Univest Financial Corp (UVSP) Reports Mixed Results for Q4 and Full Year 2023

Net Income: Q4 net income fell to $16.3 million, a decrease from $23.8 million in Q4 2022.

Earnings Per Share: Diluted EPS for Q4 was $0.55, down from $0.81 in the same quarter last year.

Net Interest Margin: Declined to 2.84% in Q4 2023 from 3.76% in Q4 2022.

Loan and Lease Growth: Gross loans and leases saw a modest annual increase of 7.3%.

Deposits: Total deposits grew by 7.8% over the year, despite a quarterly decrease.

Asset Quality: Nonperforming assets remained stable quarter-over-quarter but increased year-over-year.

Dividend: Declared a quarterly cash dividend of $0.21 per share.

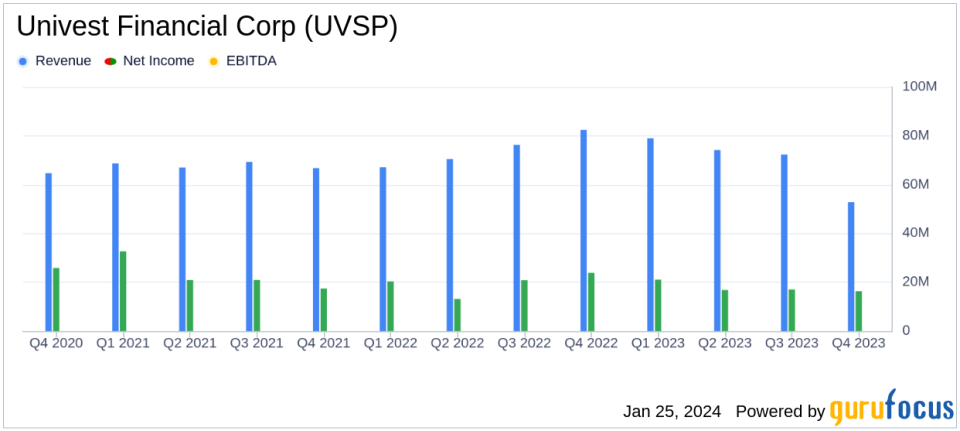

On January 24, 2024, Univest Financial Corp (NASDAQ:UVSP) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which operates through its Banking, Wealth Management, and Insurance segments, reported a decrease in net income and diluted earnings per share (EPS) for the fourth quarter compared to the same period in the previous year. Despite this, Univest saw an annual increase in gross loans and leases, as well as a rise in total deposits.

Financial Performance Overview

Univest's net income for the fourth quarter of 2023 was $16.3 million, or $0.55 diluted EPS, compared to $23.8 million, or $0.81 diluted EPS, for the same quarter in 2022. This decline reflects challenges such as increased costs of funds and interest-bearing liabilities, which were only partially offset by higher yields and balances of interest-earning assets. The net interest margin also contracted to 2.84% from 3.76% in the previous year, impacted by excess liquidity.

While the quarter saw a slight decrease in gross loans and leases, there was a notable annual growth of 7.3%, driven by commercial real estate and residential mortgage loans. Total deposits followed a similar pattern, with a quarterly decrease but a 7.8% increase over the year. The composition of deposits shifted, with noninterest-bearing deposits making up a larger proportion by the end of 2023.

Income Statement and Balance Sheet Highlights

Univest's net interest income for the quarter was $52.8 million, a decrease from both the previous quarter and the same quarter last year. Noninterest income also decreased by 9.0% year-over-year, influenced by lower investment advisory commission and fee income, as well as a significant drop in bank-owned life insurance income and other income categories.

Noninterest expenses saw a slight increase due to expansion efforts and investments in technology. Notably, deposit insurance premiums rose by 90.7% due to an increased assessment rate and base. The effective income tax rate for the quarter was 20.3%, reflecting the benefits of tax-exempt income.

Asset quality showed some signs of pressure, with nonperforming assets totaling $40.1 million at the end of the quarter, up from $33.5 million at the end of 2022. The provision for credit losses for the quarter was $1.9 million, down from the previous year's quarter.

Dividend and Capital Strength

Univest declared a quarterly cash dividend of $0.21 per share, maintaining its commitment to shareholder returns. The company's capital ratios remained solid, with a Tier 1 leverage ratio of 9.36% and a common equity tier 1 risk-based capital ratio of 10.61%.

Conclusion

Univest Financial Corp's fourth quarter and full-year 2023 results reflect a mixed financial performance, with challenges in net interest income and noninterest income being offset by growth in loans and deposits. The company's stable asset quality and consistent dividend payments underscore its resilience in a changing economic landscape. Investors and stakeholders will be watching closely to see how Univest navigates the upcoming year amid these financial headwinds.

For a more detailed breakdown of Univest Financial Corp's financial results, including full financial tables and additional commentary, please refer to the original 8-K filing.

Explore the complete 8-K earnings release (here) from Univest Financial Corp for further details.

This article first appeared on GuruFocus.