Unpacking the Investment Potential of Universal Health Services Inc (UHS): A Deep Dive into Key ...

Universal Health Services Inc (NYSE:UHS) has recently been in the spotlight, drawing interest from investors and financial analysts due to its robust financial stance. With shares currently priced at $131.34, Universal Health Services Inc has witnessed a surge of 2.53% over a period, marked against a three-month change of -4.81%. A thorough analysis, underlined by the GuruFocus Score Rating, suggests that Universal Health Services Inc is well-positioned for substantial growth in the near future.

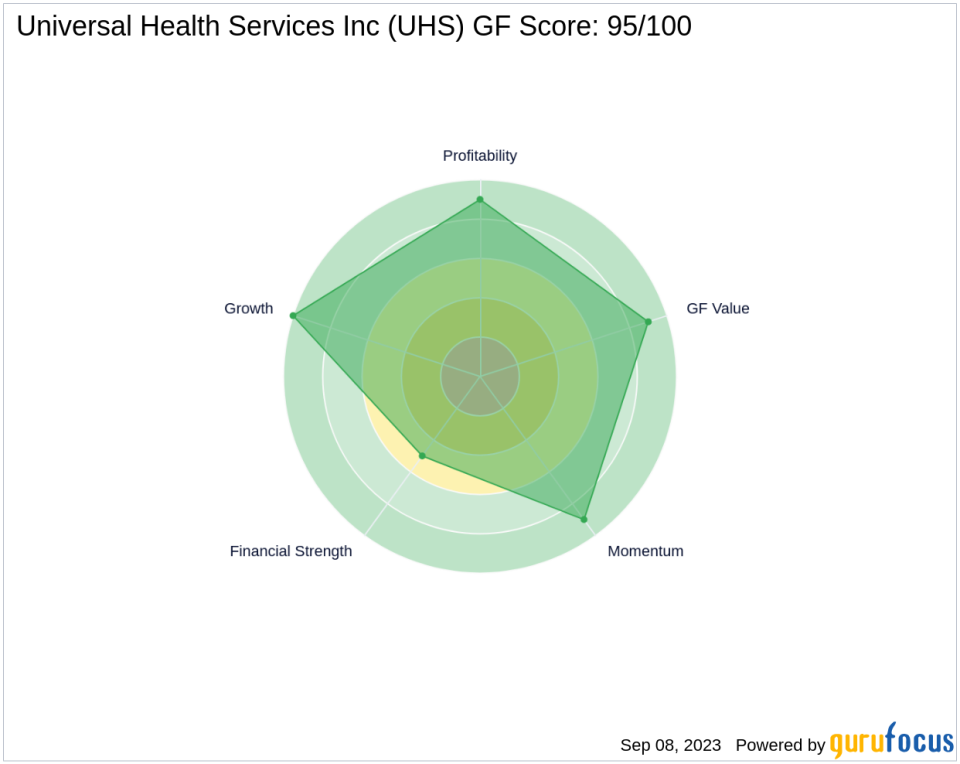

Decoding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Universal Health Services Inc's GF Score components are as follows:

1. Financial strength rank: 5/10

2. Profitability rank: 9/10

3. Growth rank: 10/10

4. GF Value rank: 9/10

5. Momentum rank: 9/10

Each one of these components is ranked and the ranks also have positive correlation with the long term performances of stocks. The GF score is calculated using the five key aspects of analysis. Through backtesting, we know that each of these key aspects has a different impact on the stock price performance. Thus, they are weighted differently when calculating the total score. With a high profitability rank and a slightly lower financial strength rank, GuruFocus assigned Universal Health Services Inc the GF Score of 95 out of 100, which signals the highest outperformance potential.

