Unpacking Q3 Earnings: Hormel Foods (NYSE:HRL) In The Context Of Other Packaged Food Stocks

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the packaged food stocks, including Hormel Foods (NYSE:HRL) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 29 packaged food stocks we track reported a slower Q3; on average, revenues missed analyst consensus estimates by 2.2% while next quarter's revenue guidance was 10.9% below consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but packaged food stocks held their ground better than others, with the share prices up 8.3% on average since the previous earnings results.

Hormel Foods (NYSE:HRL)

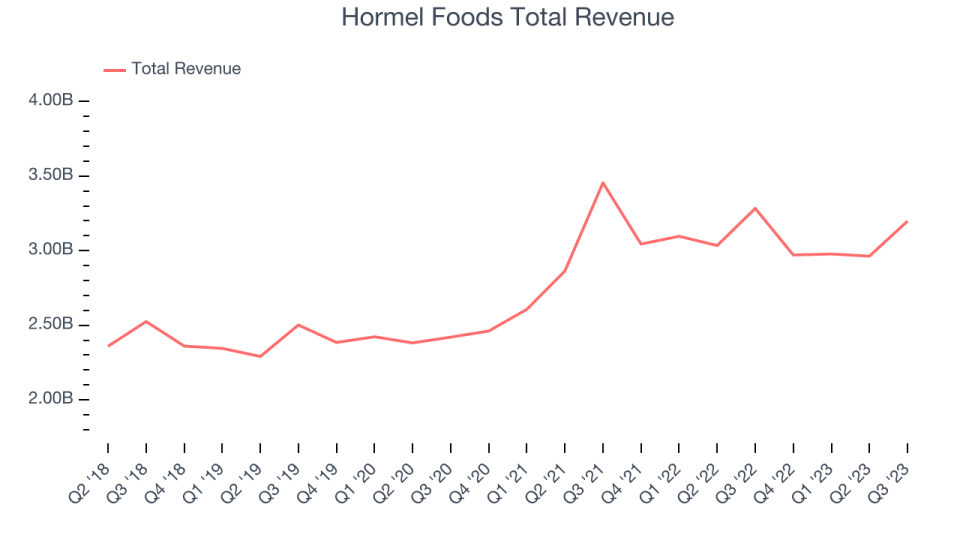

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Hormel Foods reported revenues of $3.20 billion, down 2.6% year on year, falling short of analyst expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 3.9% since the results and currently trades at $30.7.

Read our full report on Hormel Foods here, it's free.

Best Q3: Lamb Weston (NYSE:LW)

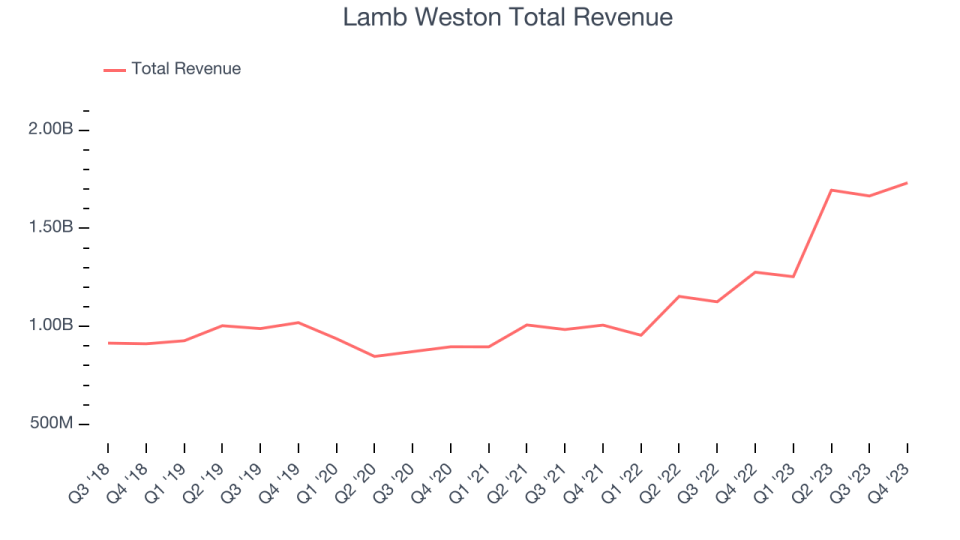

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.73 billion, up 35.7% year on year, outperforming analyst expectations by 1.9%. It was a decent quarter for the company, with a beat of analysts' revenue estimates. Looking forward, while revenue guidance was maintained from the previous outlook, EPS guidance was raised.

Lamb Weston achieved the fastest revenue growth among its peers. The stock is up 4.6% since the results and currently trades at $109.74.

Is now the time to buy Lamb Weston? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $523.2 million, down 34.7% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with a miss of analysts' revenue and EPS estimates.

Cal-Maine had the slowest revenue growth in the group. The stock is down 0.8% since the results and currently trades at $54.44.

Read our full analysis of Cal-Maine's results here.

Hershey (NYSE:HSY)

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

Hershey reported revenues of $3.03 billion, up 11.1% year on year, surpassing analyst expectations by 2.7%. It was a mixed quarter for the company, with an impressive beat of analysts' revenue estimates. On the other hand, its EPS missed analysts' expectations.

The stock is down 1.7% since the results and currently trades at $191.

Read our full, actionable report on Hershey here, it's free.

Mission Produce (NASDAQ:AVO)

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $257.9 million, up 8.4% year on year, falling short of analyst expectations by 10.6%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 5% since the results and currently trades at $10.06.

Read our full, actionable report on Mission Produce here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned