Unraveling the Dividend Story of Air Lease Corp (AL)

An In-depth Analysis of the Company's Dividend Performance and Sustainability

Air Lease Corp(NYSE:AL) recently announced a dividend of $0.2 per share, payable on 2023-10-06, with the ex-dividend date set for 2023-09-11. As investors anticipate this forthcoming payout, attention also turns to the company's dividend history, yield, and growth rates. Leveraging data from GuruFocus, we delve into Air Lease Corp's dividend performance and evaluate its sustainability.

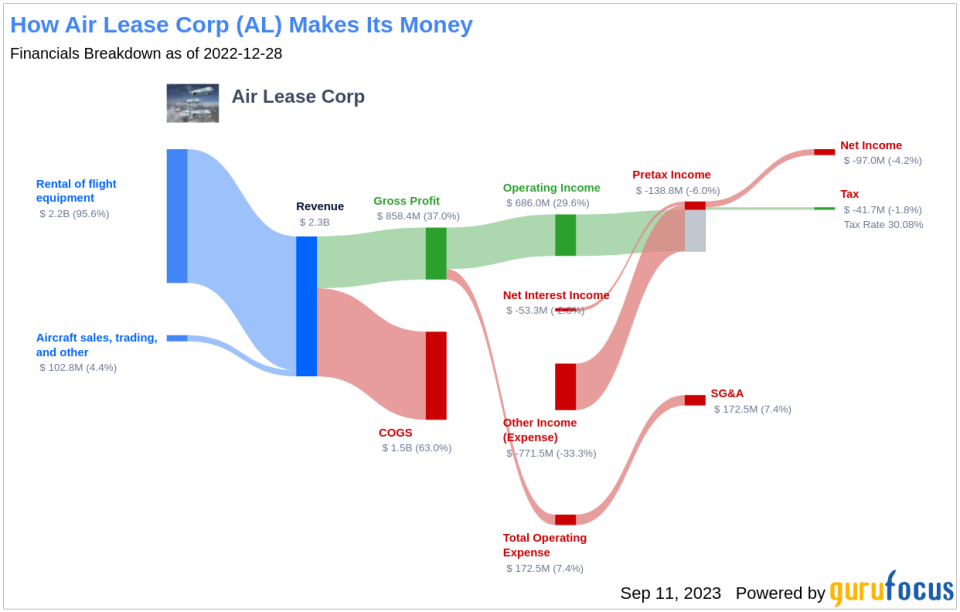

Understanding Air Lease Corp's Business Model

Warning! GuruFocus has detected 7 Warning Signs with AL. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Air Lease Corp is an aircraft leasing company headquartered in the United States, with the majority of its revenue generated from the Asia region. The company purchases aircraft from leading manufacturers such as The Boeing Company (Boeing) and Airbus S.A.S and leases them to airlines worldwide. Its portfolio includes single-aisle narrow-bodied jets and twin-aisle wide-bodied aircraft. The primary revenue stream stems from aircraft leasing, supplemented by fleet management services to investors and aircraft portfolio owners.

