Unraveling the Dividend Profile of Eaton Vance Tax-mangd Glo Buy-write Oppo (ETW)

A Comprehensive Analysis of ETW's Dividend Performance and Sustainability

Eaton Vance Tax-mangd Glo Buy-write Oppo (NYSE:ETW) recently announced a dividend of $0.06 per share, payable on 2023-09-29, with the ex-dividend date set for 2023-09-21. As investors eagerly anticipate this forthcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. In this article, we delve into Eaton Vance Tax-mangd Glo Buy-write Oppo's dividend performance and assess its sustainability using data from GuruFocus.

About Eaton Vance Tax-mangd Glo Buy-write Oppo

Warning! GuruFocus has detected 4 Warning Sign with AOD. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

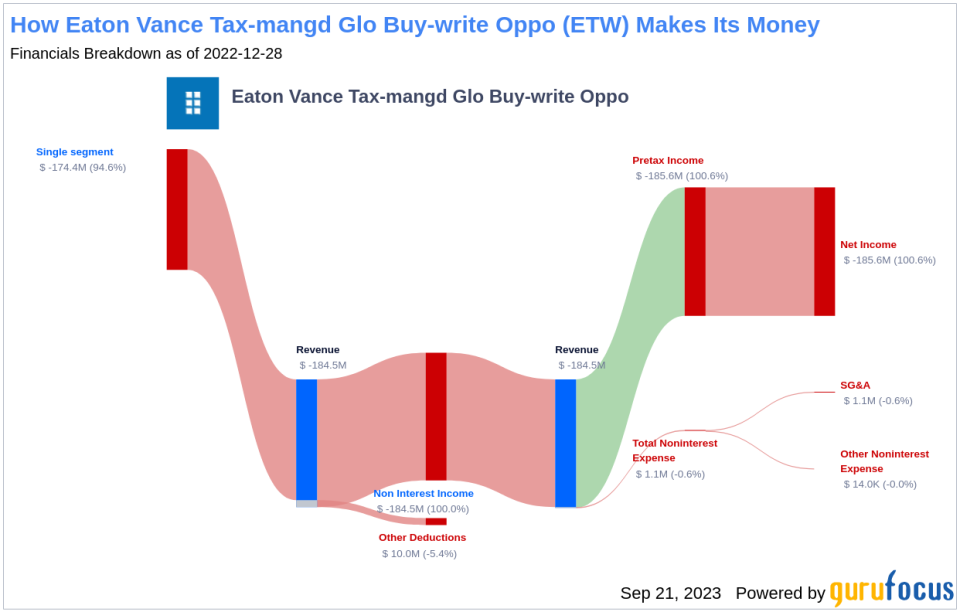

Eaton Vance Tax-mangd Glo Buy-write Oppo is a US-based diversified, closed-end management investment company. The firm primarily aims to provide current income and gains, with a secondary objective of capital appreciation. The company invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to generate current earnings from the option premium. Its portfolio spans across various sectors including capital markets, chemicals, banks, biotechnology, and media.

Reviewing Eaton Vance Tax-mangd Glo Buy-write Oppo's Dividend History

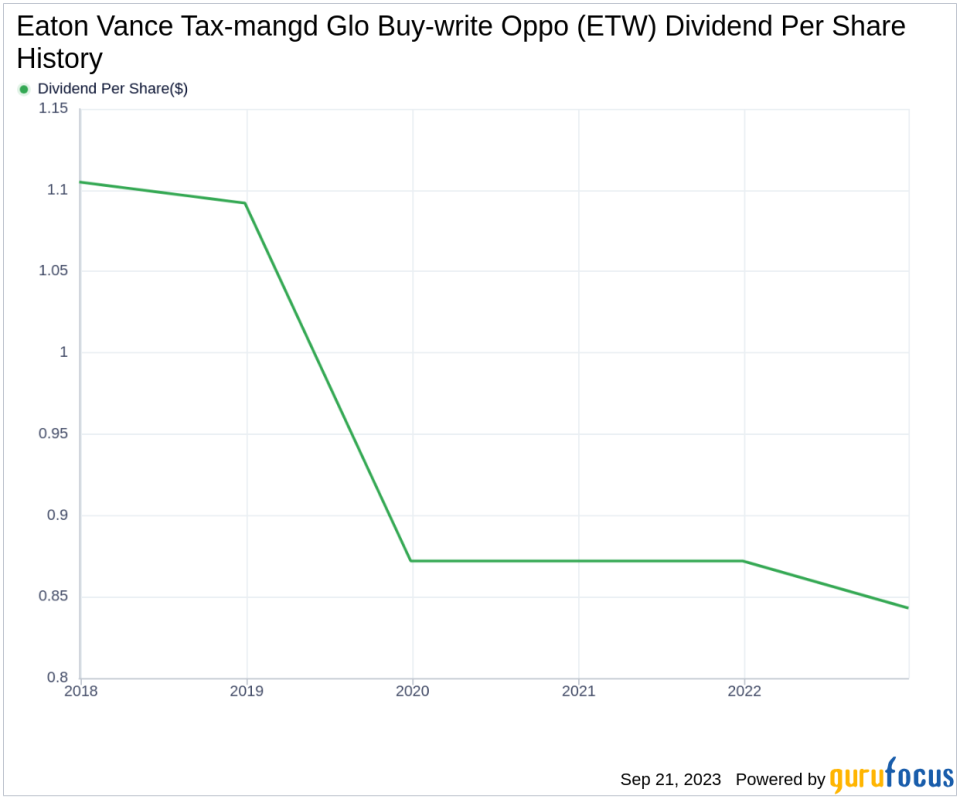

Since 2005, Eaton Vance Tax-mangd Glo Buy-write Oppo has maintained a consistent dividend payment record, with dividends currently being distributed on a monthly basis. The chart below illustrates the annual Dividends Per Share for tracking historical trends.

