Unlocking Jazz Pharmaceuticals' Potential: A Roadmap for Growth

Jazz Pharmaceuticals PLC (NASDAQ:JAZZ) is a fast-growing pharmaceutical company headquartered in Dublin. The company has an extensive portfolio of Food and Drug Administration-approved drugs that continue to be leaders in the global narcolepsy and acute lymphoblastic leukemia therapeutics markets. As a result, this allows the company not to depend on sales from a single product and to distribute its free cash flow more effectively, including on the development of next-generation medicines.

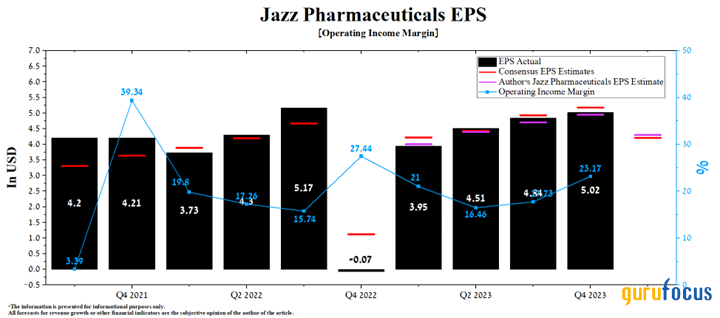

On Feb. 28, the company published financial results for 2023, which exceeded our expectations despite the decline in sales of Xyrem caused by the appearance of more and more generics on the market. Its fourth-quarter non-GAAP earnings amounted to $5.02 per share, an increase of $5.19 compared to the previous year. Its total cash and short-term investments totaled $1.63 billion, continuing the positive trend that began in 2021.

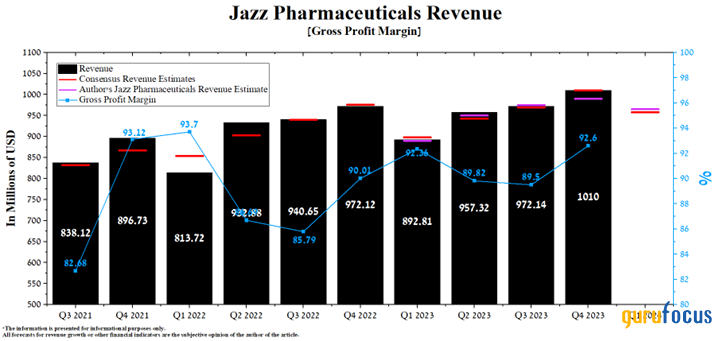

Source: Author's elaboration, based on GuruFocus data.

In addition, Jazz management expects continued year-over-year growth in its gross margin and revenue in 2024.

Source: Jazz Pharmaceuticals

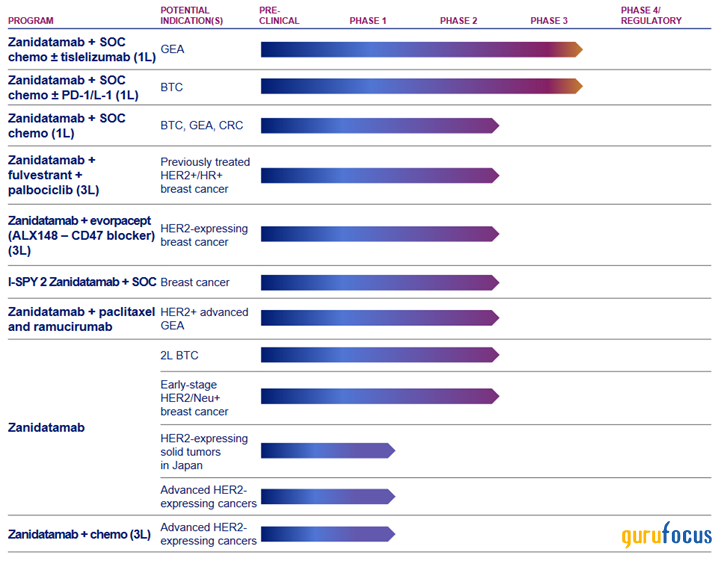

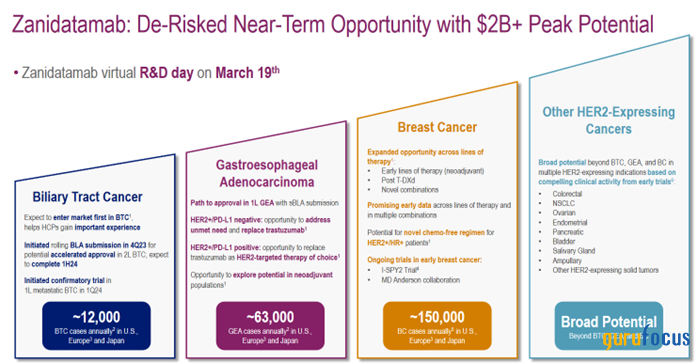

Moreover, unlike many mid-cap companies, Jazz continues to trade at a significant discount despite zanidatamab's potential regulatory approval for the treatment of patients with biliary tract cancer in the second half of 2024.

