Universal Technical Institute (NYSE:UTI) Delivers Impressive Q1, Provides Encouraging Full-Year Guidance

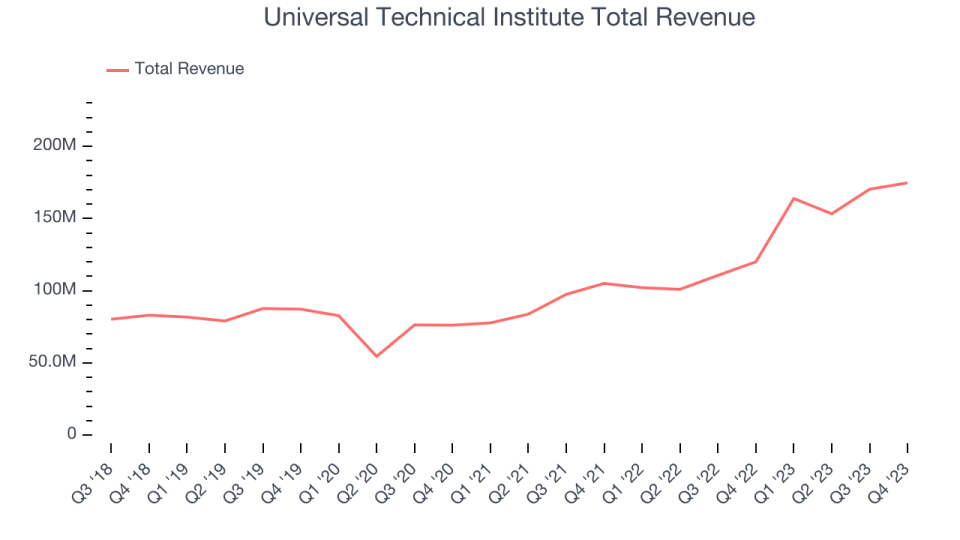

Vocational education Universal Technical Institute (NYSE:UTI) reported results ahead of analysts' expectations in Q1 FY2024, with revenue up 45.6% year on year to $174.7 million. The company's full-year revenue guidance of $715 million at the midpoint also came in slightly above analysts' estimates. It made a GAAP profit of $0.17 per share, improving from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Universal Technical Institute? Find out by accessing our full research report, it's free.

Universal Technical Institute (UTI) Q1 FY2024 Highlights:

Revenue: $174.7 million vs analyst estimates of $168.3 million (3.8% beat)

EPS: $0.17 vs analyst estimates of $0.04 ($0.13 beat)

Raised full year 2024 guidance at the midpoint for revenue, adjusted EBITDA, and adjusted EPS

Free Cash Flow of $6.99 million, down 84.8% from the previous quarter

Gross Margin (GAAP): 47.1%, down from 56.7% in the same quarter last year

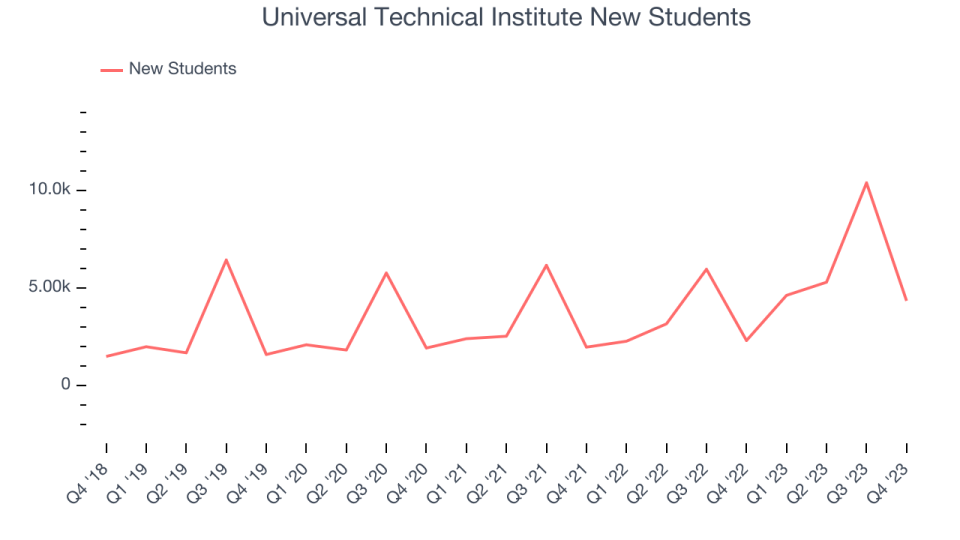

New Students: 4,346

Market Capitalization: $791.5 million

"In the first quarter of 2024, we continued to outperform our financial expectations and advance our growth, diversification, and optimization strategy," said Jerome Grant, CEO of Universal Technical Institute, Inc.

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Universal Technical Institute's annualized revenue growth rate of 16.1% over the last 5 years was solid for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Universal Technical Institute's healthy annualized revenue growth of 34.9% over the last 2 years is above its 5-year trend, suggesting its brand resonates with consumers.

We can dig even further into the company's revenue dynamics by analyzing its number of New Students, which reached 4,346 in the latest quarter. Over the last 2 years, Universal Technical Institute's New Students averaged 45.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's average selling price has fallen.

This quarter, Universal Technical Institute reported magnificent year-on-year revenue growth of 45.6%, and its $174.7 million of revenue beat Wall Street's estimates by 3.8%. Looking ahead, Wall Street expects sales to grow 8.4% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While Universal Technical Institute posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Universal Technical Institute's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 3.7%.

This was a classic 'beat and raise' quarter for the company, with key line items coming in ahead of Wall Street analysts' expectations. The company also raised full year guidance for revenue, adjusted EBITDA, and adjusted EPS (while maintaining previous the full year outlook for new students and free cash flow). Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 4.2% after reporting and currently trades at $15.3 per share.

Key Takeaways from Universal Technical Institute's Q1 Results

We were impressed by how significantly Universal Technical Institute blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 4.2% after reporting and currently trades at $15.3 per share.

Universal Technical Institute may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.