Universal Stainless & Alloy Products Inc (USAP) Reports Record Sales, Aligns with EPS ...

Record Sales: Q4 sales surged to $79.8 million, a 12% increase from Q3 2023 and a record full year 2023 sales of $285.9 million, up 42% from 2022.

Gross Margin: Improved to 16.4% of sales in Q4 2023, the highest since Q2 2018, despite facing raw material headwinds.

Net Income: Q4 net income rose 35% to $2.6 million, or $0.27 per diluted share, aligning with analyst EPS estimates of $0.35.

Premium Alloy Sales: Reached a record $21.1 million in Q4, contributing to a significant 74% annual increase in this high-margin segment.

Aerospace Demand: Aerospace sales continued to drive growth with a 15% sequential increase to a record $61.9 million in Q4.

Financial Position: Managed working capital was $148.1 million at year-end 2023, with a strong backlog of $318.2 million.

Capital Expenditures: Totaled $13.0 million for the full year 2023, reflecting investments in new Vacuum Arc Remelt furnaces.

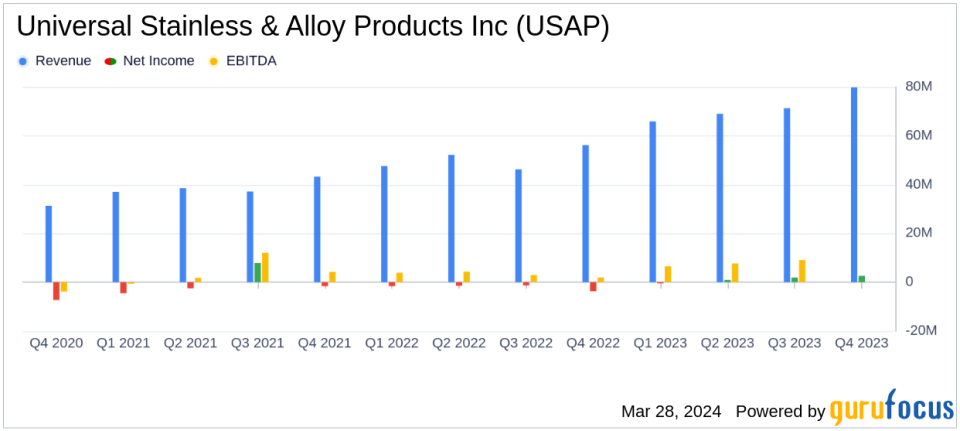

On March 28, 2024, Universal Stainless & Alloy Products Inc (NASDAQ:USAP) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a manufacturer and marketer of semi-finished and finished specialty steel products, reported record sales and net income for the period, highlighting a robust year of financial performance.

Financial and Operational Highlights

USAP's fourth-quarter sales reached a record high of $79.8 million, a 12% increase over the previous quarter, and full-year sales soared to $285.9 million, marking a 42% increase from 2022. The company's strategic focus on high-margin premium and specialty alloys paid off, with full-year premium alloy sales surging 74% to $68.1 million. Aerospace sales, driven by strong market demand, also reached a record $216.1 million for the year, a 57% increase from 2022.

The company's gross margin improved significantly to 16.4% of sales in the fourth quarter, the highest since the second quarter of 2018, despite facing a $1.6 million headwind from raw material costs. Operating income rose to $4.8 million in Q4, up 9% from the previous quarter. Net income for the quarter increased by 35% to $2.6 million, or $0.27 per diluted share, which aligns with the estimated earnings per share of $0.35.

Challenges and Outlook

While USAP has demonstrated strong financial achievements, it also faced challenges such as raw material price volatility and increased SG&A expenses due to higher employee-related and insurance costs. However, the company's management remains optimistic about the future, expecting the negative surcharge misalignment caused by falling commodity prices to lessen by the end of the second quarter of 2024.

President and CEO Christopher M. Zimmer commented on the company's performance and future outlook, noting the strategic focus on premium and specialty alloys and robust demand in the aerospace market. He stated, "We have entered 2024 with a strong book of business, with premium alloys representing more than a third of our backlog, and with robust demand continuing unabated in aerospace."

Financial Position and Investments

USAP's financial position remains strong, with managed working capital at $148.1 million at the end of 2023. The company successfully reduced total debt by $12.9 million from the end of 2022, ending the year with $85.6 million in total debt. Capital expenditures for the year totaled $13.0 million, mainly for the addition of two new Vacuum Arc Remelt furnaces, which are expected to enhance the company's capabilities and capacity in premium and specialty alloys.

Universal Stainless & Alloy Products Inc's record sales and earnings for Q4 and the full year of 2023 reflect the company's successful strategic focus and operational efficiency. With a strong backlog and continued demand, particularly in the aerospace sector, USAP appears well-positioned for sustained growth in the coming periods.

For more detailed information and analysis, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Universal Stainless & Alloy Products Inc for further details.

This article first appeared on GuruFocus.