Unpacking Q3 Earnings: Designer Brands (NYSE:DBI) In The Context Of Other Footwear Retailer Stocks

Looking back on footwear retailer stocks' Q3 earnings, we examine this quarter's best and worst performers, including Designer Brands (NYSE:DBI) and its peers.

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

The 4 footwear retailer stocks we track reported a weak Q3; on average, revenues missed analyst consensus estimates by 1.8% while next quarter's revenue guidance was 3% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, and footwear retailer stocks have not been spared, with share prices down 10.6% on average, since the previous earnings results.

Weakest Q3: Designer Brands (NYSE:DBI)

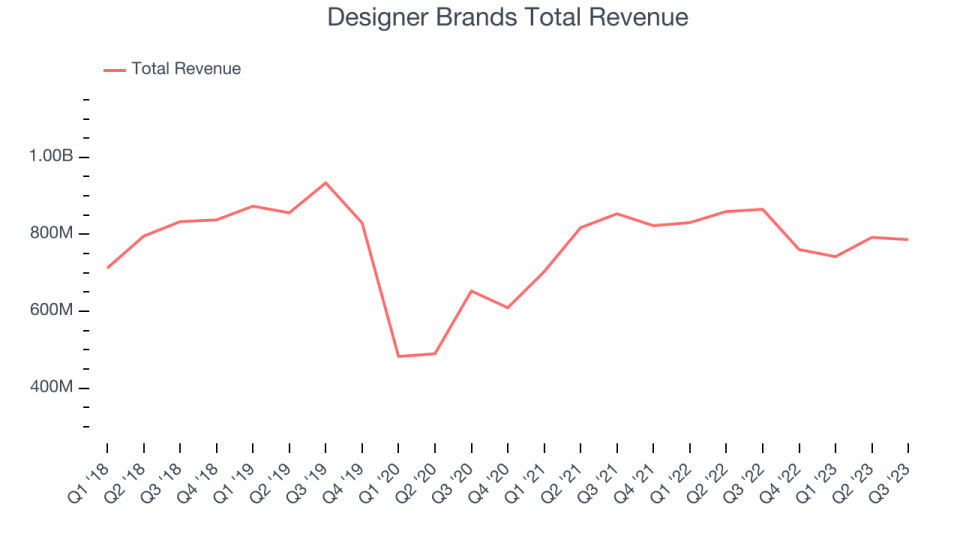

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Designer Brands reported revenues of $786.3 million, down 9.1% year on year, falling short of analyst expectations by 4.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

"This quarter, we were impacted by a footwear market that contracted for the first time since COVID coupled with unseasonably warm weather, which significantly reduced customer demand for shoes and pressured our heavily seasonal assortment," stated Doug Howe, Chief Executive Officer.

Designer Brands delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 32.4% since the results and currently trades at $8.66.

Read our full report on Designer Brands here, it's free.

Best Q3: Boot Barn (NYSE:BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $374.5 million, up 6.5% year on year, falling short of analyst expectations by 0.7%. It was a weaker quarter for the company, with underwhelming earnings guidance for the next quarter.

Boot Barn delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 6.8% since the results and currently trades at $74.02.

Is now the time to buy Boot Barn? Access our full analysis of the earnings results here, it's free.

Genesco (NYSE:GCO)

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $579.3 million, down 4.1% year on year, falling short of analyst expectations by 1.6%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year. In addition, same-store sales, revenue, and EPS all missed.

The stock is down 23.1% since the results and currently trades at $28.76.

Read our full analysis of Genesco's results here.

Shoe Carnival (NASDAQ:SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $319.9 million, down 6.4% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

Shoe Carnival delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 6.4% since the results and currently trades at $25.75.

Read our full, actionable report on Shoe Carnival here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned