Universal Technical (UTI) to Consolidate Houston Operations

Universal Technical Institute, Inc.'s UTI transportation, skilled trades and energy education division, Universal Technical Institute (UTI), is set to consolidate its Houston operations. This move aims to enhance student support by aligning curriculum, student-facing systems and services for those pursuing careers in high-demand fields.

The company remains optimistic in this regard and expects the consolidation to strengthen UTI's position as the leading provider of career technical training solutions in the Houston market, where it has been operating for more than 40 years.

Takeaways From the Consolidation

Starting in May 2024, a phased teach-out agreement will be implemented. The MIAT-Houston campus, acquired by the company in November 2021, will operate under its UTI brand. UTI-Houston and MIAT-Houston, strategically located near Interstate 45 in the city's north section, are less than a quarter of a mile apart. Post the consolidation, which is expected to be fully completed by early fiscal 2025, both facilities will remain operational.

The transition ensures students access to expanded support services and a more streamlined and standardized educational delivery model. Future students can complete certain programs more quickly. Beginning in May, UTI's existing faculty will teach consistent course objectives, and classes will continue in the same locations using familiar technology and equipment.

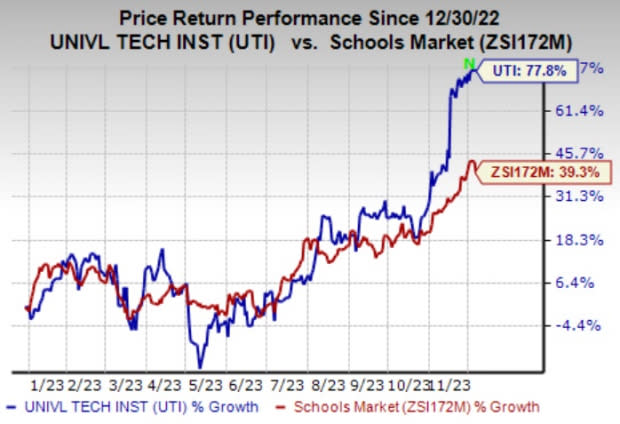

Image Source: Zacks Investment Research

Shares of UTI fell 0.08% on Dec 5 during the after-hour trading session. The stock has gained 77.8% year to date compared with the Zacks Schools industry’s 39.3% growth.

Focus on UTI Division

Universal Technical consistently focuses on growth and diversification initiatives to maintain its growth momentum. Its proven education and employment model reflects consistent graduation and in-field employment rates, along with rooted partnerships with top industry participants and employers. The company’s focus on driving its operational initiatives helps it optimally prepare and position students for fulfilling careers in the significantly demanding fields that it serves.

During the fiscal fourth quarter, revenues from the UTI division increased 4.2% to $115.3 million year over year. New student starts totaled 6,500, up 9% from a year ago. The planned new program launches and scaling of its two latest campuses in Austin, TX, and Miramar, FL, drove the performance.

In 2023, the company launched 13 of the 14 planned new UTI programs across eight campuses. The remaining Aviation, Airframe and Powerplant technician program at the UTI Miramar campus is expected to launch soon, following the completion of the delayed Federal Aviation Administration certification process.

Zacks Rank & Key Picks

Universal Technical currently sports a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 102.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.7% and 187.9%, respectively, from the year-ago period’s levels.

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have increased 14.4% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates a rise of 28.6% and 132.8%, respectively, from the year-ago period’s levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have increased 40.8% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS indicates a rise of 8.2% and 44.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Universal Technical Institute Inc (UTI) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report