Unpacking Q3 Earnings: Nature's Sunshine (NASDAQ:NATR) In The Context Of Other Personal Care Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the personal care stocks, starting with Nature's Sunshine (NASDAQ:NATR).

Personal care products include lotions, fragrances, shampoos, cosmetics, and nutritional supplements, among others. While these products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. As with other consumer staples categories, personal care brands must exude quality and be priced optimally given the crowded competitive landscape. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 14 personal care stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 0.8% while next quarter's revenue guidance was 15.7% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but personal care stocks held their ground better than others, with the share prices up 20.3% on average since the previous earnings results.

Nature's Sunshine (NASDAQ:NATR)

Started on a kitchen table in Utah, Nature’s Sunshine Products (NASDAQ:NATR) manufactures and sells nutritional and personal care products.

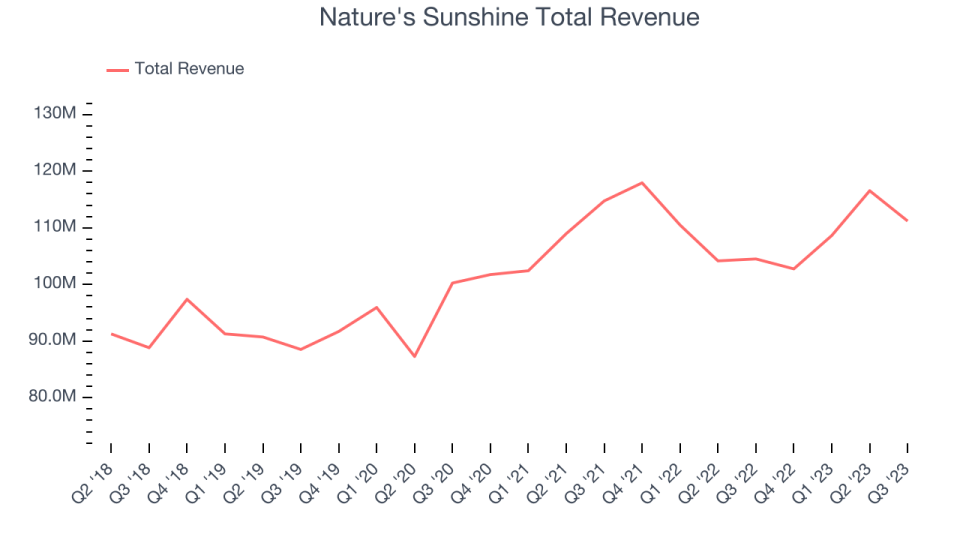

Nature's Sunshine reported revenues of $111.2 million, up 6.4% year on year, in line with analyst expectations. It was a strong quarter for the company, with an impressive beat of analysts' operating margin and earnings estimates.

"Nature’s Sunshine delivered another strong quarter, with double-digit growth in Asia/Pacific and North America,” said CEO Terrence Moorehead.

The stock is down 6.4% since the results and currently trades at $17.14.

Is now the time to buy Nature's Sunshine? Access our full analysis of the earnings results here, it's free.

Best Q3: Olaplex (NASDAQ:OLPX)

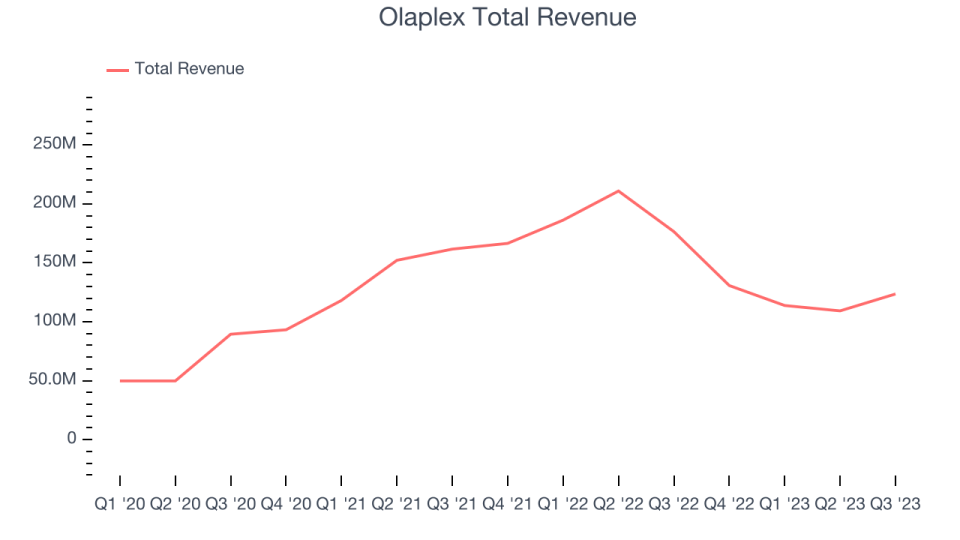

A pioneer in the “bond building’ segment of hair care, Olaplex (NASDAQ:OLPX) offers products and treatments that focus on repairing the damage caused by traditional heat and chemical-based styling processes.

Olaplex reported revenues of $123.6 million, down 30% year on year, outperforming analyst expectations by 6.8%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates. Its operating margin also outperformed Wall Street's estimates.

The stock is up 69.6% since the results and currently trades at $2.34.

Is now the time to buy Olaplex? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Nu Skin (NYSE:NUS)

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE:NUS) is a personal care and dietary supplements company that engages in direct selling.

Nu Skin reported revenues of $498.8 million, down 7.3% year on year, falling short of analyst expectations by 4.1%. It was a weak quarter for the company, with next quarter and full-year revenue guidance missing analysts' expectations.

The stock is down 0.2% since the results and currently trades at $18.6.

Read our full analysis of Nu Skin's results here.

USANA (NYSE:USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $213.4 million, down 8.5% year on year, falling short of analyst expectations by 3.2%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

The stock is down 8.9% since the results and currently trades at $50.5.

Read our full, actionable report on USANA here, it's free.

BeautyHealth (NASDAQ:SKIN)

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

BeautyHealth reported revenues of $97.4 million, up 9.7% year on year, falling short of analyst expectations by 17%. It was a weak quarter for the company. Its revenue, EBITDA, and EPS missed Wall Street's estimates and it lowered its full-year guidance for virtually every metric we track.

BeautyHealth had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 28.6% since the results and currently trades at $2.79.

Read our full, actionable report on BeautyHealth here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned