Unpacking Q4 Earnings: Expedia (NASDAQ:EXPE) In The Context Of Other Consumer Internet Stocks

As consumer internet stocks’ Q4 earnings season wraps, let's dig into this quarter's best and worst performers, including Expedia (NASDAQ:EXPE) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 0.5% while next quarter's revenue guidance was 1.2% below consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but consumer internet stocks held their ground better than others, with the share prices up 5.6% on average since the previous earnings results.

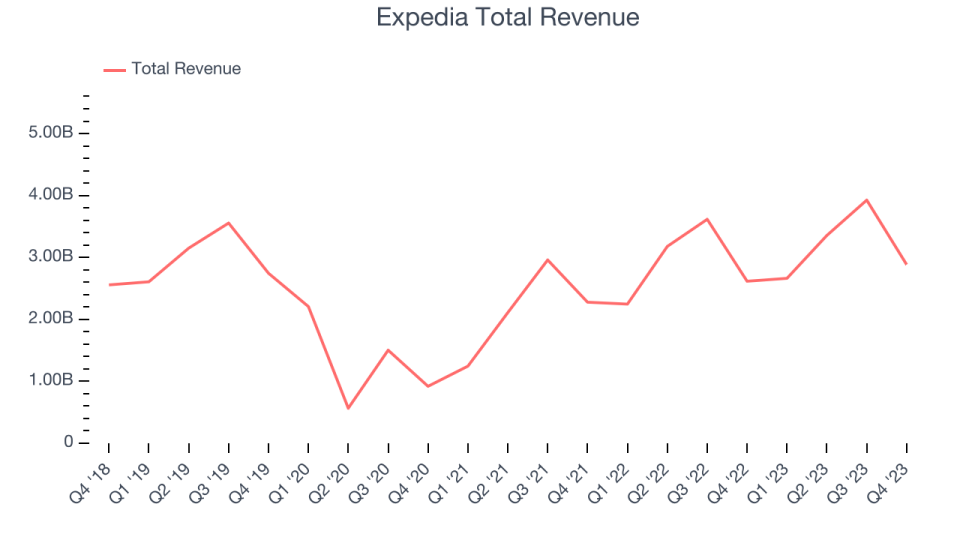

Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $2.89 billion, up 10.3% year on year, in line with analyst expectations. It was a mixed quarter for the company, with adjusted EBITDA exceeding expectations. On the other hand, its revenue growth stalled as its gross bookings came in lower than expected.

"We delivered on our full year guidance and drove record results, all while completing a massive transformation and navigating the inherent volatility that comes with that. Our work is finally starting to deliver results, and we are in the best place we've ever been technologically," said Peter Kern, Vice Chairman and CEO, Expedia Group.

The stock is down 14.3% since the results and currently trades at $136.8.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

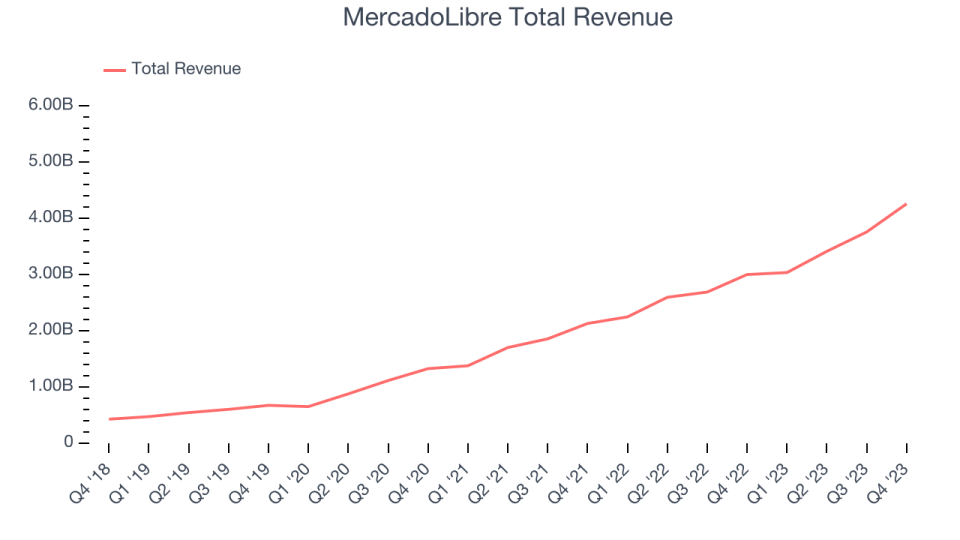

Best Q4: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.26 billion, up 41.9% year on year, outperforming analyst expectations by 2.8%. It was an impressive quarter for the company. MercadoLibre's robust user growth enabled it to beat analysts' revenue, total payment volume (TPV), and gross merchandise volume (GMV) estimates.

The stock is down 15.5% since the results and currently trades at $1,539.51.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $300.4 million, down 27.3% year on year, falling short of analyst expectations by 2.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The stock is up 14% since the results and currently trades at $2.76.

Read our full analysis of Angi's results here.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $8.83 billion, up 12.5% year on year, surpassing analyst expectations by 1.4%. It was a mixed quarter for the company, with solid growth in its user base but slow revenue growth.

The company reported 260.3 million users, up 12.8% year on year. The stock is up 28.6% since the results and currently trades at $631.39.

Read our full, actionable report on Netflix here, it's free.

Robinhood (NASDAQ:HOOD)

With a mission to “democratize finance”, Robinhood (NASDAQ:HOOD) is an online platform enabling the commission-free trading of stocks, exchange-traded funds, and cryptocurrencies.

Robinhood reported revenues of $471 million, up 23.9% year on year, surpassing analyst expectations by 4%. It was a good quarter for the company, with a decent beat of analysts' revenue estimates.

The company reported 23.4 million users, up 1.7% year on year. The stock is up 72.9% since the results and currently trades at $20.49.

Read our full, actionable report on Robinhood here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.