Unraveling the Future of R1 RCM Inc (RCM): A Deep Dive into Key Metrics

Long-established in the Healthcare Providers & Services industry, R1 RCM Inc (NASDAQ:RCM) has enjoyed a stellar reputation. However, it has recently witnessed a daily loss of 4.87%, juxtaposed with a three-month change of -12.57%. Fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of R1 RCM Inc.

Decoding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Financial strength rank: 5/10

Profitability rank: 6/10

Growth rank: 1/10

GF Value rank: 5/10

Momentum rank: 8/10

Based on the above method, GuruFocus assigned R1 RCM Inc the GF Score of 68 out of 100, which signals poor future outperformance potential.

Understanding R1 RCM Inc's Business

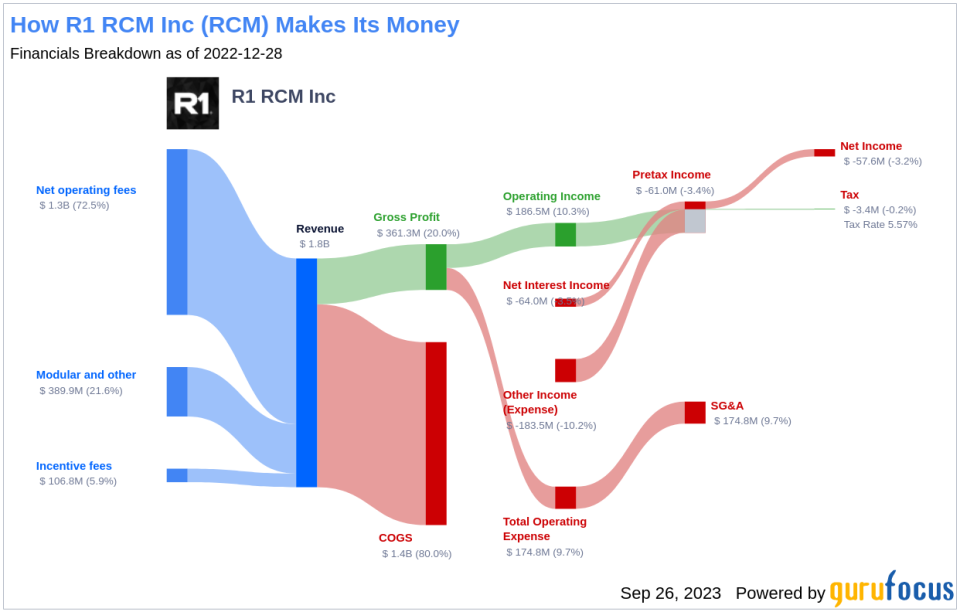

R1 RCM Inc is a provider of technology-driven solutions that transform the patient experience and financial performance of healthcare providers. Its services help healthcare providers generate sustainable improvements in their operating margins and cash flows while also enhancing patient, physician, and staff satisfaction. Its service offering consists of end-to-end RCM services for health systems, hospitals, and physician groups that provide comprehensive revenue cycle infrastructure to providers, including all revenue cycle personnel, technology solutions, and process workflow. The majority of the revenue comes from the operating fees received.

Financial Strength Breakdown

R1 RCM Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company's interest coverage ratio of 1.66 positions it worse than 85.11% of 403 companies in the Healthcare Providers & Services industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. It's worth noting that the esteemed investor Benjamin Graham typically favored companies with an interest coverage ratio of at least five.

The company's Altman Z-Score is just 2.18, which is below the safe threshold of 2.99. Although this does not imply immediate danger of financial distress, the stock may face some financial struggles if the Altman Z-score drops below 1.81.

Additionally, the company's low cash-to-debt ratio at 0.07 indicates a struggle in handling existing debt levels. Furthermore, the company's debt-to-Ebitda ratio is 5.85, which is above Joel Tillinghast's warning level of 4 and is worse than 77.26% of 409 companies in the Healthcare Providers & Services industry. Tillinghast said in his book Big Money Think's Small: Biases, Blind Spots, and Smarter Investing that a high debt-to-Ebitda ratio can be a red flag unless tangible assets cover the debt.

Growth Prospects

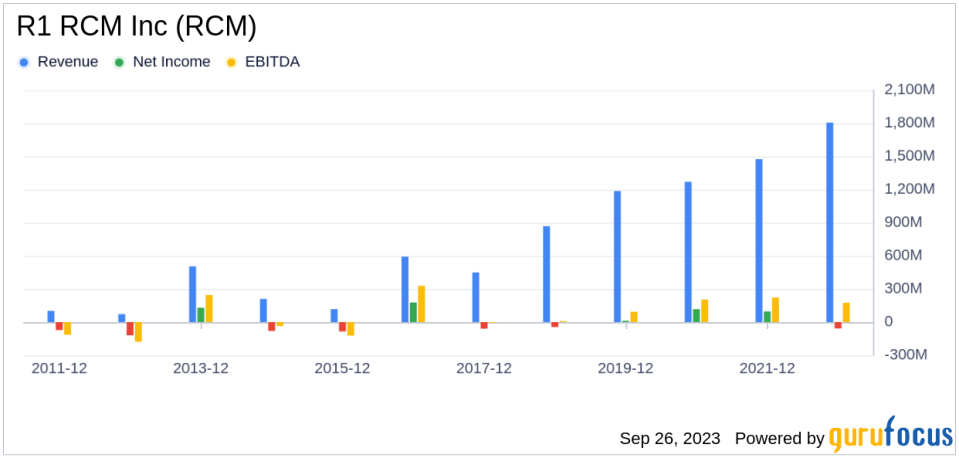

A lack of significant growth is another area where R1 RCM Inc seems to falter, as evidenced by the company's low Growth rank. The company's revenue has declined by -21.6 per year over the past three years, which underperforms worse than 92.84% of 573 companies in the Healthcare Providers & Services industry. Stagnating revenues may pose concerns in a fast-evolving market.

Lastly, R1 RCM Inc predictability rank is just one star out of five, adding to investor uncertainty regarding revenue and earnings consistency.

Conclusion

Given the company's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While R1 RCM Inc has a commendable history in the Healthcare Providers & Services industry, its current financial health and growth prospects suggest a challenging road ahead. Investors should consider these factors when making investment decisions.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.