Universal Display (OLED) Q2 Earnings Miss, Revenues Fall Y/Y

Universal Display Corporation OLED reported second-quarter 2020 adjusted earnings of 2 cents per share (per ASC Topic 606 basis), which declined 78.3% year over year and missed the Zacks Consensus Estimate by 16.7%.

Revenues declined 50.9% year over year to $58 million and missed the Zacks Consensus Estimate by 18.3%. The decrease in revenues was mainly due to weakened demand for emitter products as a result of the COVID-19 pandemic and higher inventory level.

Segment Details

Material sales (55% of total revenues) decreased 58.2% from the year-ago quarter’s figure to $31.9 million. Green emitters sales (including yellow-green emitters) were $24.2 million, down 54% year over year. Red emitter sales were $7.5 million, down 53.1% year over year.

Royalty and license fees (38.6% of total revenues) decreased 42.4% year over year to $22.4 million. Adesis revenues came in at $3.7 million during the reported quarter compared with $2.9 million reported in the year-ago quarter.

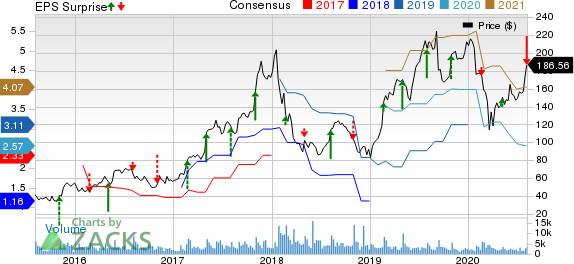

Universal Display Corporation Price, Consensus and EPS Surprise

Universal Display Corporation price-consensus-eps-surprise-chart | Universal Display Corporation Quote

Contract research services revenues (6.3% of total revenues) came in at $3.6 million, up 26.2% year over year.

Operating Details

Gross margin in the quarter under review came in at 78.1%, which contracted 150 basis points (bps) from the year-ago quarter’s figure. Material gross margin contracted 300 bps year over year to 68%.

Operating expenses of $46.5 million were up 2.4% year over year. As a percentage of revenues, operating expenses expanded to 80.2% on a year-over-year basis from 38.4% in the year-ago quarter.

The company reported operating loss of $1.1 million against operating income of $48.6 million in the year-ago quarter.

Balance Sheet

As of Jun 30, 2020, Universal Display had cash and cash equivalents (including short-term investments) of $644 million compared with of $639.8 million as of Mar 31, 2020.

Cash flow from operating activities was $32 million compared with $5.7 million in the prior quarter.

The company approved a quarterly cash dividend of 15 cents per share, to be paid out on Sep 30, 2020 to all shareholders of record on Sep 16, 2020.

Guidance

The company has withdrawn its guidance for 2020 due to COVID-19 related uncertainties prevailing in the market.

Zacks Rank & Stocks to Consider

Currently, Universal Display carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are ANGI Homeservices ANGI, Agilent A and Analog Devices ADI. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ANGI Homeservices, Agilent and Analog Devices are set to report their quarterly results on Aug 10, 18 and 19, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

ANGI Homeservices Inc. (ANGI) : Free Stock Analysis Report

Universal Display Corporation (OLED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research