Zanidatamab is a bispecific monoclonal antibody directed against ECD2 and ECD4 of HER2. Based on its mechanism of action, as well as the published results of phase 2 clinical trials, we believe this product candidate has the potential to not only become one of Jazz's key products in the next two years, but also to significantly improve the quality of life of patients with esophageal cancer, biliary tract cancer, breast cancer and colorectal cancer.

Source: Jazz Pharmaceuticals

We initiate our coverage of Jazz Pharmaceuticals with an outperform rating for the next 12 months.

Current financial position and outlook

Jazz's revenue for the fourth quarter was about $1.01 billion, exceeding expectations by about $20 million and, just as importantly, growing 3.90% year over year.

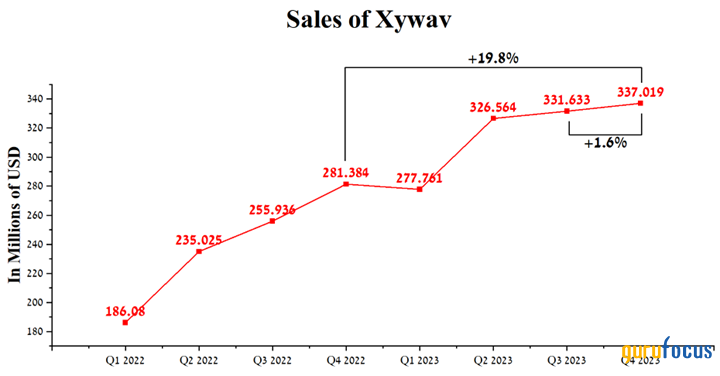

Moreover, the company's actual revenue beat analysts' consensus estimates in seven of the last 10 quarters, thanks partly to strong demand for Xywav, a drug approved by regulators to treat patients with cataplexy and idiopathic hypersomnia. Its sales were $337 million for the three months ended Dec. 31, an increase of 19.80% year over year due to higher selling prices as well as its approval in Canada for the treatment of cataplexy in patients with narcolepsy.

Source: Author's elaboration, based on quarterly securities reports.

Another key contributor to the company's revenue growth is Rylaze, which is a medication used to treat certain patients with acute lymphoblastic leukemia as well as lymphoblastic lymphoma. Its mechanism of action is based on accelerating the deamidation of L-asparagine to ammonia and aspartic acid, thereby significantly reducing the amount of asparagine for leukemia cells and promoting their death.

Total sales of Rylaze were $101.7 million in the fourth quarter of 2023, an increase of 25.70% year over year due to higher sales volume in the United States and its approval in the European Union in September 2023.

Source: Author's elaboration, based on quarterly securities reports.

As a result, Jazz's trailing 12-month price-sales ratio was 1.94, which is not only 37% lower than the average over the past five years but also significantly lower than its key competitors in the health care sector, such as Takeda Pharmaceutical (NYSE:TAK), Pfizer (NYSE:PFE) and Merck (NYSE:MRK). As a result, this is one of the factors indicating that financial market participants continue to remain conservative about the business outlook, even as demand for its key products has grown and management has pursued an aggressive research and development program aimed at creating experimental drugs to treat patients with various types of cancer and neurological disorders.

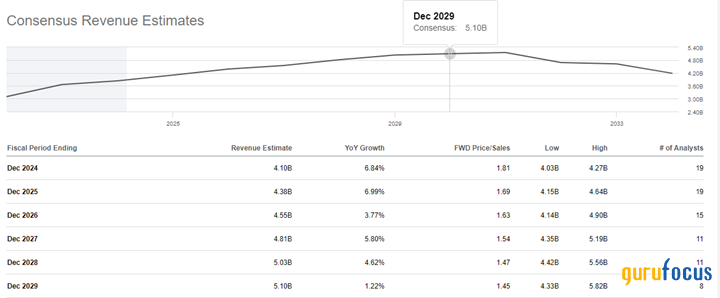

Source: Author's elaboration, based on analyst data.

The company is expected to report its first-quarter 2024 financial results on May 6. According to analyst estimates, Jazz's revenue for the quarter is anticipated to range from $912.70 million to $1.02 billion, up 7.30% year over year.

Source: Author's elaboration, based on GuruFocus data.

Nevertheless, we expect the company's total revenue to reach $965 million in the first three months of 2024, about $7 million above the median of the above range, primarily due to continued extremely strong demand for Xywav and Epidiolex/Epidyolex, as well as geographic expansion using Rylaze.

