Unraveling the GF Value of Packaging Corp of America (PKG): A Fair Valuation

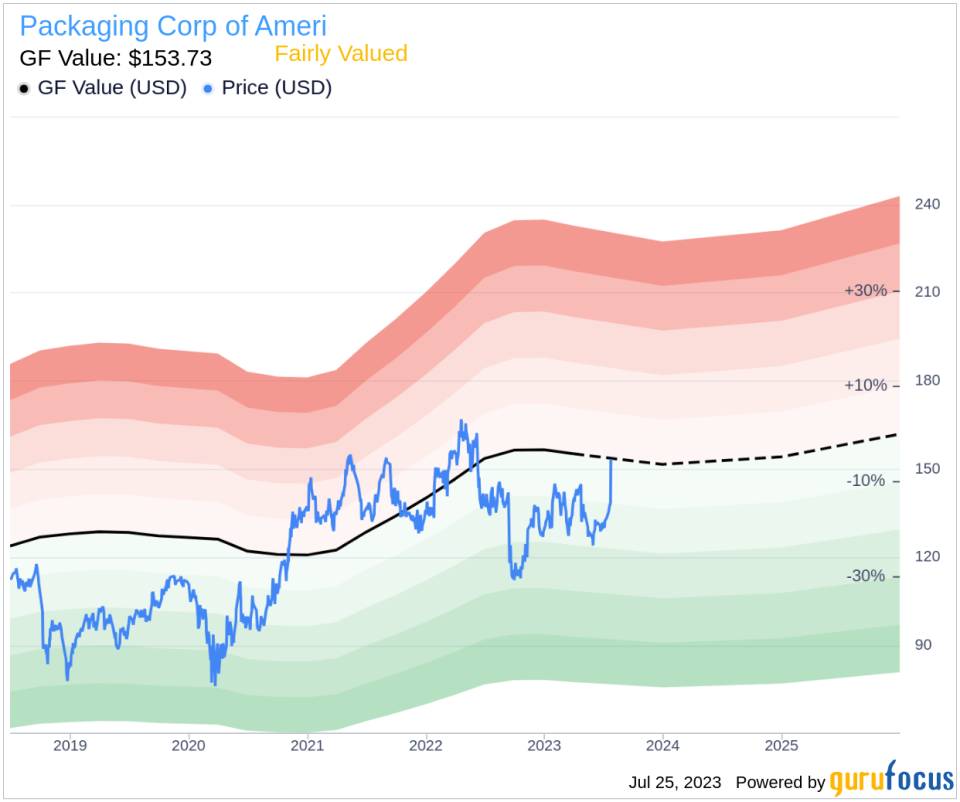

As of July 25, 2023, the stock price of Packaging Corp of America (NYSE:PKG) has seen a gain of 10.61%, reaching $153.39. With a market cap of $13.8 billion and sales of $8.3 billion, the company's financial metrics are noteworthy. The GF Value, a unique indicator of a stock's intrinsic worth, stands at $153.73, suggesting that Packaging of America is fairly valued. This valuation is based on historical trading multiples, past performance, and future business performance estimates.

Packaging Corp of America, the third-largest containerboard and corrugated packaging manufacturer in the United States, produces over 4 million tons of containerboard annually. With a 10% share of the domestic containerboard market, the company differentiates itself by focusing on smaller customers and operating with a high degree of flexibility.

GF Value and Valuation

According to GuruFocus' valuation method, Packaging of America (NYSE:PKG) is fairly valued. The GF Value Line, which represents the fair value at which the stock should ideally be traded, is based on historical multiples, an internal adjustment factor from GuruFocus, and analyst estimates of future business performance. If the stock's share price is significantly above or below the GF Value Line, it may indicate overvaluation or undervaluation respectively. Given Packaging of America's current price of $153.39 per share, the stock is estimated to be fairly valued, and its long-term return is likely to mirror the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

