Unpacking Q3 Earnings: PlayStudios (NASDAQ:MYPS) In The Context Of Other Consumer Internet Stocks

Let's dig into the relative performance of PlayStudios (NASDAQ:MYPS) and its peers as we unravel the now-completed Q3 consumer internet earnings season.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a weaker Q3; on average, revenues beat analyst consensus estimates by 1.2% while next quarter's revenue guidance was 1.1% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but consumer internet stocks held their ground better than others, with the share prices up 15.9% on average since the previous earnings results.

PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

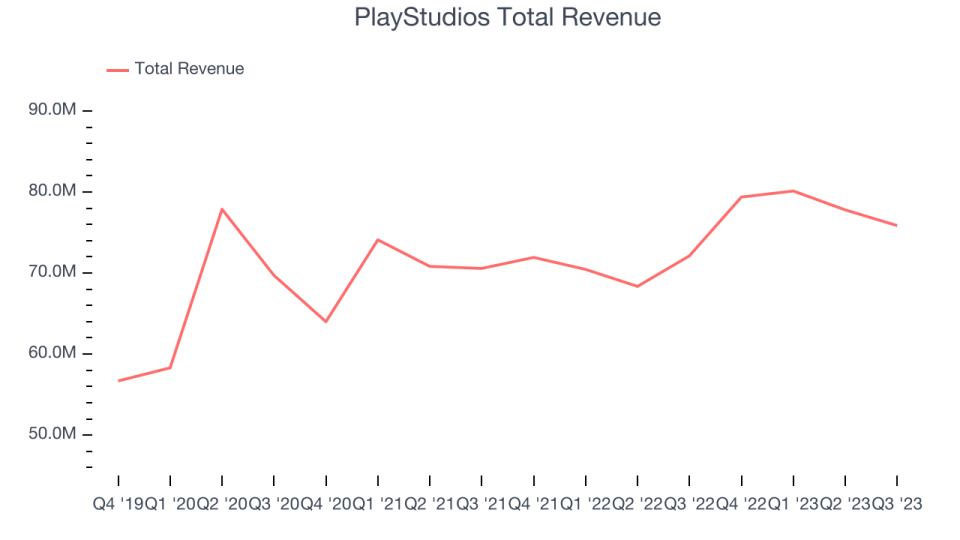

PlayStudios reported revenues of $75.86 million, up 5.2% year on year, falling short of analyst expectations by 1.9%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' revenue estimates.

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “We expect gains to continue and we remain focused on reaching margin parity with our peers. While we’ve yet to see the same level of momentum in our top-line revenues, I’m confident in our growth pipeline. Specific revenue drivers include further refinements in myVEGAS Slots and myKONAMI Slots, the continued scaling up of our early-stage growth games, the introduction of new game titles currently in development, and the expansion of our playAWARDS loyalty marketing platform to external partners.”

PlayStudios delivered the weakest full-year guidance update of the whole group. The company reported 13.71 million monthly active users, up 105% year on year. The stock is down 20.3% since the results and currently trades at $2.32.

Read our full report on PlayStudios here, it's free.

Best Q3: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $3.76 billion, up 39.8% year on year, outperforming analyst expectations by 5.9%. It was a very strong quarter for the company, with impressive growth in its user base and exceptional revenue growth.

MercadoLibre delivered the fastest revenue growth among its peers. The company reported 120 million daily active users, up 36.4% year on year. The stock is up 28% since the results and currently trades at $1,662.51.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $373.3 million, down 18.9% year on year, falling short of analyst expectations by 5.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The stock is up 9.7% since the results and currently trades at $16.78.

Read our full analysis of Overstock's results here.

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $912 million, up 19.8% year on year, surpassing analyst expectations by 6.6%. It was a very good quarter for the company, with a solid beat of analysts' revenue estimates and strong growth in its user base.

The company reported 75.8 million monthly active users, up 15.9% year on year. The stock is up 40.9% since the results and currently trades at $84.15.

Read our full, actionable report on Roku here, it's free.

Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $36.43 million, down 39.5% year on year, falling short of analyst expectations by 8.5%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The company reported 168,000 monthly active users, down 47.5% year on year. The stock is down 13.3% since the results and currently trades at $4.94.

Read our full, actionable report on Skillz here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned