Unraveling the Dividend Dynamics of NorthEast Community Bancorp Inc (NECB)

Delving into the Dividend History, Growth, and Sustainability of NECB

NorthEast Community Bancorp Inc(NASDAQ:NECB) recently announced a dividend of $0.06 per share, payable on 2023-11-08, with the ex-dividend date set for 2023-10-05. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into NorthEast Community Bancorp Incs dividend performance and assess its sustainability.

Company Overview: NorthEast Community Bancorp Inc

Warning! GuruFocus has detected 3 Warning Signs with NECB. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

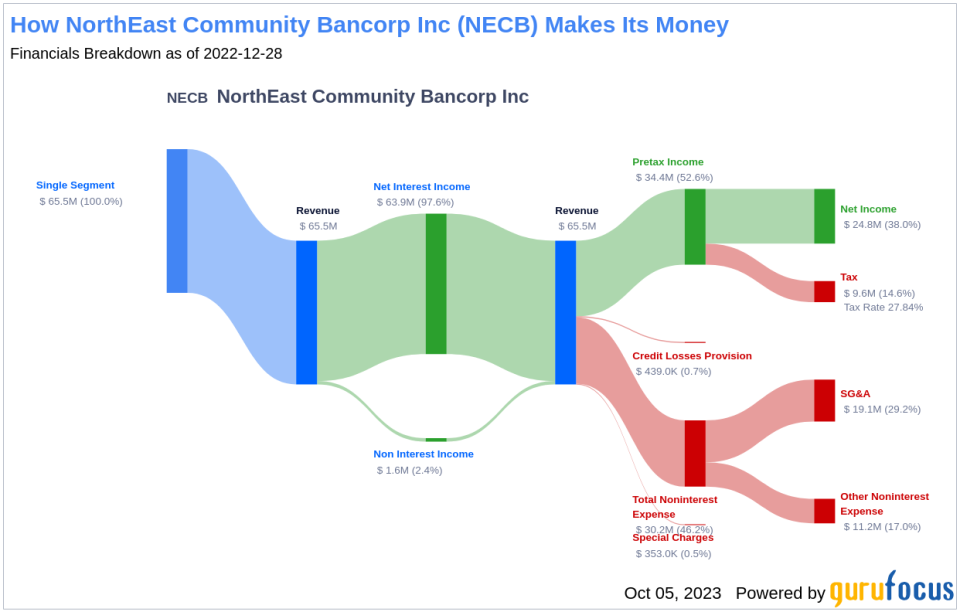

NorthEast Community Bancorp Inc operates as a community-oriented financial institution. It is principally engaged in the business of attracting deposits and investing those funds into mortgage and commercial loans. They conduct their activities throughout the Northeastern United States including New York, Massachusetts, New Jersey, and Connecticut. The company offers a comprehensive line of banking products and services, including mobile banking as well as commercial real estate loans, commercial construction financing, lines of credit, and term loans. It also offers investment advisory and financial planning services.

A Glimpse at NorthEast Community Bancorp Inc's Dividend History

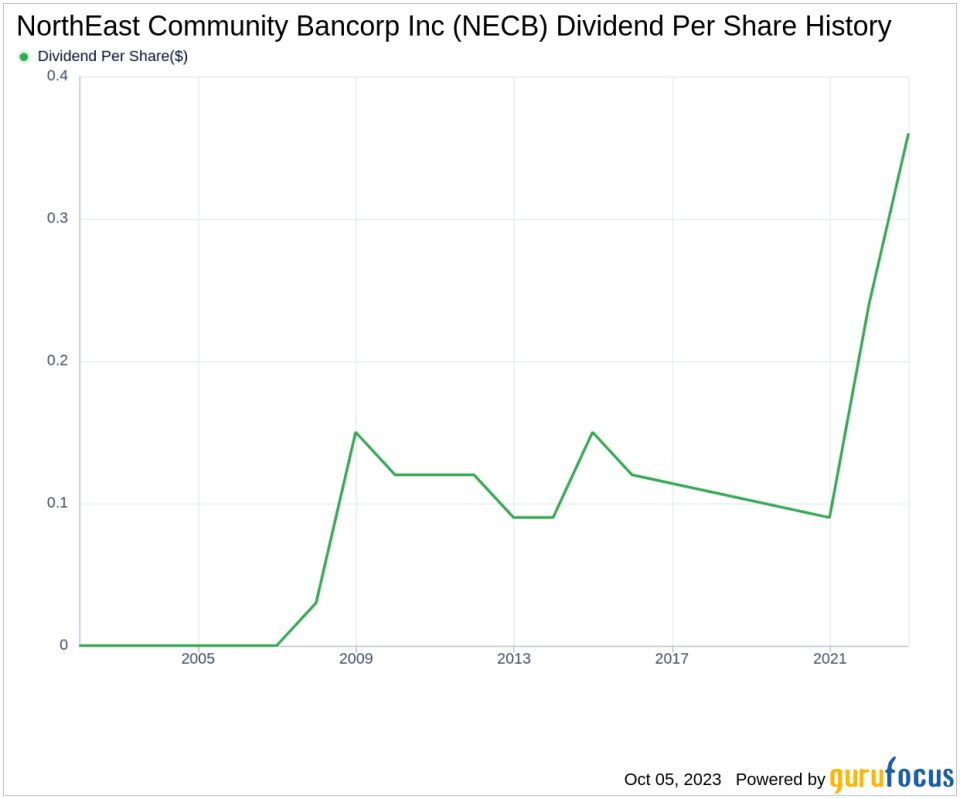

NorthEast Community Bancorp Inc has maintained a consistent dividend payment record since 2007. Dividends are currently distributed on a quarterly basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down NorthEast Community Bancorp Inc's Dividend Yield and Growth

