Unpacking Q4 Earnings: Match Group (NASDAQ:MTCH) In The Context Of Other Consumer Subscription Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the consumer subscription stocks, starting with Match Group (NASDAQ:MTCH).

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 1.3% while next quarter's revenue guidance was 1% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, and while some of the consumer subscription stocks have fared somewhat better than others, they have not been spared, with share prices declining 9.7% on average since the previous earnings results.

Match Group (NASDAQ:MTCH)

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

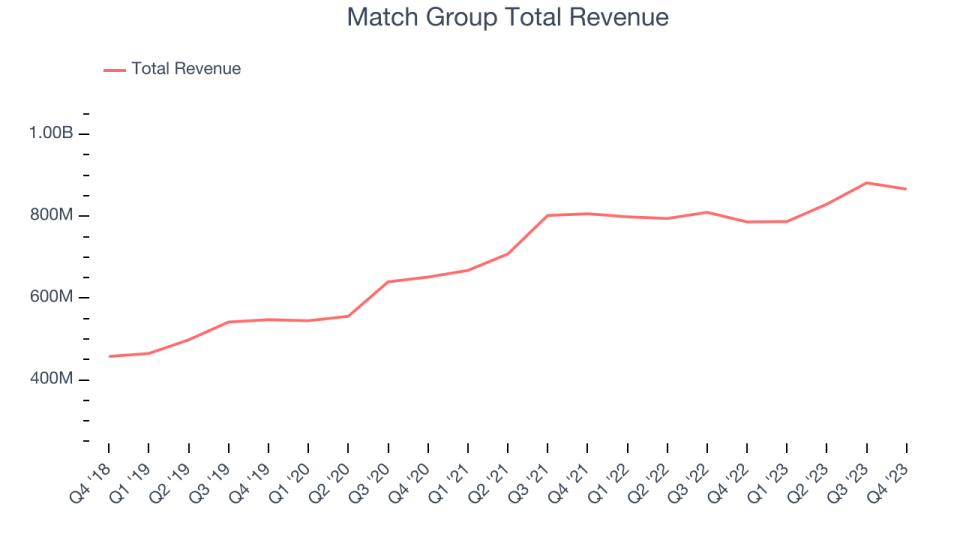

Match Group reported revenues of $866.2 million, up 10.2% year on year, in line with analyst expectations. It was a mixed quarter for the company, with operating margin and EPS exceeding analysts' estimates. Although its user base fell (driven by softness at Tinder), its average price increase of 17% across its apps enabled the company to narrowly top expectations.

On the other hand, its revenue guidance for next quarter missed Wall Street's estimates as it expects Tinder subscribers to decline. That anticipated drop, however, will be offset by continued price increases at Tinder, whose pricing is playing catching up with its peers (the app's services have been underpriced for years).

The stock is down 5.8% since the results and currently trades at $35.53.

Is now the time to buy Match Group? Access our full analysis of the earnings results here, it's free.

Best Q4: Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $151 million, up 45.4% year on year, outperforming analyst expectations by 1.8%. It was an impressive quarter for the company, with strong growth in its user base and exceptional revenue growth. In addition, guidance for next quarter and the full year were ahead of expectations for both revenue and adjusted EBITDA.

Duolingo achieved the fastest revenue growth and highest full-year guidance raise among its peers. The company reported 6.6 million users, up 57.1% year on year. The stock is up 16.6% since the results and currently trades at $228.3.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Chegg (NYSE:CHGG)

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $188 million, down 8.4% year on year, exceeding analyst expectations by 1.1%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

Chegg had the slowest revenue growth in the group. The company reported 4.6 million users, down 8% year on year. The stock is down 20.1% since the results and currently trades at $7.43.

Read our full analysis of Chegg's results here.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $8.83 billion, up 12.5% year on year, surpassing analyst expectations by 1.4%. It was a mixed quarter for the company, with solid growth in its user base but slow revenue growth.

The company reported 260.3 million users, up 12.8% year on year. The stock is up 28.1% since the results and currently trades at $628.9.

Read our full, actionable report on Netflix here, it's free.

Coursera (NYSE:COUR)

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $168.9 million, up 18.8% year on year, surpassing analyst expectations by 2.5%. It was a mixed quarter for the company, with strong growth in its user base but underwhelming revenue guidance for the next quarter.

Coursera scored the biggest analyst estimates beat among its peers. The company reported 142 million users, up 20.3% year on year. The stock is down 27.3% since the results and currently trades at $13.93.

Read our full, actionable report on Coursera here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.