Unpacking Q3 Earnings: Micron Technology (NASDAQ:MU) In The Context Of Other Semiconductors Stocks

As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the semiconductors stocks, including Micron Technology (NASDAQ:MU) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 0.8% while next quarter's revenue guidance was 4.1% below consensus. Investors abandoned cash-burning companies to buy stocks with higher margins of safety, but semiconductors stocks held their ground better than others, with the share prices up 18.7% on average since the previous earnings results.

Micron Technology (NASDAQ:MU)

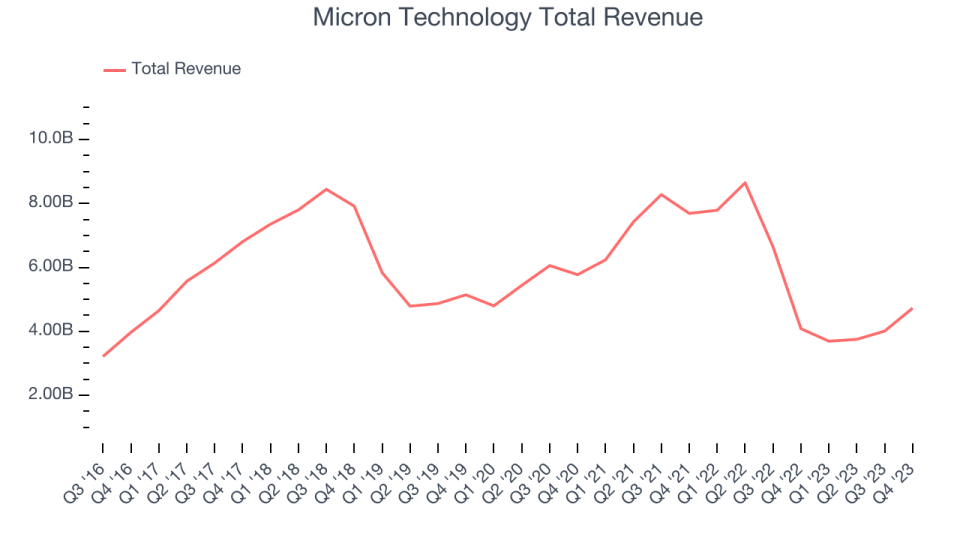

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $4.73 billion, up 15.7% year on year, topping analyst expectations by 1.6%. It was a mixed quarter for the company, with a significant improvement in its inventory levels but a decline in its operating margin.

The stock is up 7.3% since the results and currently trades at $84.43.

Is now the time to buy Micron Technology? Access our full analysis of the earnings results here, it's free.

Best Q3: Nvidia (NASDAQ:NVDA)

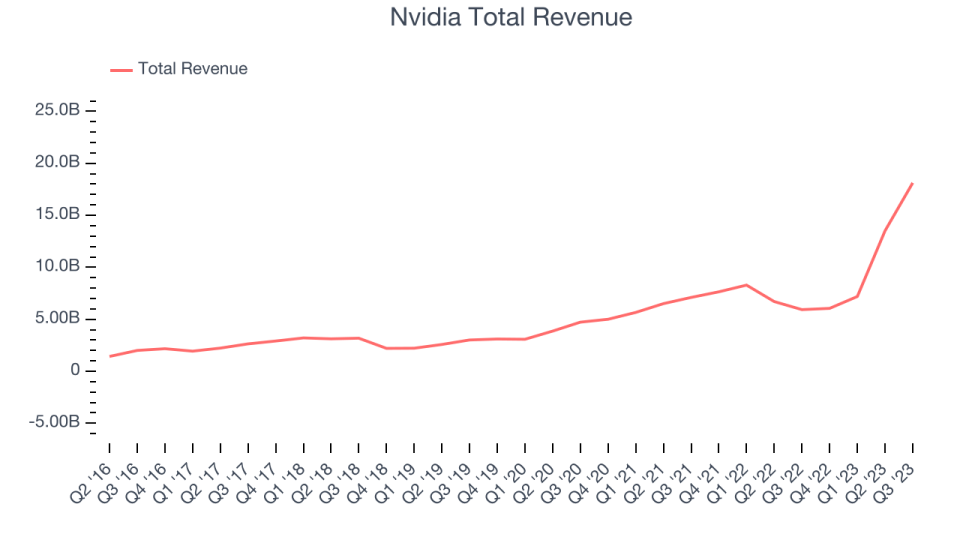

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $18.12 billion, up 206% year on year, outperforming analyst expectations by 12.5%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

Nvidia delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 13.1% since the results and currently trades at $565.51.

Is now the time to buy Nvidia? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Power Integrations (NASDAQ:POWI)

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ:POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

Power Integrations reported revenues of $125.5 million, down 21.7% year on year, falling short of analyst expectations by 3.7%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is up 2.5% since the results and currently trades at $77.07.

Read our full analysis of Power Integrations's results here.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $202.3 million, down 29.3% year on year, surpassing analyst expectations by 1.1%. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter. On the other hand, Kulicke and Soffa blew past analysts' adjusted operating income and EPS expectations this quarter.

The stock is up 8.6% since the results and currently trades at $50.75.

Read our full, actionable report on Kulicke and Soffa here, it's free.

MACOM (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM reported revenues of $150.4 million, down 15.6% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 18.2% since the results and currently trades at $86.17.

Read our full, actionable report on MACOM here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned