Unpacking American Homes 4 Rent's Dividend Performance: A Deep Dive

An Analysis of Dividend History, Yield, Growth, and Sustainability

Real estate investment trust, American Homes 4 Rent (NYSE:AMH), recently announced a dividend of $0.22 per share, payable on 2023-09-29, with the ex-dividend date set for 2023-09-14. As investors anticipate this upcoming payment, it is crucial to examine the company's dividend history, yield, and growth rates. Using data from GuruFocus, we delve into American Homes 4 Rent's dividend performance and assess its sustainability.

About American Homes 4 Rent

Warning! GuruFocus has detected 8 Warning Signs with AMH. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

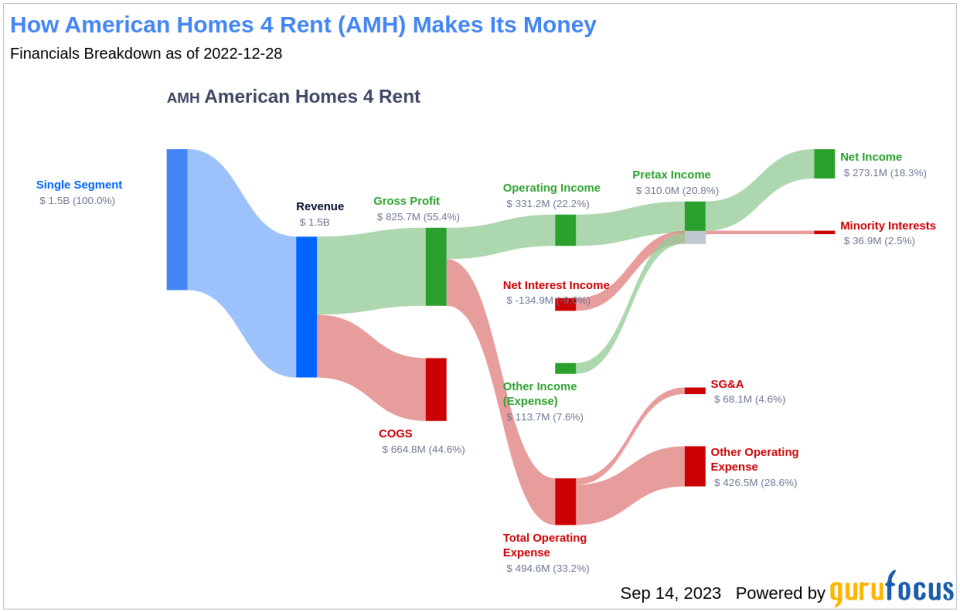

American Homes 4 Rent is a real estate investment trust primarily engaged in acquiring, operating, and leasing single-family homes as rental properties across the United States. The company's real estate portfolio predominantly consists of single-family properties in urban markets in the Southern and Midwestern regions of the U.S. American Homes 4 Rent's land holdings also represent a sizable percentage of its total assets in terms of value. The company primarily generates its income in the form of rental revenue from single-family properties through short-term or annual leases. The firm's largest geographical markets include Dallas, Texas; Indianapolis, Indiana; Atlanta, Georgia; and Charlotte, North Carolina in terms of the number of properties in each.

American Homes 4 Rent's Dividend History

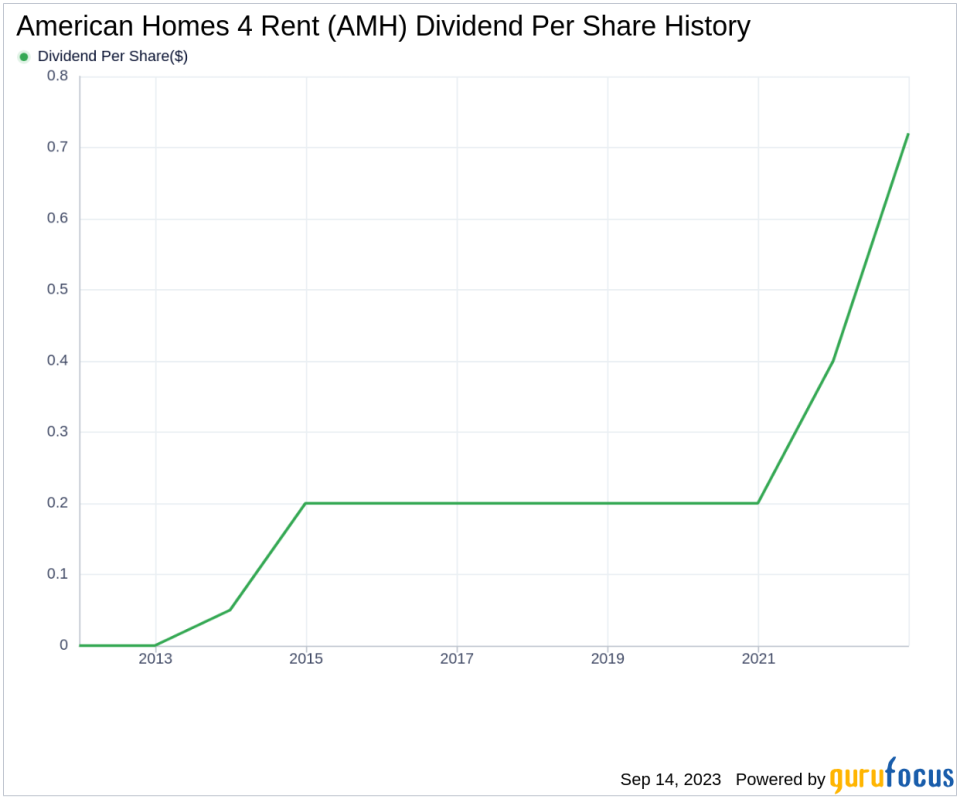

Since 2013, American Homes 4 Rent has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The stock is recognized as a dividend achiever, an honor given to companies that have increased their dividend each year for at least the past 10 years.

Dividend Yield and Growth

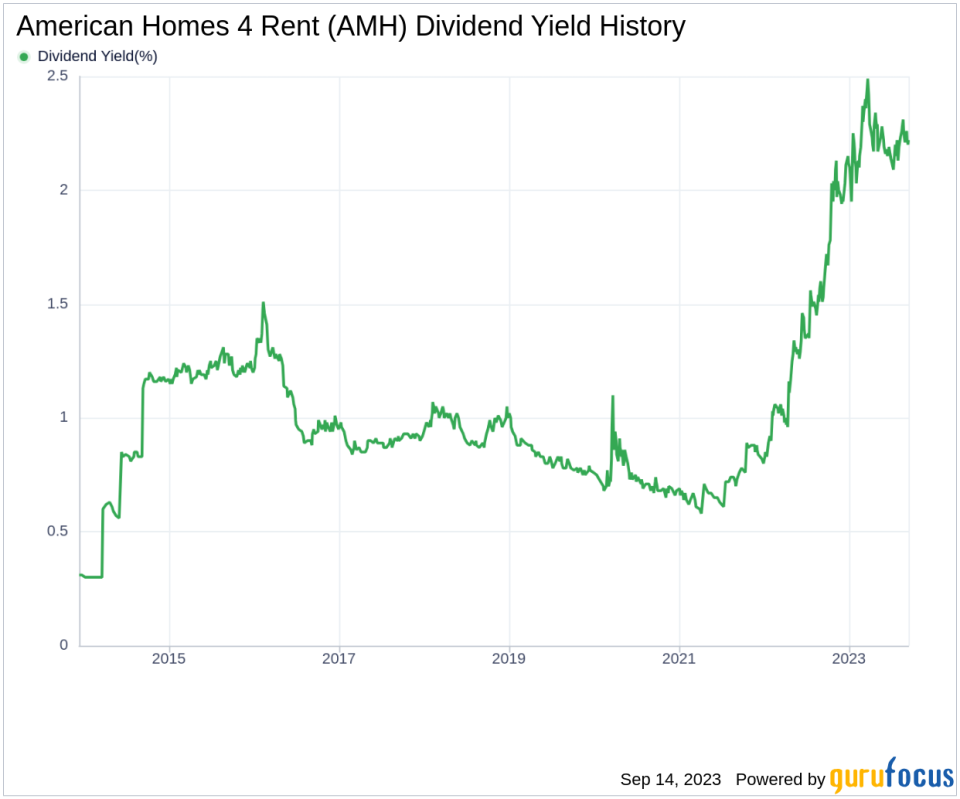

As of today, American Homes 4 Rent has a trailing dividend yield of 2.20% and a forward dividend yield of 2.43%, suggesting an expected increase in dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 53.30%, which decreased to 27.40% per year when extended to a five-year horizon.

Assessing Dividend Sustainability

To evaluate the sustainability of the dividend, it's important to consider the company's payout ratio. The dividend payout ratio of American Homes 4 Rent as of 2023-06-30 is 0.82, which may suggest that the company's dividend may not be sustainable. American Homes 4 Rent's profitability rank of 7 out of 10 suggests good profitability prospects, with the company reporting net profit in 7 out of the past 10 years.

Growth Metrics and Future Outlook

American Homes 4 Rent's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's revenue has increased by approximately 4.10% per year on average, outperforming approximately 63.98% of global competitors. During the past three years, American Homes 4 Rent's earnings increased by approximately 34.80% per year on average, outperforming approximately 81.65% of global competitors.

Conclusion

Considering American Homes 4 Rent's consistent dividend payments, growth rate, and profitability, it appears to be a promising choice for investors seeking consistent returns. However, the company's high payout ratio raises questions about the sustainability of its dividends. Despite this, the company's strong growth metrics and profitability rank indicate a positive future outlook. Ultimately, investors should conduct thorough research and consider their financial goals before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.