The Universal Security Instruments (NYSEMKT:UUU) Share Price Is Down 89% So Some Shareholders Are Rather Upset

This month, we saw the Universal Security Instruments, Inc. (NYSEMKT:UUU) up an impressive 37%. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 89% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Universal Security Instruments

Because Universal Security Instruments made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Universal Security Instruments saw its revenue increase by 10.0% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 36% per year in the last five years. The market can be a harsh master when your company is losing money and revenue growth disappoints.

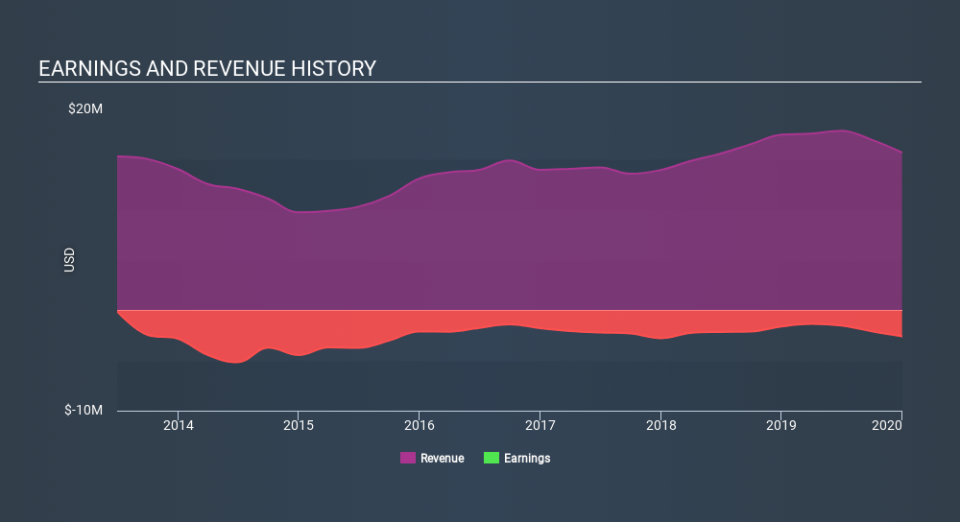

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Universal Security Instruments shareholders are down 53% for the year. Unfortunately, that's worse than the broader market decline of 1.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 36% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Universal Security Instruments is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Of course Universal Security Instruments may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.