Unraveling the Dividend Story of First Trust MLP and Energy Income Fund

An In-depth Analysis of FEI's Dividend Performance and Sustainability

First Trust MLP and Energy Income Fund (NYSE:FEI) recently announced a dividend of $0.05 per share, payable on 2023-10-16, with the ex-dividend date set for 2023-10-02. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. This article, using data from GuruFocus, dives into First Trust MLP and Energy Income Fund's dividend performance and assesses its sustainability.

Company Overview: First Trust MLP and Energy Income Fund

Warning! GuruFocus has detected 5 Warning Sign with FEI. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

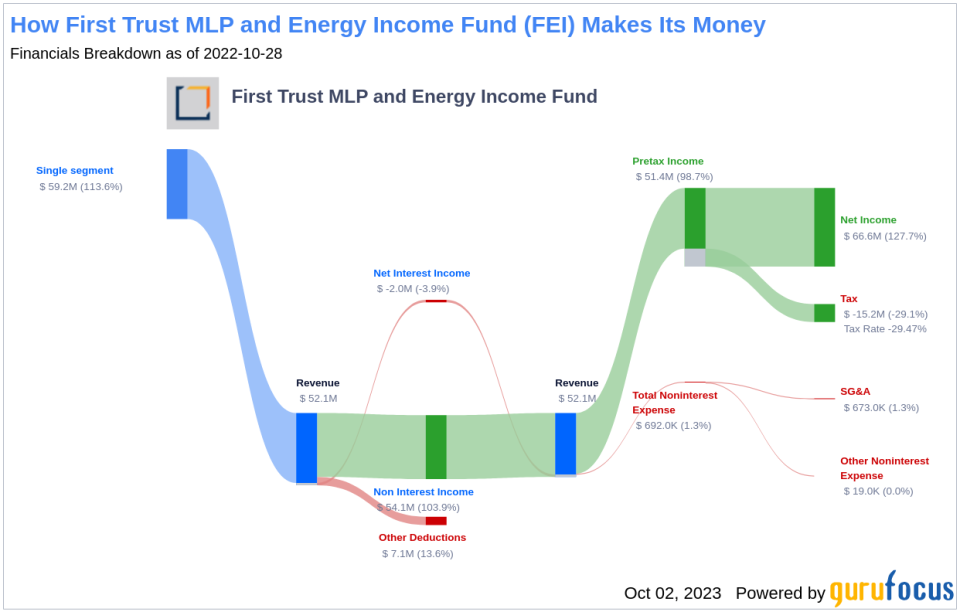

First Trust MLP and Energy Income Fund is a non-diversified, closed-end management investment company. It focuses on investing in publicly traded master limited partnerships (MLP) related entities, and other companies in the energy sector and energy utility industries. Its investment objective is to seek a high level of total return with an emphasis on current distributions paid to common shareholders.

First Trust MLP and Energy Income Fund's Dividend History

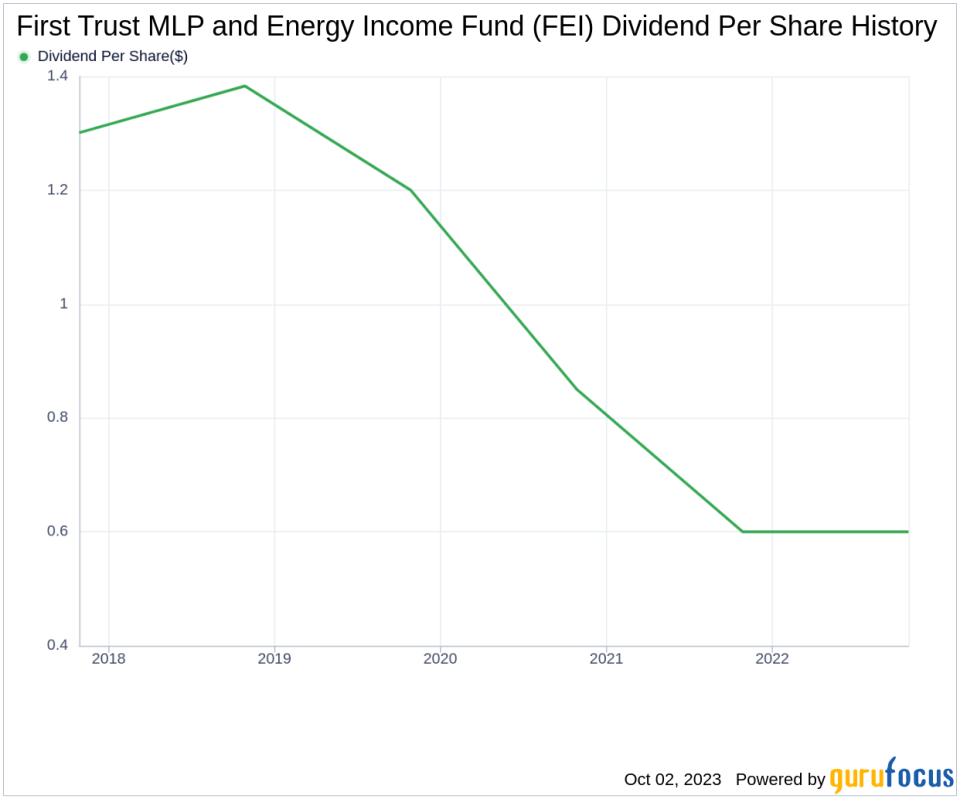

First Trust MLP and Energy Income Fund has maintained a consistent dividend payment record since 2013, currently distributing dividends on a monthly basis. The chart below shows the annual Dividends Per Share for tracking historical trends.

First Trust MLP and Energy Income Fund's Dividend Yield and Growth

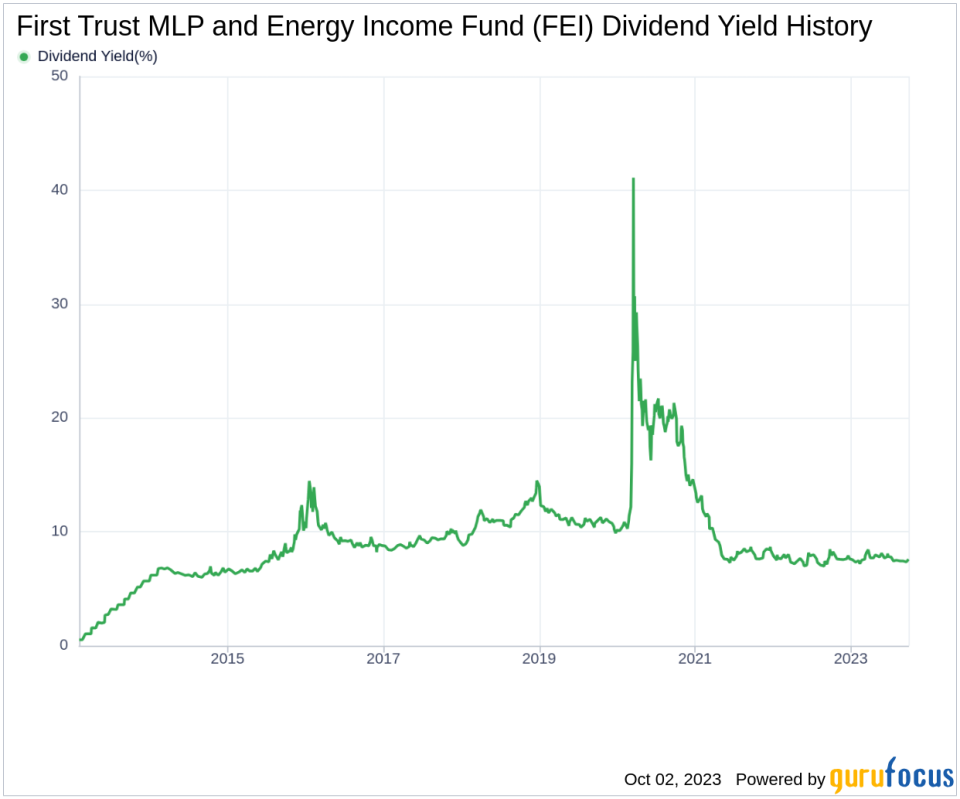

As of today, First Trust MLP and Energy Income Fund has a 12-month trailing dividend yield and a 12-month forward dividend yield of 7.59%, suggesting an expectation of same dividend payments over the next 12 months. However, the company's annual dividend growth rate over the past three years was -20.60%, increasing to -17.50% per year over a five-year horizon. This results in a 5-year yield on cost of approximately 2.90%.

Is First Trust MLP and Energy Income Fund's Dividend Sustainable?

The sustainability of a dividend is often evaluated using the company's payout ratio. First Trust MLP and Energy Income Fund's dividend payout ratio as of 2023-04-30 is 1.03, which may suggest that the company's dividend may not be sustainable. The company's profitability rank of 2 out of 10 further supports this assertion. However, the company has reported net profit in 4 years out of the past 10 years.

Growth Metrics: The Future Outlook

For dividends to be sustainable, a company must have robust growth metrics. Unfortunately, First Trust MLP and Energy Income Fund's growth rank of 2 out of 10 suggests poor growth prospects. However, the company's revenue per share has increased by approximately 18.40% per year on average, outperforming approximately 70.2% of global competitors. Furthermore, First Trust MLP and Energy Income Fund's 3-year EPS growth rate is approximately 25.70% per year on average, outperforming approximately 70.53% of global competitors.

Conclusion

First Trust MLP and Energy Income Fund presents a mixed bag in terms of dividend sustainability. While the company has maintained a consistent dividend payment record and shown strong revenue growth, its high payout ratio and low profitability and growth ranks raise concerns. Investors should keep these factors in mind when considering the company's future dividend prospects. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.