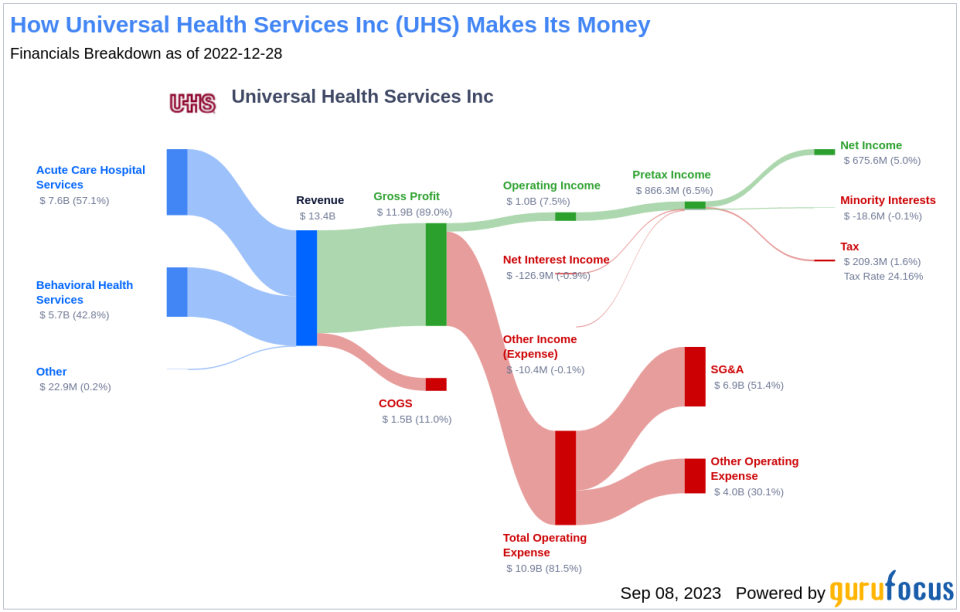

Understanding Universal Health Services Inc's Business

Universal Health Services Inc, with a market cap of $9.12 billion and sales of $13.80 billion, operates acute care hospitals, behavior health centers, surgical hospitals, ambulatory surgery centers, and radiation oncology centers. The firm operates in two key segments: Acute Care Hospital Services and Behavioral Health Services. The Acute Care Hospital Services segment includes the firm's acute care hospitals, surgical hospitals, and surgery and oncology centers. The company's operating margin stands at 7.94%.

Profitability Rank Breakdown

The Profitability Rank shows Universal Health Services Inc's impressive standing among its peers in generating profit. The Piotroski F-Score confirms Universal Health Services Inc's solid financial situation based on Joseph Piotroski's nine-point scale, which measures a company's profitability, funding and operating efficiency. Universal Health Services Inc's strong Predictability Rank of 5.0 stars out of five underscores its consistent operational performance, providing investors with increased confidence.

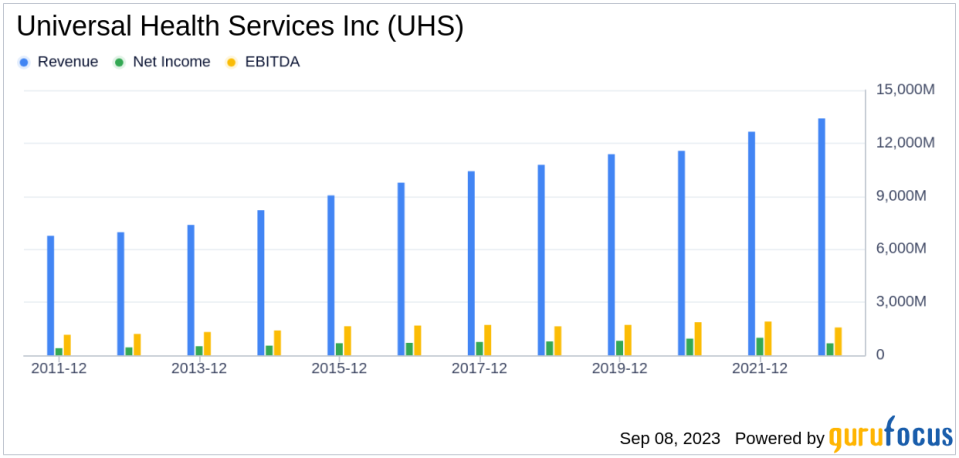

Growth Rank Breakdown

Ranked highly in Growth, Universal Health Services Inc demonstrates a strong commitment to expanding its business. The company's 3-Year Revenue Growth Rate is 12.4%, which outperforms better than 60.6% of 571 companies in the Healthcare Providers & Services industry. Moreover, Universal Health Services Inc has seen a robust increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA) over the past few years. Specifically, the three-year growth rate stands at 3.3, and the rate over the past five years is 5.3. This trend accentuates the company's continued capability to drive growth.

Conclusion

Given Universal Health Services Inc's financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm's unparalleled position for potential outperformance. This analysis underscores the importance of considering these key financial metrics when making investment decisions. GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.