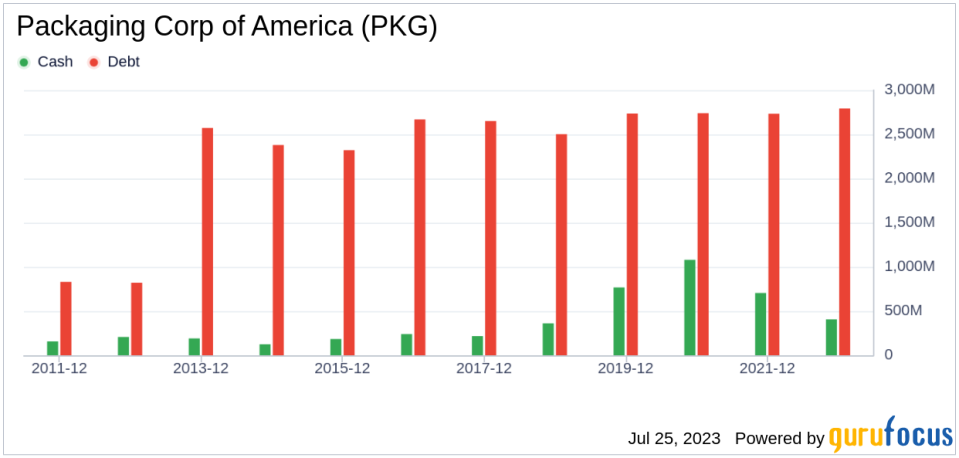

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a companys financial strength before deciding to buy shares. Packaging of America has a cash-to-debt ratio of 0.17, ranking worse than 67.84% of companies in the Packaging & Containers industry. This suggests a fair balance sheet, with GuruFocus ranking Packaging of Americas financial strength as 7 out of 10.

Profitability

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Companies with high profit margins are typically safer investments than those with low profit margins. With a revenue of $8.3 billion and Earnings Per Share (EPS) of $10.42, Packaging of America has demonstrated profitability over the past 10 years. Its operating margin of 16.75% ranks better than 94.78% of companies in the Packaging & Containers industry, indicating strong profitability.

Growth

One of the key valuation factors for a company is growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. Packaging of America has an average annual revenue growth of 7.3%, ranking better than 54% of companies in the Packaging & Containers industry. Its 3-year average EBITDA growth is 10.2%, ranking better than 60.18% of companies in the same industry.

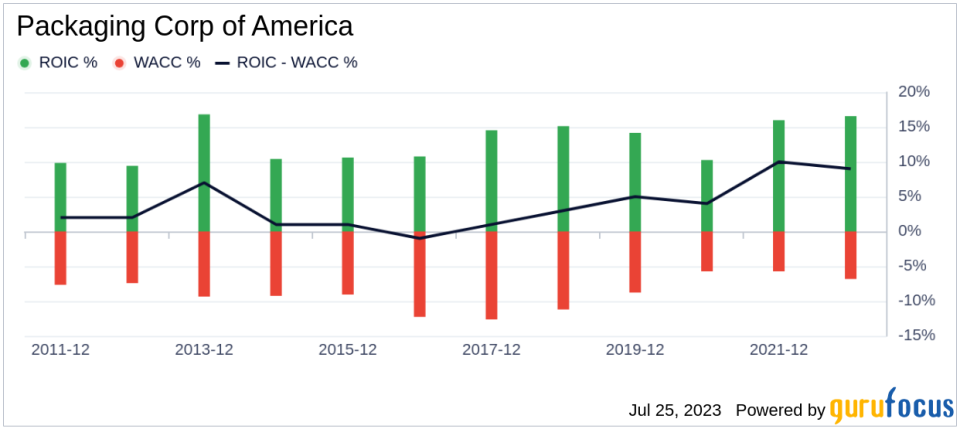

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another way to assess its profitability. When the ROIC is higher than the WACC, the company is creating value for shareholders. For Packaging of America, the ROIC for the past 12 months is 15.33, and the WACC is 7.4.

Conclusion

In conclusion, Packaging of America (NYSE:PKG) stock is estimated to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 60.18% of companies in the Packaging & Containers industry. For more insights into Packaging of America stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.