Understanding Eaton Vance Tax-mangd Glo Buy-write Oppo's Dividend Yield and Growth

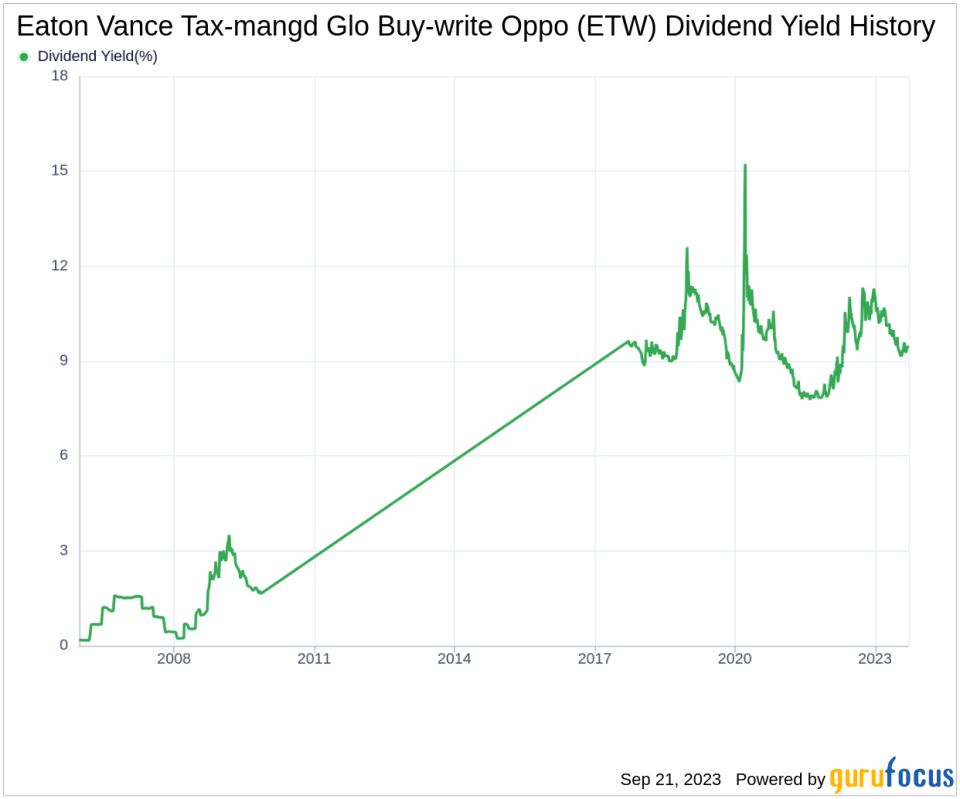

As of present, Eaton Vance Tax-mangd Glo Buy-write Oppo has a 12-month trailing dividend yield of 9.25% and a 12-month forward dividend yield of 8.88%, indicating a projected decrease in dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was -1.10%, which further decreased to -5.60% per year when extended to a five-year horizon. Given these figures, the 5-year yield on cost of Eaton Vance Tax-mangd Glo Buy-write Oppo stock is approximately 6.93% as of today.

Assessing Dividend Sustainability: Payout Ratio and Profitability

To gauge the sustainability of the dividend, it's essential to examine the company's payout ratio. The dividend payout ratio reveals the percentage of earnings the company distributes as dividends. A lower ratio indicates that the company retains a considerable portion of its earnings, ensuring funds for future growth and unforeseen downturns. As of 2023-06-30, Eaton Vance Tax-mangd Glo Buy-write Oppo's dividend payout ratio is 0.70, suggesting potential concerns about the sustainability of the company's dividend.

Eaton Vance Tax-mangd Glo Buy-write Oppo's profitability rank of 3 out of 10 as of 2023-06-30 further raises questions about the sustainability of the dividend. The company has reported net profit in 4 out of the past 10 years.

Investigating Growth Metrics: The Future Outlook

For dividends to be sustainable, a company must exhibit robust growth metrics. Eaton Vance Tax-mangd Glo Buy-write Oppo's growth rank of 3 out of 10 suggests that the company has poor growth prospects, which could further jeopardize the sustainability of its dividend.

Conclusion

In conclusion, while Eaton Vance Tax-mangd Glo Buy-write Oppo's consistent dividend payment history is commendable, the declining dividend growth rate, high payout ratio, and poor profitability and growth ranks indicate potential concerns about the sustainability of its dividends. Investors should therefore exercise caution and conduct thorough research before making investment decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.