Universal Stainless (USAP) Up 39% in 6 Months: Here's Why

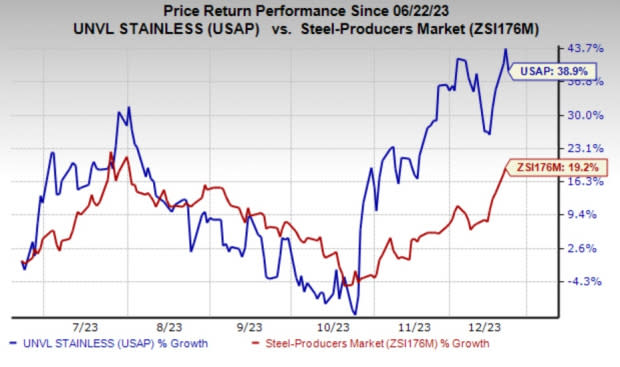

Universal Stainless & Alloy Products, Inc.‘s USAP shares have rallied 38.9% in the past six months. Owing to the upside, the stock outperformed the industry’s rise of 19.2% over the same time frame. The company has topped the S&P 500’s nearly 8.7% rise in the same period.

Image Source: Zacks Investment Research

Let’s discuss the factors driving this Zacks Rank #2 (Buy) stock.

What’s Driving Universal Stainless?

In the third quarter, USAP delivered a strong financial performance, with earnings doubling from the previous quarter’s levels and an impressive 54% year-over-year growth in sales, reaching $71.3 million. The surge in premium alloy sales, driven by increased aerospace demand, played a crucial role in advancing the development of specialty alloys. Aerospace sales in the third quarter reached a record high of $53.9 million, contributing 75.6% to total sales and surging 70.3% from the year-ago quarter’s levels.

The company's gross margin showed consistent improvement, reaching $10.9 million and contributing 15.2% to sales — the highest level since the second quarter of 2018. This positive trend was fueled by a favorable product mix and higher selling prices, effectively offsetting negative surcharge misalignment resulting from declining commodity prices.

USAP is currently in the commissioning phase of its capital project, integrating two Vacuum-Arc Remelt (VAR) furnaces into the North Jackson facility. Post-completion, this initiative is expected to boost the company's capacity in premium and specialty alloys by 20%, enabling the expansion of its portfolio with technologically advanced, higher-margin products, particularly in aerospace applications, including defense.

In the third quarter, USAP exceeded expectations by reporting adjusted earnings of 20 cents per share, surpassing the Zacks Consensus Estimate of 15 cents. This marked the company's fourth consecutive quarter of positive earnings surprises, with an average beat of 44.4%. The Zacks Consensus Estimate for USAP's 2023 earnings is pegged at 52 cents, indicating a year-over-year surge of 170.3%. The consensus estimate for the current year's earnings underwent a positive revision of 15.6% in the past 60 days, highlighting the robust growth potential of the company.

Universal Stainless & Alloy Products, Inc. Price and Consensus

Universal Stainless & Alloy Products, Inc. price-consensus-chart | Universal Stainless & Alloy Products, Inc. Quote

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AXTA’s current-year earnings is pegged at $1.58 per share, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 29.7% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5%, on average. The stock has rallied around 80.8% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents per share, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 36.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report