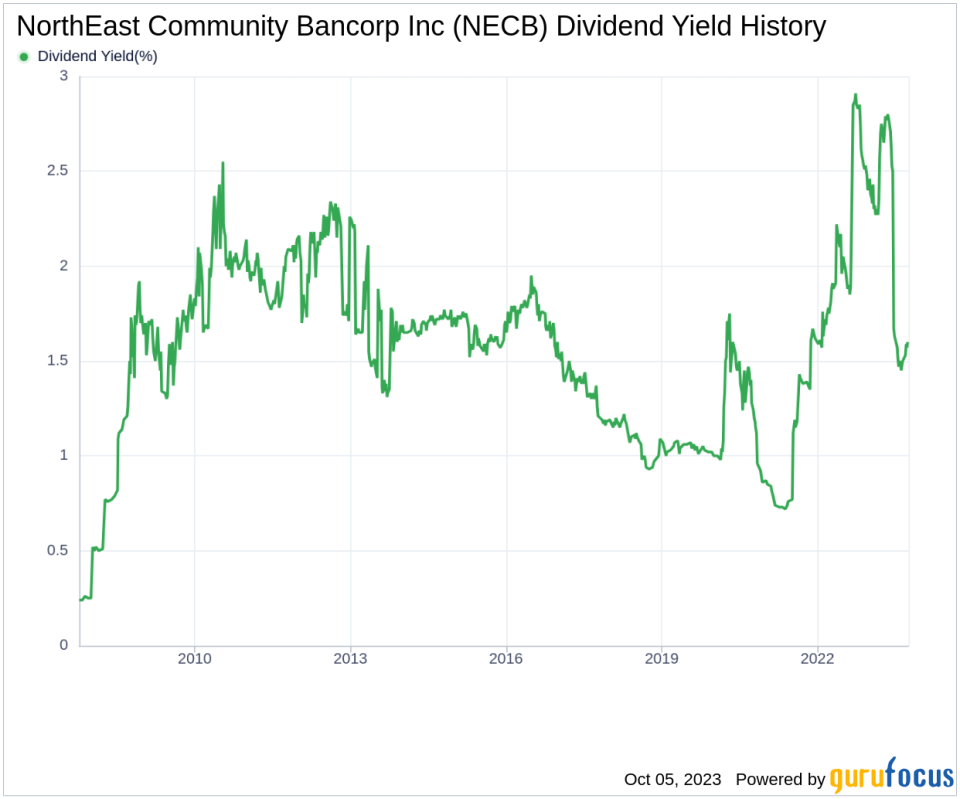

As of today, NorthEast Community Bancorp Inc currently has a 12-month trailing dividend yield of 1.60% and a 12-month forward dividend yield of 1.60%. This suggests an expectation of same dividend payments over the next 12 months.

Over the past three years, NorthEast Community Bancorp Inc's annual dividend growth rate was 44.20%. Extended to a five-year horizon, this rate decreased to 25.90% per year. And over the past decade, NorthEast Community Bancorp Inc's annual dividends per share growth rate stands at 6.40%.

Based on NorthEast Community Bancorp Inc's dividend yield and five-year growth rate, the 5-year yield on cost of NorthEast Community Bancorp Inc stock as of today is approximately 5.06%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, NorthEast Community Bancorp Inc's dividend payout ratio is 0.09.

NorthEast Community Bancorp Inc's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks NorthEast Community Bancorp Inc's profitability 5 out of 10 as of 2023-06-30, suggesting fair profitability. The company has reported net profit in 8 years out of past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. NorthEast Community Bancorp Inc's growth rank of 5 out of 10 suggests that the company has a fair growth outlook.

Revenue is the lifeblood of any company, and NorthEast Community Bancorp Inc's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. NorthEast Community Bancorp Inc's revenue has increased by approximately 35.40% per year on average, a rate that outperforms than approximately 96.85% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, NorthEast Community Bancorp Inc's earnings increased by approximately 99.20% per year on average, a rate that outperforms than approximately 97.57% of global competitors.

Lastly, the company's 5-year EBITDA growth rate of 80.60%, which outperforms than approximately 99.57% of global competitors.

Conclusion

Based on NorthEast Community Bancorp Inc's dividend payments, growth rate, payout ratio, profitability, and growth metrics, it is evident that the company has a stable and sustainable dividend policy. The consistent dividend payments, combined with a low payout ratio and robust growth metrics, indicate the company's commitment to rewarding its shareholders while maintaining enough reserves for future growth. However, investors should continue to monitor these metrics closely to ensure the sustainability of the dividends in the long run.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.