Unpacking Q2 Earnings: Revolve (NYSE:RVLV) In The Context Of Other Consumer Internet Stocks

As consumer internet stocks’ Q2 earnings season wraps, let's dig into this quarter's best and worst performers, including Revolve (NYSE:RVLV) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 0.92%, while on average next quarter revenue guidance was 0.04% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable and consumer internet stocks have not been spared, with share prices down 16.8% since the previous earnings results, on average.

Revolve (NYSE:RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

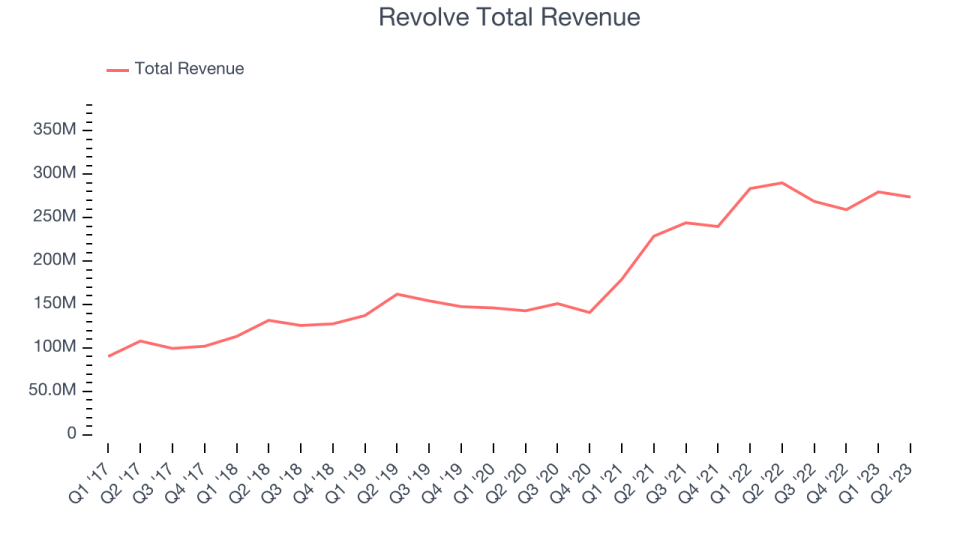

Revolve reported revenues of $273.7 million, down 5.63% year on year, missing analyst expectations by 0.39%. It was a weaker quarter for the company, with declining revenue and a miss of analysts' revenue estimates.

"Aspirational consumer discretionary spending remains challenging, particularly on goods in the U.S. for our younger customer demographic, which is evident in our second quarter financial results," said co-founder and co-CEO Mike Karanikolas.

The stock is down 19.8% since the results and currently trades at $14.73.

Read our full report on Revolve here, it's free.

Best Q2: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

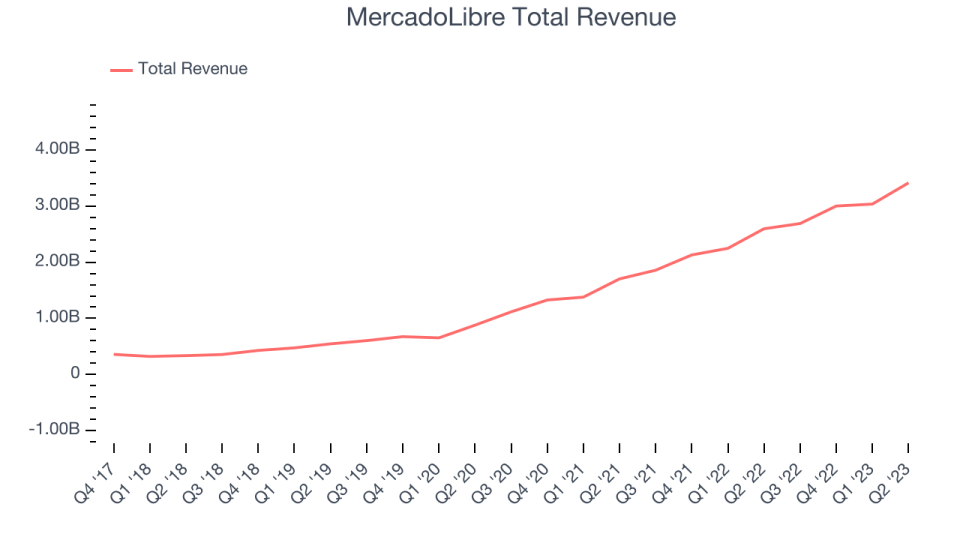

MercadoLibre reported revenues of $3.42 billion, up 31.5% year on year, beating analyst expectations by 4.4%. It was a very strong quarter for the company, with impressive growth in its user base and a decent beat of analysts' revenue estimates.

MercadoLibre achieved the fastest revenue growth among its peers. The company reported 109 million daily active users, up 29.8% year on year. The stock is up 8.14% since the results and currently trades at $1,260.14.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $40.2 million, down 45.2% year on year, missing analyst expectations by 5.66%. It was a weak quarter for the company, with a declining number of users and revenue.

The stock is down 59.5% since the results and currently trades at $4.38.

Read our full analysis of Skillz's results here.

Match (NASDAQ:MTCH)

Match.com was an early innovator in dating apps and was actually launched as a dial-up service before widespread internet adoption. Match (NASDAQ:MTCH) today has a portfolio of apps including Tinder, OkCupid, Match.com, and Hinge.

Match reported revenues of $829.6 million, up 4.41% year on year, beating analyst expectations by 2.23%. It was a mixed quarter for the company, with a decline in its user base and slow revenue growth. On a positive note, revenue and EPS exceeded Wall Street's expectations during the quarter.

The company reported 15.6 million users, down 4.88% year on year. The stock is down 18.1% since the results and currently trades at $37.8.

Read our full, actionable report on Match here, it's free.

LegalZoom (NASDAQ:LZ)

LegalZoom (NASDAQ:LZ) is an online platform that provides online legal services to individuals and small businesses. The company’s co-founders found it difficult and expensive to find lawyers and file paperwork when trying to start a business so they started LegalZoom instead to address this pain point.

LegalZoom reported revenues of $168.9 million, up 3.04% year on year, beating analyst expectations by 1.1%. It was a mixed quarter for the company, with revenue coming in ahead of Wall Street's expectations, even if just narrowly. On the other hand, its weak revenue growth wasn't great. Also, while next quarter's revenue guidance was in line, adjusted EBITDA guidance was below.

The company reported 1.55 million users, up 11.4% year on year. The stock is down 31.7% since the results and currently trades at $10.49.

Read our full, actionable report on LegalZoom here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned