Unmasking RPT Realty's Dividend Performance and Sustainability

Insights into the Dividend History and Future Prospects of RPT Realty

RPT Realty (NYSE:RPT) recently announced a dividend of $0.14 per share, payable on 2023-10-02, with the ex-dividend date set for 2023-09-19. As investors anticipate this upcoming payment, it's essential to delve into the company's dividend history, yield, and growth rates. Using data from GuruFocus, we will scrutinize RPT Realty's dividend performance and evaluate its sustainability.

About RPT Realty

Warning! GuruFocus has detected 9 Warning Signs with RPT. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

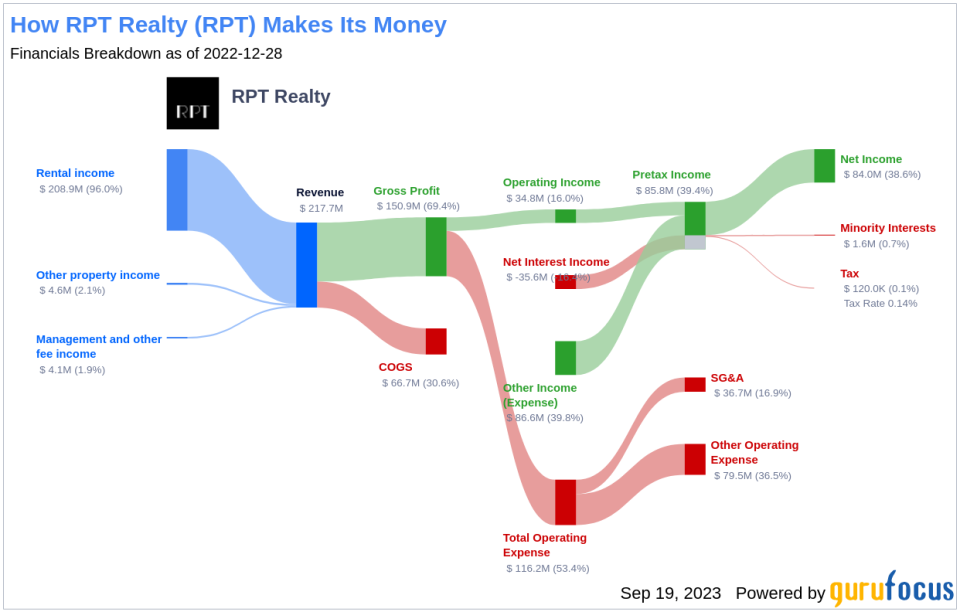

RPT Realty is a self-managed real estate investment trust that invests in and manages retail properties. The company owns and operates a national portfolio of open-air shopping destinations principally located in top U.S. markets. RPT Realty's property portfolio consists of 44 wholly-owned shopping centers, 13 shopping centers owned through its grocery-anchored joint venture, and 48 retail properties owned through its net lease joint venture, representing 15.0 million square feet of gross leasable area.