The company's operating income margin was 23.17% for the fourth quarter of 2023, an increase of 5.44% compared to the previous year. More importantly, the trend for its improvement has continued since the beginning of last year. We estimate this financial metric will reach 24.50% in 2024 and increase to 26.50% by 2025, mainly due to increased sales of anti-cancer drugs, lower cost of product sales and the potential launch of zanidatamab in the U.S. and Europe in 2024.

Source: Jazz Pharmaceuticals presentation.

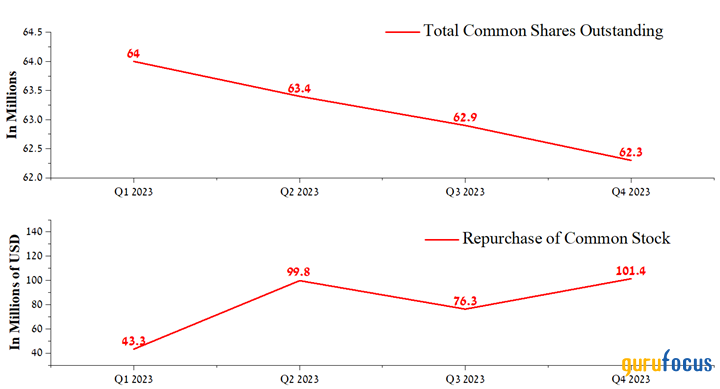

On the other hand, the company's first-quarter earning per share are expected to be between $3.84 and $4.7, up 6.50% year over year. We expect its EPS to be 9 cents above this range and reach $4.30, including through a share repurchase program.

Source: Author's elaboration, based on GuruFocus data.

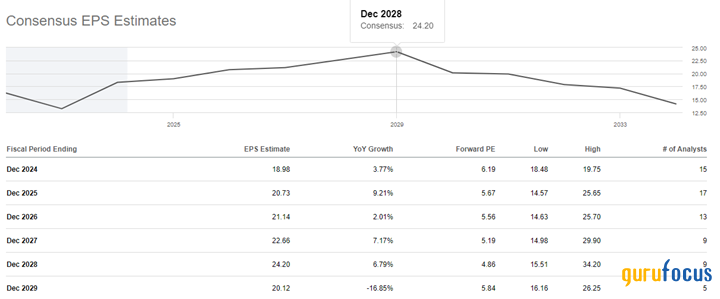

Moreover, the company's trailing 12-month non-GAAP price-earnings ratio is 6.40, indicating it is trading at a significant discount to the health care sector, even though Jazz has relatively strong revenue growth and also has product candidates being developed for the treatment of essential tremor, Parkinson's disease tremor and small cell lung cancer.

Simultaneously, its price-earnings ratio is expected to decline to 4.86 by 2028, which we estimate is a highly attractive value for investors looking for undervalued health care assets with a diversified pipeline of first-in-class drugs.

Source: Author's elaboration, based on analyst projections.

Conclusion

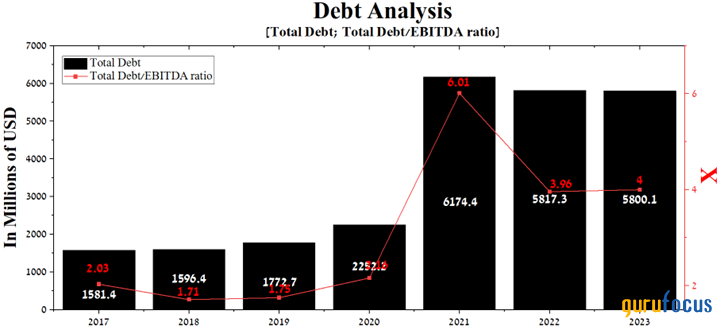

The key risks that could negatively affect Jazz's investment attractiveness are a higher rate of decline in Xyrem sales due to competition with its generics, possible failures in the development of its innovative experimental drugs for the treatment of various types of cancer and maintaining a total debt/Ebitda ratio above 3.50 over recent years.

Source: Author's elaboration, based on GuruFocus data.

However, despite the risks described above, many of the company's key medicines continue to grow at high rates, and thanks to effective business strategies implemented by its management, its gross and operating income margins continue to improve quarter over quarter.

Moreover, the company continues to be a leader in the global narcolepsy therapeutics market, which is reflected in Xywav's extremely strong sales growth, allows it to invest aggressively in the development of its portfolio of product candidates, including zanidatama, suvecaltamide, JZP441, JZP351 and also resort to using a share repurchase program in recent quarters.

Author's elaboration, based on GuruFocus data.

We initiate our coverage of Jazz Pharmaceuticals with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.