by year-end.

On February 26, 2024, Unity Software Inc (NYSE:U) released its 8-K filing, detailing the company's financial performance for the fourth quarter of 2023. Unity, a leading platform for creating and operating interactive, real-time 3D content, reported a 35% increase in revenue to $609 million for the quarter. This growth includes $99 million from the termination of a service agreement and entry into a perpetual license agreement with W?t? FX. Excluding this one-time transaction, revenue would have been $510 million, representing a 2% decline year-over-year on a pro-forma basis.

The company's Adjusted EBITDA for Q4 was $186 million, with the W?t? FX transaction contributing $102 million. Without this transaction, Adjusted EBITDA would have been $84 million, marking a significant increase from the 5% margin of the same quarter last year. Unity's GAAP net loss improved to $254 million from the previous year's $288 million. The company's cash flow also remained positive, with $72 million provided by operations and $61 million in free cash flow for the quarter.

Unity is undergoing a strategic reset, focusing on its core businesses of Engine, Cloud, and Monetization, while narrowing investments in new businesses, primarily in Industries. The company is exiting certain non-core businesses, which contributed $283 million in revenue in 2023 but operated at a significant Adjusted EBITDA loss. Unity expects to complete the first phase of its reset by the end of Q1 2024, which includes portfolio adjustments and cost structure right-sizing aimed at reducing approximately $250 million in annualized non-GAAP operating expenses.

For the first quarter of 2024, Unity is guiding revenue for its Strategic Portfolio to be between $415-420 million and Adjusted EBITDA for the total company to be $45-50 million. The full-year guidance for the Strategic Portfolio is set at $1,760 to $1,800 million in revenue, with Adjusted EBITDA for the total company expected to be between $400-425 million. Unity anticipates revenue growth acceleration in the second half of 2024 and aims to exit the year with double-digit growth and Adjusted EBITDA margins over 25%.

Unity's leadership expressed confidence in the company's strategic direction and its ability to deliver value to customers and shareholders. The company is optimistic about its future, particularly in the gaming industry and expanding real-time 3D capabilities to other industries.

Unity's balance sheet remains solid, with the company well-positioned to navigate its strategic transition and capitalize on growth opportunities in the dynamic gaming and real-time 3D markets.

Investors and stakeholders are encouraged to review the detailed financial tables and reconciliations provided in the filing for a comprehensive understanding of Unity's financial position and performance.

"We are focused on delivering value for our customers. We believe that we are making the right interventions to win with customers for many years to come through a more focused portfolio, a leaner cost structure, and innovation that customers value. We are well positioned to win with customers in games and across Industries. We are optimistic about our future, and confident that we will execute the two-phase reset with excellence. We are committed to increasing shareholder value through revenue growth, margin expansion, and free cash flow generation and we believe that the steps we have taken in the past few months position us for success in 2024 and beyond." - Jim Whitehurst, Interim CEO, and Luis Visoso, CFO

Explore the complete 8-K earnings release (here) from Unity Software Inc for further details.

This article first appeared on GuruFocus.