Universal Health Services (UHS): A Hidden Gem in the Healthcare Sector?

With a daily gain of 2.36%, a three-month loss of -6.69%, and an Earnings Per Share (EPS) of 9.63, Universal Health Services Inc (NYSE:UHS) presents an interesting case for potential investors. However, the question remains: is the stock modestly undervalued? This article aims to provide a comprehensive analysis of Universal Health Services' valuation and offers insights into its financial health and growth prospects. Read on to discover if this healthcare giant holds potential for your investment portfolio.

Company Overview

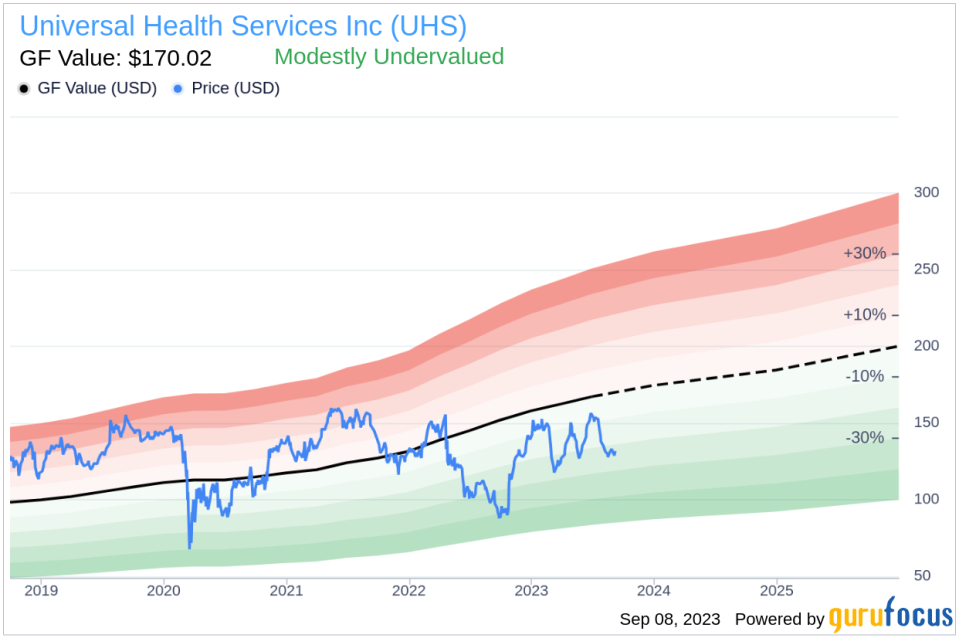

Universal Health Services Inc owns and operates acute care hospitals, behavior health centers, surgical hospitals, ambulatory surgery centers, and radiation oncology centers. The firm operates in two key segments: Acute Care Hospital Services and Behavioral Health Services. The Acute Care Hospital Services segment includes the firm's acute care hospitals, surgical hospitals, and surgery and oncology centers. With a current market cap of $9.10 billion and annual sales of $13.80 billion, the company's stock price stands at $131.12, against a GF Value of $170.02. This discrepancy suggests that the stock might be modestly undervalued.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

Given these factors, Universal Health Services is perceived to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

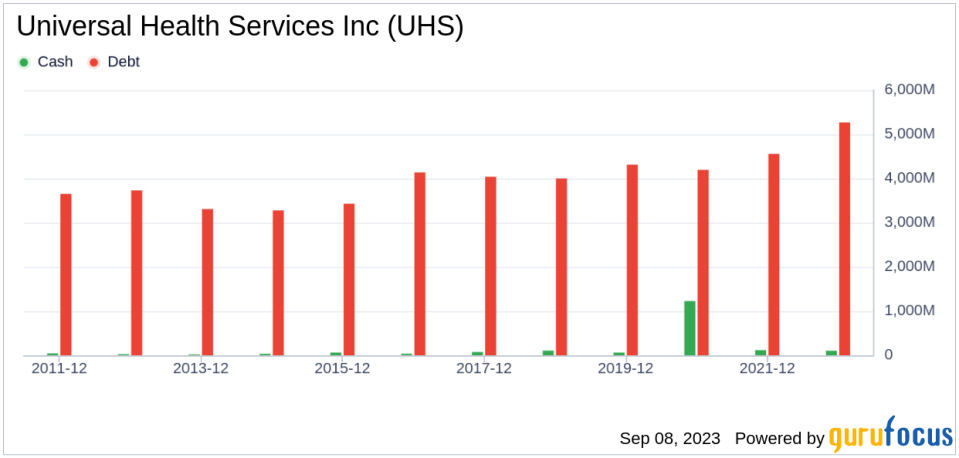

Financial Strength

Before investing, it's crucial to assess a company's financial strength. Companies with poor financial strength pose a higher risk of permanent loss. Universal Health Services' cash-to-debt ratio of 0.02 is lower than 94.79% of 653 companies in the Healthcare Providers & Services industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over time, is typically less risky. Universal Health Services, with an operating margin of 7.94%, ranks better than 66.36% of 648 companies in the Healthcare Providers & Services industry. However, its 3-year average EBITDA growth rate is 3.3%, which ranks worse than 61.41% of 526 companies in the industry.

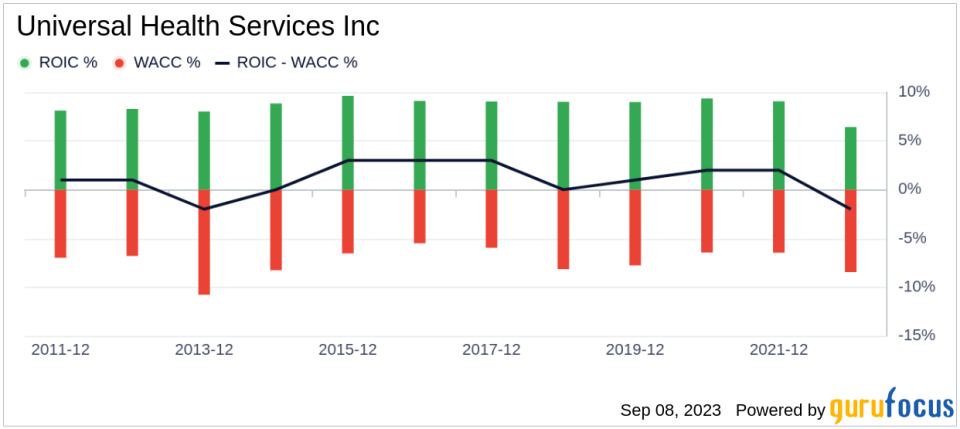

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted average cost of capital (WACC) is another way to evaluate its profitability. For the past 12 months, Universal Health Services' ROIC is 7.11, and its WACC is 8.73.

Conclusion

In summary, Universal Health Services (NYSE:UHS) is believed to be modestly undervalued. While the company's financial condition is fair and its profitability is strong, its growth ranks worse than 61.41% of 526 companies in the Healthcare Providers & Services industry. To learn more about Universal Health Services stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.