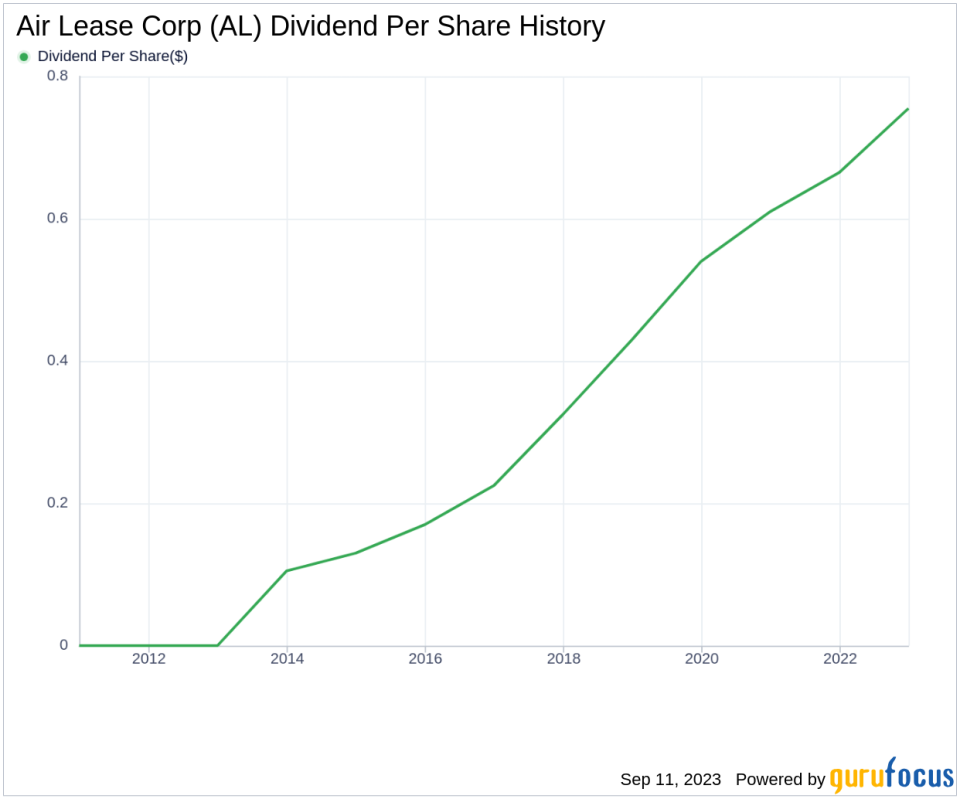

A Retrospective View of Air Lease Corp's Dividend History

Since 2013, Air Lease Corp has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The company has increased its dividend each year since 2013, earning it the distinction of a dividend achiever. This title is bestowed upon companies that have consistently increased their dividend each year for at least the past decade. Below is a chart illustrating the historical trend of annual Dividends Per Share.

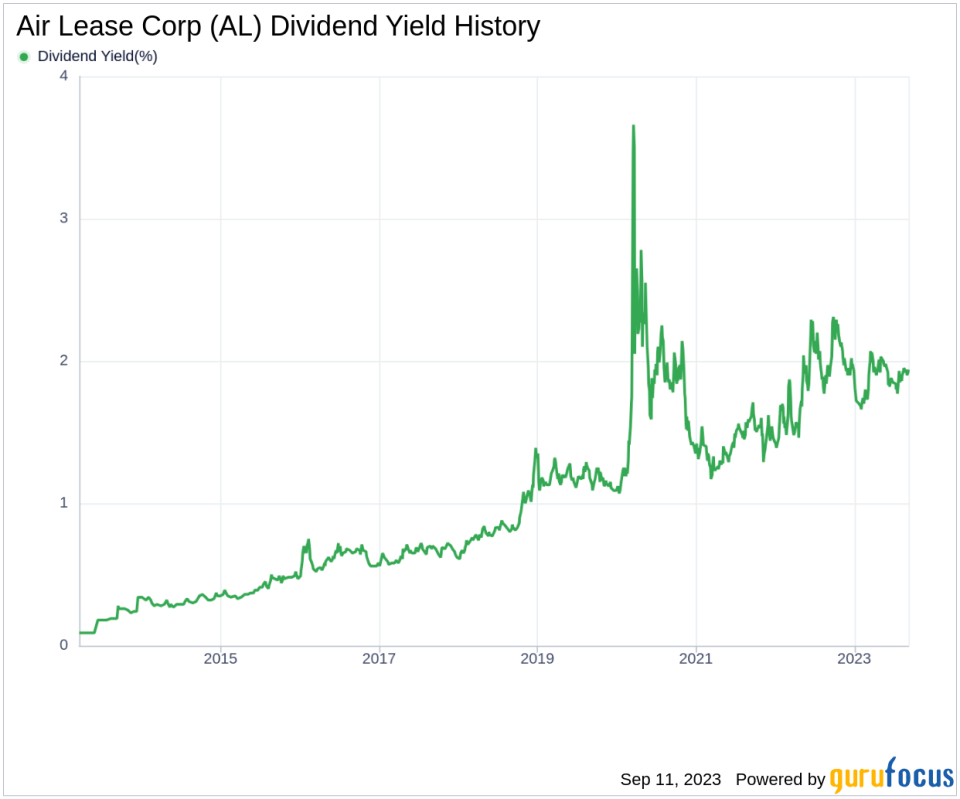

Decoding Air Lease Corp's Dividend Yield and Growth

Presently, Air Lease Corp boasts a 12-month trailing dividend yield of 1.94% and a 12-month forward dividend yield of 1.97%, indicating an anticipated increase in dividend payments over the next year.

Over the past three years, Air Lease Corp's annual dividend growth rate was 11.80%. When extended to a five-year horizon, this rate increased to 17.50% per year. Based on the company's dividend yield and five-year growth rate, the 5-year yield on cost of Air Lease Corp stock currently stands at approximately 4.35%.

Examining Dividend Sustainability: Payout Ratio and Profitability

To evaluate dividend sustainability, it's crucial to examine the company's payout ratio. The dividend payout ratio reveals the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Air Lease Corp's dividend payout ratio is 0.19.

Air Lease Corp's profitability rank provides an understanding of the company's relative earnings prowess. As of 2023-06-30, GuruFocus ranks Air Lease Corp's profitability 7 out of 10, indicating strong profitability prospects. The company has reported net profit in 9 out of the past 10 years.

Assessing Future Prospects: Growth Metrics

For dividends to be sustainable, a company must exhibit robust growth metrics. Air Lease Corp's growth rank of 7 out of 10 suggests a promising growth trajectory relative to its competitors.

Revenue is the lifeblood of any company, and Air Lease Corp's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. With an average annual increase of approximately 5.20%, Air Lease Corp's revenue growth rate outperforms approximately 53.42% of global competitors.

Concluding Remarks

In conclusion, Air Lease Corp's consistent dividend payments, impressive growth rate, low payout ratio, robust profitability, and strong growth metrics paint a promising picture for the sustainability of its dividends. As the company continues to thrive in the aircraft leasing industry, investors can look forward to potentially rewarding dividend payouts. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.