Universal Electronics Inc (UEIC) Faces Headwinds: Full Year Net Sales and Margins Decline

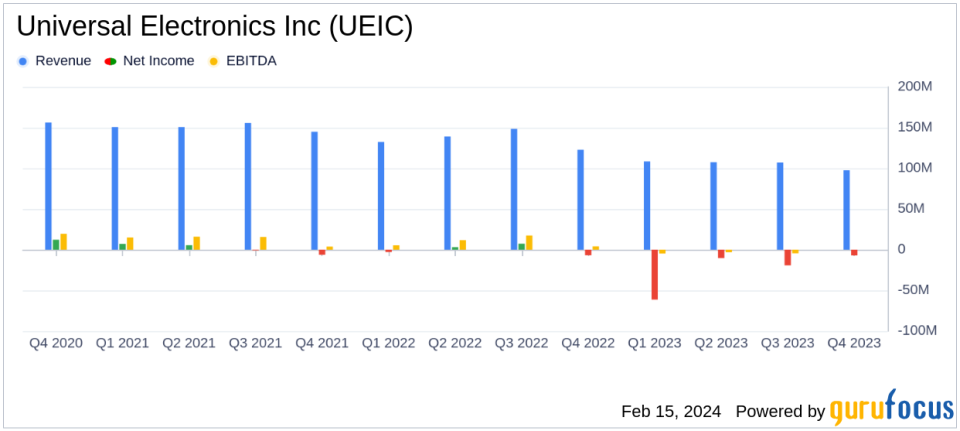

Net Sales: Full year GAAP net sales decreased to $420.5 million from $542.8 million in the previous year.

Gross Margins: Full year GAAP gross margins declined to 23.2% from 28.1% year-over-year.

Net Loss: GAAP net loss for the year stood at $98.2 million, a significant drop from a net income of $0.4 million in the prior year.

Earnings Per Share (EPS): Full year GAAP loss per share was $7.64 compared to earnings of $0.03 per diluted share in the previous year.

Cash Position: Cash and cash equivalents were $42.8 million as of December 31, 2023.

On February 15, 2024, Universal Electronics Inc (NASDAQ:UEIC) released its 8-K filing, reporting its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leader in wireless control solutions for home entertainment and smart home devices, has faced challenges that have impacted its financial performance, including a significant decrease in net sales and gross margins.

Universal Electronics Inc (NASDAQ:UEIC) is a company with a strong focus on innovation and manufacturing in the electronic products sector, particularly in wireless control products, audio-video accessories, and intelligent wireless automation components. With a global presence and a majority of its revenue generated from the United States, UEIC serves a diverse range of markets, including subscription broadcasters and consumer electronics.

Financial Performance and Challenges

For the fourth quarter of 2023, UEIC reported GAAP net sales of $97.6 million, a decrease from $122.8 million in the same period the previous year. The company's GAAP gross margins improved slightly to 28.5% from 26.2%, while adjusted Non-GAAP gross margins decreased to 30.2% from 30.7%. The GAAP operating loss was $2.6 million, compared to a loss of $1.9 million in the fourth quarter of 2022. Adjusted Non-GAAP operating income was $1.8 million, down from $8.3 million.

The full year results were more concerning, with GAAP net sales falling to $420.5 million from $542.8 million in 2022. The GAAP gross margin for the year decreased to 23.2% from 28.1%, and the company reported a GAAP operating loss of $85.3 million, including a $49.1 million non-cash charge for goodwill impairment due to a decline in the company's market capitalization. This is a stark contrast to the GAAP operating income of $14.5 million reported in the previous year. Adjusted Non-GAAP operating loss was $0.8 million, compared to an operating income of $41.8 million in 2022.

UEIC's net loss for the year was significant, with a GAAP net loss of $98.2 million, or $7.64 per share, compared to a net income of $0.4 million, or $0.03 per diluted share, in the prior year. The adjusted Non-GAAP net loss was $2.3 million, or $0.18 per share, compared to an adjusted net income of $32.7 million, or $2.56 per diluted share.

Financial Outlook and Management Commentary

Looking ahead to the first quarter of 2024, UEIC expects GAAP net sales to range between $86 million and $96 million, with a GAAP loss per share expected to range from $0.88 to $0.78. This compares to $108.4 million in net sales and a GAAP loss per share of $4.81 in the first quarter of 2023. The adjusted Non-GAAP loss per share is expected to range from $0.27 to $0.17.

"We are building for a better future," said Paul Arling, UEIs chairman and CEO. "During 2023, we successfully advanced our transformation, increasing our focus in growth areas such as home automation and climate control. We are executing our efficiency initiatives, and our strong gross margins delivered better than expected earnings per share for the fourth quarter of 2023."

Despite the challenges, UEIC's management remains confident in their strategy and long-term growth, planning to continue the share repurchase program and capitalizing on recent legal victories that affirm the company's valuable intellectual property.

Conclusion

Universal Electronics Inc (NASDAQ:UEIC) is navigating through a period of transition and facing market challenges that have affected its financial results. However, the company's focus on efficiency initiatives, growth areas, and intellectual property protection suggests a strategic approach to overcoming these hurdles and improving future profitability.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Universal Electronics Inc for further details.

This article first appeared on GuruFocus.