Unpacking Q2 Earnings: Doximity (NYSE:DOCS) In The Context Of Other Vertical Software Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the vertical software stocks, starting with Doximity (NYSE:DOCS).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 17 vertical software stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.45%, while on average next quarter revenue guidance was 2.63% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows and vertical software stocks have not been spared, with share prices down 11.5% since the previous earnings results, on average.

Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

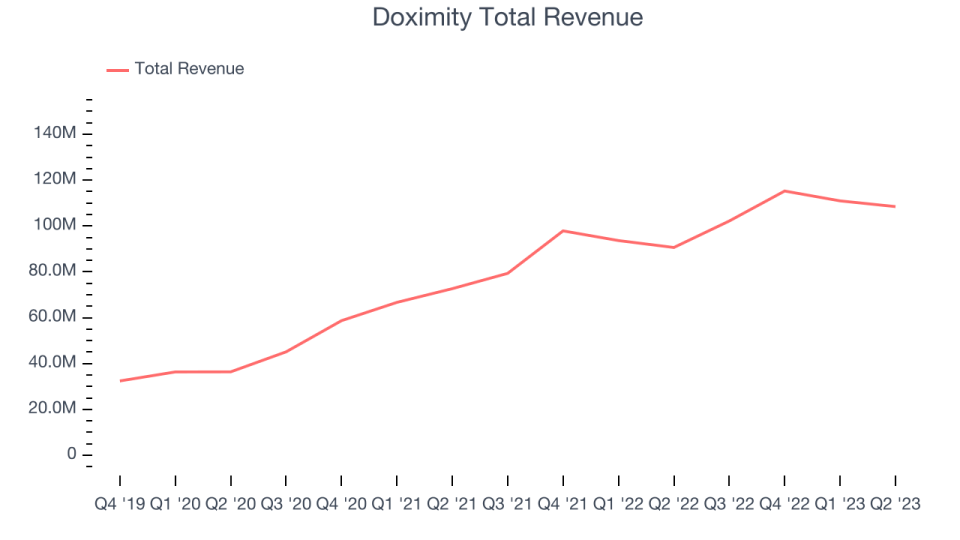

Doximity reported revenues of $108.5 million, up 19.7% year on year, beating analyst expectations by 1.35%. It was a weak quarter for the company, with revenue guidance for the next quarter and full-year missing analysts' expectations.

“We’re pleased to report another quarter of record engagement across our entire platform, with over 525,000 unique providers using our workflow tools in Q1,” said Jeff Tangney, co-founder and CEO at Doximity.

Doximity delivered the weakest full year guidance update of the whole group. The stock is down 31.4% since the results and currently trades at $22.49.

Is now the time to buy Doximity? Access our full analysis of the earnings results here, it's free.

Best Q2: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

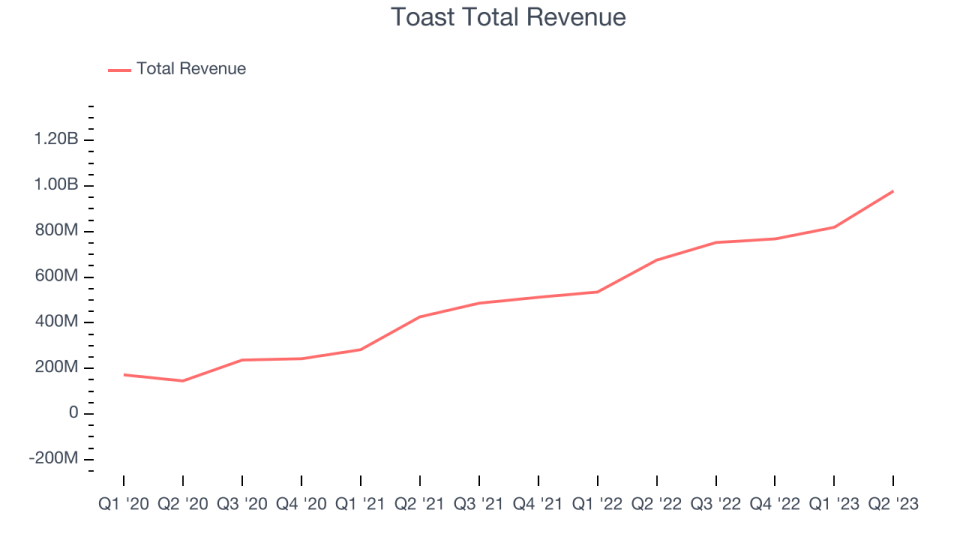

Toast reported revenues of $978 million, up 44.9% year on year, beating analyst expectations by 3.46%. It was a milestone beat-and-raise quarter for Toast as it won a deal with Marriott, exceeded $1 billion in ARR, and reached adjusted EBITDA profitability and positive free cash flow for the first time since the IPO. On top of that, the company raised its revenue and adjusted EBITDA guidance for the full year, topping analysts' expectations.

The stock is down 6.93% since the results and currently trades at $18.81.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Matterport (NASDAQ:MTTR)

Founded in 2011 before any mass market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real world spaces into 3D visualization.

Matterport reported revenues of $39.6 million, up 38.9% year on year, in line with analyst expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

The stock is down 30.5% since the results and currently trades at $2.19.

Read our full analysis of Matterport's results here.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $533.5 million, up 79.6% year on year, beating analyst expectations by 3.12%. It was a decent quarter for the company, with revenue and adjusted EBITDA exceeding expectations. While next quarter's revenue guidance was below Wall Street Consensus and full year revenue guidance was slightly above, adjusted EBITDA guidance for both periods was well ahead.

Unity delivered the fastest revenue growth among the peers. The stock is down 26.4% since the results and currently trades at $30.51.

Read our full, actionable report on Unity here, it's free.

2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $222.1 million, down 8.02% year on year, missing analyst expectations by 5.15%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its gross margin.

2U had the weakest performance against analyst estimates among the peers. The stock is down 46.6% since the results and currently trades at $2.28.

Read our full, actionable report on 2U here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned