Universal Display (OLED) Inks Long-Term Supply Deal With BOE

Universal Display Corporation OLED recently inked a long-term agreement with BOE Technology Group Co., Ltd. to supply OLED materials and related technology for use in the China-based firm. The deal for an undisclosed amount will strengthen the longstanding business relationship and will likely foster the wide proliferation of OLEDs across the global consumer electronics landscape.

In particular, Universal Display will supply its proprietary UniversalPHOLED phosphorescent OLED materials to BOE. The company’s UniversalPHOLED phosphorescent OLED technology produces OLEDs that are four times more efficient than fluorescent OLEDs and significantly more efficient than current LCDs. This provides Universal Display with a competitive advantage over other OLED makers.

Universal Display’s dominance in OLED technology is primarily driven by its strong portfolio of around 5,500 patents worldwide. Moreover, collaborations with leading centers of excellence like Princeton University, the University of Southern California, the University of Michigan and PPG Industries will continue to strengthen its patent portfolio in the long haul. The development of a blue phosphorescent emissive system is progressing steadily. Management expects the introduction of the entire series of red, green and blue phosphorescent emissive materials to open up several possibilities in a variety of OLED applications.

Strong end-market demand also presents a significant growth opportunity for Universal Display over the long term. OLED is suitable for commercial usage in a number of industries, including smartphones, television, virtual reality devices and automotive markets. The increasing proliferation of smartphones, wearables and tablets is driving the adoption of small-area OLEDs. Large-area OLED displays are increasingly used in televisions.

Further, unlike LEDs, OLEDs can be viewed directly and doesn’t need diffusers. It is also expected to be cost-effective when manufactured in high volumes, which makes it suitable for commercial application in the solid-state lighting market. The long-term supply and license agreement with the China-based electronic components producer, which is one of the world's largest manufacturers of LCDs, OLEDs and flexible displays, will likely generate incremental revenues for Universal Display.

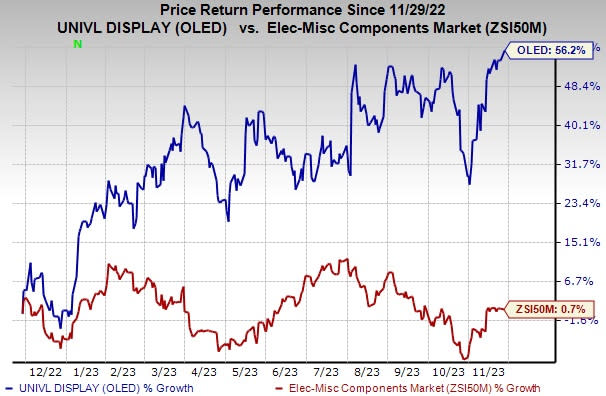

The stock has gained 56.2% in the past year compared with the industry’s growth of 0.7%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Universal Display currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2 (Buy), is a solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC sports a Zacks Rank #1. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Universal Display Corporation (OLED) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report