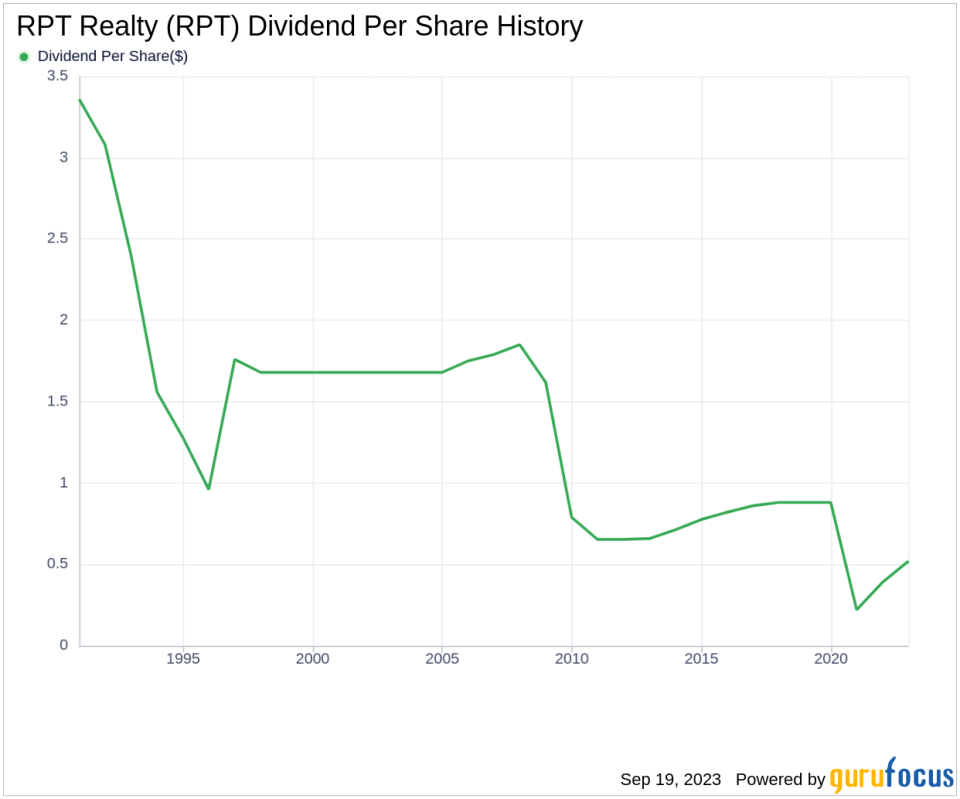

RPT Realty's Dividend History

RPT Realty has maintained a consistent dividend payment record since 1989, with dividends currently distributed on a quarterly basis. The chart below shows annual Dividends Per Share for tracking historical trends.

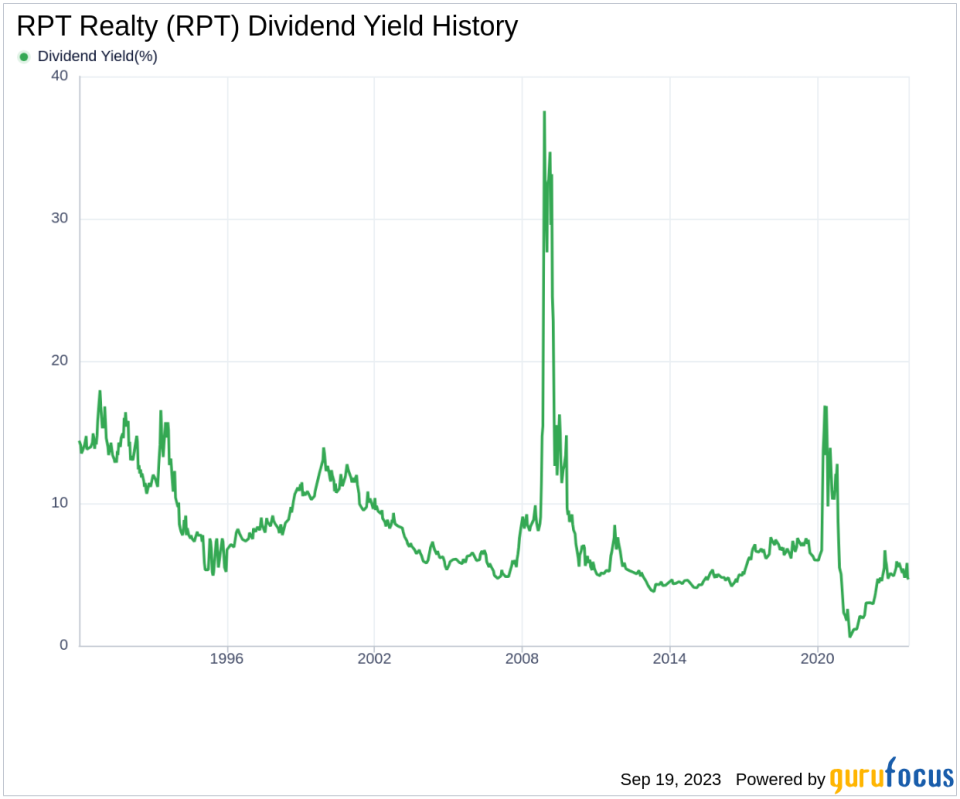

RPT Realty's Dividend Yield and Growth

RPT Realty currently has a 12-month trailing dividend yield of 4.81% and a 12-month forward dividend yield of 4.99%, indicating an expectation of increased dividend payments over the next 12 months. However, over the past three years, RPT Realty's annual dividend growth rate was -16.10%, decreasing to -16.90% per year over a five-year horizon. Over the past decade, the annual dividends per share growth rate stands at -6.30%. The 5-year yield on cost of RPT Realty stock as of today is approximately 1.89%.

Is RPT Realty's Dividend Sustainable?

The sustainability of a dividend can be assessed using the company's payout ratio. RPT Realty's dividend payout ratio as of 2023-06-30 is 0.71, suggesting that the company's dividend may not be sustainable. RPT Realty's profitability rank is 6 out of 10, suggesting fair profitability. The company has reported net profit in 8 out of the past 10 years.

Growth Metrics and Future Outlook

RPT Realty's growth rank of 6 out of 10 suggests a fair growth outlook. RPT Realty's revenue has increased by approximately -1.60% per year on average, a rate that underperforms approximately 64.35% of global competitors. Over the past three years, RPT Realty's earnings increased by approximately -5.10% per year on average, a rate that underperforms approximately 64.81% of global competitors.

Conclusion

While RPT Realty has a consistent dividend payment record, its negative growth rate and high payout ratio cast doubt on the sustainability of future dividends. Despite fair profitability and growth ranks, the company's underperformance in revenue and earnings growth compared to global competitors further raises concerns. Investors should closely monitor RPT Realty's performance and make informed decisions based on their risk tolerance and investment goals.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.